Each quarter, I pull the information on homes sales in north Scottsdale's zip code 85262 to get an idea of how the sales activity was broken out by types of home sales.

85262 is a North Scottsdale zip code. 85262 is home to many of Scottsdale's top luxury golf communities. Here are some of these communities that can be found in 85262:

The sales types are broken into three categories - They are "regular" sales (or non-distressed sales), short sales (or pre-foreclosure sales) and foreclosures (also known as lender-owned homes, bank-owned homes or REO's.)

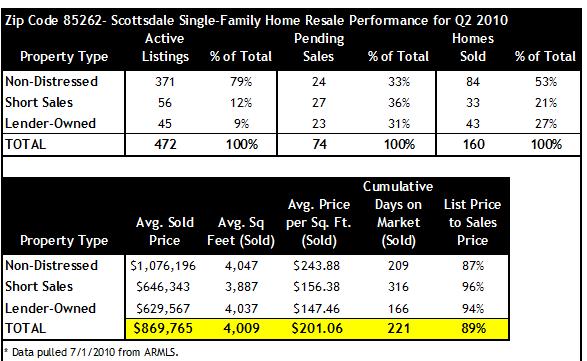

Here is how the sales activity for Scottsdale zip code 85262 broke out for Q2 2010:

Overall Findings for Q2 2010 - Scottsdale Single-Family Home Market for Zip Code 85262

- Active Homes For Sale: As we have seen in Scottsdale in general, non-distressed sales represent the majority of the homes on the market. For 85262, these homes were 79% of the market. The remaining 21% was split almost equally with short sales (12%) and lender-owned (9%).

- Pending Homes for Sale: Pending sales were almost equal between the three sub-categories. Regular sales were 33%, short sales were slightly higher at 36% and foreclosures were at 31%.

- Q2 2010 Scottsdale Home Sales: Although pending home sales in Scottsdale were almost equal at the end of Q2 2010, the actual sales figures showed a bit of divergence. The majority of home sales were regular sales (53%). Foreclosures came in second at 27% and short sales were the least represented with 21%. This makes sense as regular sales are the most "standard" sales you see today, with foreclosures coming being a little more complex. The short-sale process can take many months to complete and many sales fall out, so it makes sense it had the lowest percentage of sales.

- Home Prices: The average home price as well as the average price per square foot for non-distressed home sales were significantly higher than the two other categories. If you look at the lender-owned category, average square footage was very similar to non-distressed sales, but the average price per square foot was almost $100 less.

- Days on Market: Lender-owned homes enjoyed the shortest average days on market with 166. This is understandable as there continues to be pent-up demand for foreclosures throughout the Valley. Short sales come in with the highest days on market as the sales process is the longest of the three.

Discounts Off of List Price: A very large discount off asking price, 13%, was seen with non-distressed sales in the second quarter of 2010. This is because non-distressed sellers have the luxury of negotiating their own price versus relying on a third-party for approval. Short sales and foreclosures were in the 5% discount range for Q2 2010.

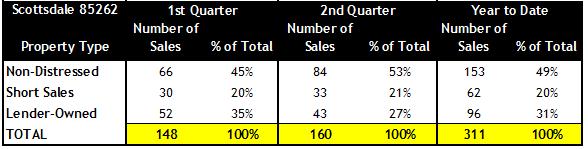

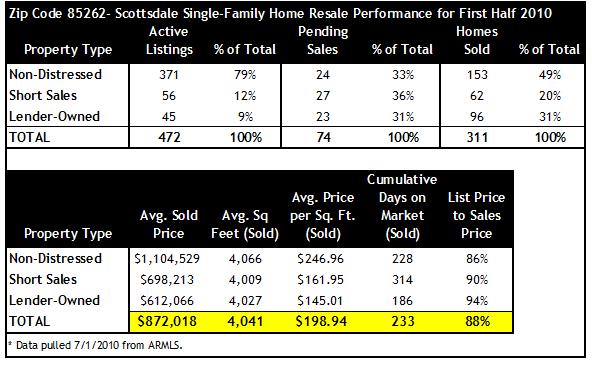

Here is the same analysis for the first half of 2010 for zip code

Originally posted on Live Better in Scottsdale

Disclaimer: Data and information was pulled from the Arizona Regional MLS (ARMLS) as of 1/1/2010, 4/1/2010 and 7/1/2010 and can change at any time. The analysis looks at single-family resale homes for sale and sales in Scottsdale AZ over the last 12 months. There may be new home inventory in these figures if the developer is using the MLS to market its homes. Information deemed reliable but not guaranteed.

Copyright © 2010 Heather Tawes Nelson

Comments(2)