Nice analysis for your area. I hope you don't see an increase in foreclosure...supposely the banks are becoming more receptive to the short sale alternative. I am working a short sale now, and so far it has been a positive experience. I also list a lot of bank owned properties and am trying to do more short sales to prevent more foreclosures in our area.

Very nice post Jane. You did a very nice job of showing the impact on your market by REO's being released and posed some interesting questions. Makes a person think.....

I just received 3 assignments in my in-box from one company alone. That was a surprise. Just happened two days ago.

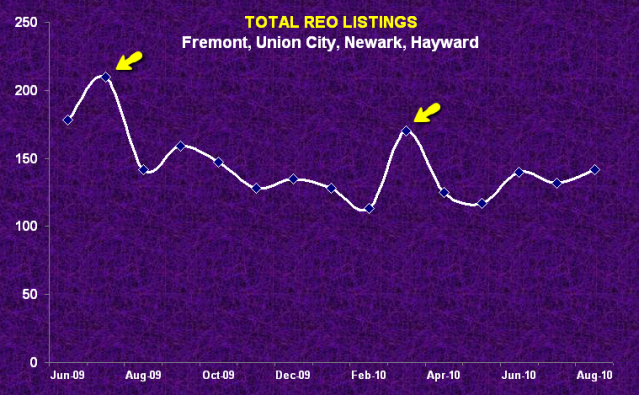

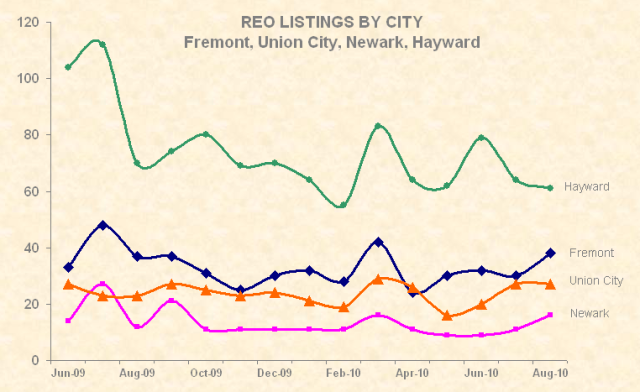

Hard to say at this point where and when more will flood the market as they already have. Excess REO homes sitting on the market will mean loss of values. With lack of motivated buyers this is a great mix for the economy.

Debbie, Foreclosure is the worst, short sale is a better alternative, although the homeowner still loses his home in both cases. It's a sad ending either way. Good luck with your short salea and REO listings!

Jane

Connie, it's hard to see where we're headed because news going around can be contradictory. Let's hope it is not a severe hit!

Mark, It seems that way, but hopefully more homeowners are able to save their homes this time.

Mario, Oversupply will surely bring down values. Let's hope REOs don't severely hit the market.

Jane

We are seeing more NEDs filed in our area, and the requests for BPOs has increased.

Comments(7)