HAP : Homeowners’ Assistance Program - Aid for the Distressed Military Home Seller

There’s a travesty happening from the Pacific to the

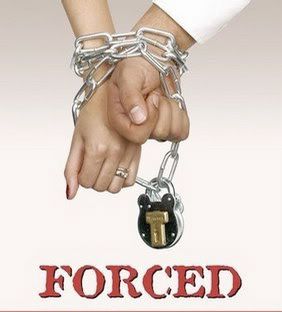

Atlantic, and all through the heartland of our fine country. As we all know, the good old US of A is in an economic and housing crisis, and everyone is being affected. It is reported that 25% of homeowners owe more than their home is worth. A staggering statistic in itself, but not really pertinent unless you actually have to move. Having to write a check to sell your home, with money you don’t even have is a sobering thought that most would decide to just stay put, given the choice, but what if you had no choice? What if the government was forcing you to move, and you had no option?

country. As we all know, the good old US of A is in an economic and housing crisis, and everyone is being affected. It is reported that 25% of homeowners owe more than their home is worth. A staggering statistic in itself, but not really pertinent unless you actually have to move. Having to write a check to sell your home, with money you don’t even have is a sobering thought that most would decide to just stay put, given the choice, but what if you had no choice? What if the government was forcing you to move, and you had no option?

Think about it. Forced out of your home by the government. Doesn’t seem possible. Well, unfortunately it is, and these poor hapless souls agreed to move years ago.

This is exactly what is happening to the many of our Armed Forces heroes who are getting new orders or PCS – Permanent Change of Station. It is estimated around 150,000 or more military personnel move every year, and the majority of military personnel move approximately once every two to three years or so protecting our country.

What was going on three years ago in the housing market? That’s right the biggest boom ever seen. What type of mortgage do the majority of Veterans use to buy a home? You guessed it, 0 down VA loans. How many people do you think who bought zero down three years ago are upside down on their mortgage today? I would guess nearly all of them. Guess what is happening now? They’re all being forced to move.

What was going on three years ago in the housing market? That’s right the biggest boom ever seen. What type of mortgage do the majority of Veterans use to buy a home? You guessed it, 0 down VA loans. How many people do you think who bought zero down three years ago are upside down on their mortgage today? I would guess nearly all of them. Guess what is happening now? They’re all being forced to move.

Forced relocation is a hardship, that qualifies for a short sale, but that ruins one’s credit.

Fortunately there is some help out there. HAP : Homeowners’ Assistance Program. It’s not the end all be all, for the military, but help of any kind in this terrible situation is not only uplifting, it’s absolutely warranted. In fact, more help should be given since the qualifying criteria are somewhat unforgiving.

I personally have been involved with numerous HAP : Homeowners’ Assistance Program transactions.

I sell Tacoma Real Estate which is located in a heavy military area with Ft. Lewis, McChord AFB, both located in the Puyallup, Spanaway area and Puget Sound Naval Shipyard PSNS located in Bremerton, WA are nearby. Consequently the Tacoma Real Estate market is flooded with the distressed military home seller. The HAP : Homeowners’ Assistance Program can help.

The American Recovery and Reinvestment Act of 2009 expanded The HAP : Homeowners’ Assistance Program to assist these service members, and even civilian Dept. of Defense employees which are scattered throughout the Tacoma Real Estate market.

Here is the low down on the entire HAP : Homeowners’ Assistance Program.

For full information, go to http://hap.usace.army.mil/homepage.html

It’s important if you are a military member in these troubling circumstances to deal with an agent completely familiar with all the nuances of a HAP : Homeowners’ Assistance Program transaction.

If you’re in the Marines, Army, Navy or Air Force in need to relocate or short sale, contact John M. Cameron - Broker (206) 910-0200. We know how to handle your relocation and short sale.

You can also visit me on my website http://www.finditorsellit.com. I’d be happy to help and/or find another agent who’s familiar with the program regardless of whether you’re in the Tacoma Real Estate market or not I can find someone who knows what they’re doing to help you.

Comments(3)