Mortgage Interest Rate Myths

This may come as a shock to many borrowers, but it's absolutely true. Mortgage interest rates are not set by the Federal Reserve and, contrary to popular belief, mortgage rates are not directly tied to the yields of US Treasury bills, bonds, or notes - including the 10-year Treasury Note. That's right. Despite what you might hear in the media, mortgage interest rates are actually set by lending institutions, and are based solely on the performance of mortgage-backed securities. This may come as a shock to many borrowers, but it's absolutely true. Mortgage interest rates are not set by the Federal Reserve and, contrary to popular belief, mortgage rates are not directly tied to the yields of US Treasury bills, bonds, or notes - including the 10-year Treasury Note. That's right. Despite what you might hear in the media, mortgage interest rates are actually set by lending institutions, and are based solely on the performance of mortgage-backed securities.

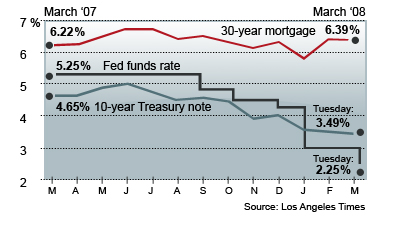

For years now, the media and inexperienced loan officers everywhere have suggested that the 10-year Treasury Note, a government-backed security, is directly tied to mortgage interest rates, that the two are separated by a specific interval - which is simply not true. The graph on this page, which shows interest rates for 30-year fixed-rate mortgages and the yield for the 10-year Treasury Note for 13 months, clearly demonstrates this fact.

At a quick glance, yes, it's easy to see why the mistake is made. As you can see, for 11 out of the 13 months recorded in the graph, the yield of the 10-year Treasury Note and interest rates for 30-year fixed-rate mortgages did follow a somewhat similar long-term path, despite obvious short-term divergences. However, take a closer look at the drastic change that occurs from January through March 2008. What's interesting about this graph is that, during this period, the Federal Reserve had cut interest rates six times, from September 2007, to March 2008, and yet mortgage rates were actually higher in March 2008 than they were a year before. Not only does this demonstrate that the yield of the 10-year Treasury Note is not pegged to mortgage interest rates, it also reveals that mortgage interest rates are not set by the Fed either.

Stop being misled. If you or someone you know is thinking about buying or refinancing a home, give us a call. We'll give the facts you need to make a truly informed decision.

|

Comments(2)