I’ve thought a lot about Rain Man over the past few months as I’ve been following the press coverage of the sub-prime mortgage crisis. The story’s been on the front page of the Wall Street Journal nearly every day. Pretty much every show on CNBC — except Kudlow & Co.and one or two others — has been obsessed with the topic. Yet no one seems to be asking the Rain Man question: “How big is the sub-prime mortgage market?”

And the answer, as Ben Stein makes clear, is not very big at all.

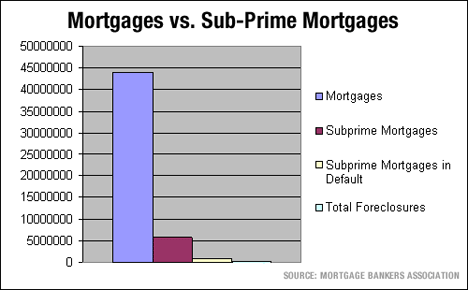

Currently there are about 44 million mortgages in the U.S., and less than 14 percent of them are sub-prime. And only about 13 percent of those are late on payments, with the majority of late payers working through their problems with the banks.

So, all in all, when you work through the details and get down to the number that really matters, only about 0.6 percent of U.S. mortgages are currently in foreclosure. That’s up a hair from roughly 0.5 percent last year. That’s it.

Comments(27)