Sand Dune Park... Manhattan Beach

Sand Dune Park... Manhattan Beach

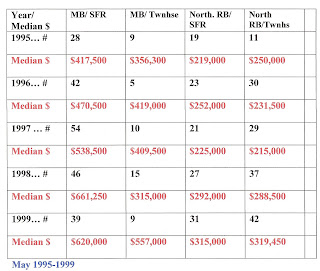

I remember the market in 1995-1999. Most of the foreclosures were over and people who had lost their jobs were finding work again. Interest rates were good around 7.5-8.5% and life was moving along back to normal in the Beach Cities. There has always been a certain group of people who are afraid to buy because the price might go down.

When I entered real estate in 1979 these people were waiting for prices to go back to 1968 levels. In 1995 they were waiting for prices to drop back to 1987 levels. And today there are those who are waiting for prices to drop back to 1997 levels. The only thing that has happened over the years is that prices bounced around and then eventually went up and up and up. It's been the same story since my family moved to California in 1952.

Agents get slammed because we don't tell the truth about how terrible the real estate market is... but the problem is that it isn't that terrible. It's not great but it isn't terrible. Often our memories are short and we forget that those homes priced in the $180,000's were out of reach for many because they weren't making enough to qualify.

Today's market is no different. People look longingly at the prices from 1995-1999 and forget they could have bought then.... but didn't because many were waiting for prices to fall. Today those who bought in the 90's are thought to be lucky. If they sell at a profit then they are greedy. No one remembers that these people took a chance at homeownership while others waited for the market to fall. They struggled with the monthly payments at interest rates that were between 8-10%.

Yes there is a certain amount of luck associated with the housing market but mainly the luck is only because you bought. It's like the old joke about the blonde named Sally who asked God to let her win the lottery.. every week she checked and she didn't win. She was really mad at God and wanted to know why she hadn't won yet.... and finally God replied: "Sally... help me out here ... you have to buy a ticket".

You have to get in the game before you can win a prize... if you don't take a chance and buy a house you will probably never own one.... YOU HAVE TO BUY A TICKET

All content copyright © 2007 Kaye Thomas

Comments(16)