Does your Loan Officers Credit Score Matter to You?

Nationwide Mortgage Licensing System now Checking S.A.F.E Act Loan Officers Credit Reports

St Paul, MN: In reaction to the mortgage market meltdown that exploded onto the market in early 2007, Congress went after what they believed to be a major contributor to the problem, the lack of licensing and standards for Loan Officers.

The result was the S.A.F.E. Act of 2008, which requires pre-employment education, passing a difficult Federal test, passing difficult State tests for each state the Loan Officer is conducting business, yearly continuing education, criminal background checks, and as of Nov 1, 2010, a review of the Loan Officers personal credit report.

While just about everyone would agree that this was a move in the right direction, Congress seriously dropped the ball. The S.A.F.E. Act, only requires non-bank Mortgage Loan Officers and Loan Officers working for Mortgage Brokers to meet the requirements. Loan Officers at big banks, Wells Fargo, US Bank, Chase, Bank of America, and any other Federally Charters Bank ARE NOT REQUIRED to do anything except register their name in the system. This has created a huge gap in knowledge, experience, and Loan Officer quality.

Part of the S.A.F.E Act required a public access web site where consumers can look up their Loan Officer. Follow this link: http://www.nmlsconsumeraccess.org to check out your favorite loan officer.

CREDIT REPORTS are now required as to be submitted into the Nationwide System for State Review. State Regulators will review each non-bank Loan Officers credit report to determine how responsible the Loan Officer is with their personal credit. One can only assume this is under the misguided thought that if the Loan Officer isn't able to handle their own credit, how can they advise you on yours? On the surface, this doesn't sound like a bad requirement, but there are many reasons that good people can end up having bad credit through no fault of their own. Major medical issues, spouse job loss, etc. The exact same factors that could turn YOUR personal good credit bad.

CREDIT REPORTS are now required as to be submitted into the Nationwide System for State Review. State Regulators will review each non-bank Loan Officers credit report to determine how responsible the Loan Officer is with their personal credit. One can only assume this is under the misguided thought that if the Loan Officer isn't able to handle their own credit, how can they advise you on yours? On the surface, this doesn't sound like a bad requirement, but there are many reasons that good people can end up having bad credit through no fault of their own. Major medical issues, spouse job loss, etc. The exact same factors that could turn YOUR personal good credit bad.

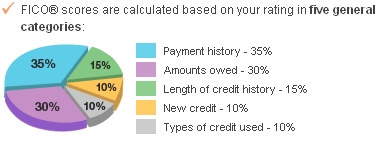

Items under review will include: Bankruptcies, judgments (except medical), tax liens (both state and federal), foreclosures (past three years), general late payments on accounts, collection accounts, outstanding child support, and more. According to the rules, they will not be looking at the actual credit score, but systematically looking at the Loan Officers overall long term financial irresponsibility before they make a final decision on granting a license.

I personally have excellent credit, and have no fear over my credit report, but let's assume a Loan Officer DOES have credit issues? No problem. Just go work for a bank and problem solved. No credit report required.

------------------------------------------------------------

Be Smart - Get Answers

Joe Metzler is a Certified Minnesota Mortgage Specialist (MMS). His team has over 50-years mortgage lending experience in MN and WI. View his web site at www.JoeMetzler.com. Joe's NMLS # is 274132

33 Wentworth Ave E #290, Saint Paul, MN 55118

Ph: (651) 552-3681

We Beat The Banks Everyday

Mortgages Unlimited is a Full Eagle FHA Lender. We lend in MN, WI only

(C) Copyright 2010 - Joe Metzler. Re-Blog but don't steal.

Comments(6)