Kaye... some interesting points. Sure, rates on seconds are higher... sure, you can write off PMI on 2007 for now. But I still crunch numbers and usually would do a rate that includes PMI.. This is usually your best savings for 2 reasons. One especially now, that values have come down a little. Lenders use to sell the PMI aspect saying that you could do a new appraisal down the road, to get rid of PMI, if you have more equity later. Well, that won't work now. Here is a post I did on PMI a while back. Hope this helps some : PMI (Private Mortgage Insurance); why you need it and the different types of PMI…… Overall..... good informative blog.

Ana- It seems that those with great financial resources are buying what they want and are not overly worried about the future of the overall real estate market..

Jeff-I have not thought about PMI for years as the second market seemed to be such a better deal..but I must admit I have been questioning that in recent months.. Good article on PMI..

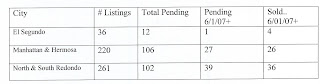

Marlene: Townhomes/Condos in MB are very hot right now.. Hermosa is seeing an upswing in the townhome/condo market close to the beach.. North Redondo.. our area of affordable homes is holding it's own..

Kaye, I was so glad to read your post. Let's show the public the numbers, which speak for themselves. Your numbers are very encouraging. Very nice post.

Maggie- I'm working on another post with numbers from 200-2007.. and they do speak for themselves..so glad you stopped by..

Comments(8)