Washington County Maryland - USDA Rural Development Home Mortgage Loan - No Money Down - 100% Financing

Through a special loan program from the U.S. Department of Agriculture Rural Development Loan Program, home buyers in Washington County Maryland may qualify for moderate income housing opportunities in rural communities. The USDA Rural Loan promotes home ownership by offering No Money Down Financing or 100% Mortgage Financing, with No Monthly Mortgage Insurance requirements, and flexible sources allowed for paying a home buyers closing costs.

Through a special loan program from the U.S. Department of Agriculture Rural Development Loan Program, home buyers in Washington County Maryland may qualify for moderate income housing opportunities in rural communities. The USDA Rural Loan promotes home ownership by offering No Money Down Financing or 100% Mortgage Financing, with No Monthly Mortgage Insurance requirements, and flexible sources allowed for paying a home buyers closing costs.

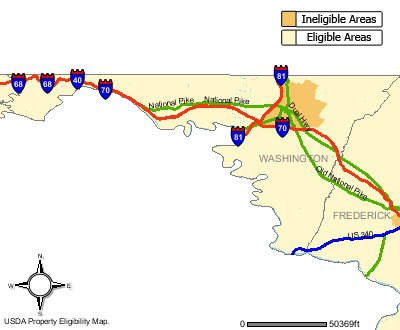

This loan program is available throughout Washington County except for areas in and around Fountainhead-Orchard Hills and Halfway. The remainder of the County, including Big Pool, Brownsville, Clear Spring, Fairplay, Hancock, and Maugansville, is eligible for this Rural Loan Program.

Eligible properties must meet certain restrictions regarding the condition of the property (i.e. no fixer uppers), no in-ground pools, and the land value can't exceed 30% of the properties appraised value. The house must be the primary residence.

Home buyer restrictions include a minimum 620 middle credit score for all borrowers on the loan and the combined household income can't exceed $89,150 (family size 1-4) and $117,700 (family size 5+). Income in excess of these limits can still qualify for the USDA Loan provided the home buyer can document certain deductions to their gross income as determined by the Washington County USDA Rural Income Loan Calculator.

Home buyers purchasing a house in an eligible USDA Rural Loan area with a household income that meets USDA Rural Loan income requirements can determine how much the USDA Loan program will save them on their upfront down payment and monthly payment using the USDA Vs. FHA Comparison Calculator. When evaluating the benefits of a USDA Vs. FHA loan the home buyer only has to decide if they should save on the monthly payment or buy a more expensive house with the same payment as a lower priced house using FHA financing.

To learn more about the USDA Rural Development Mortgage Loan go to MarylandUSDA.com or call (410) 552-5912 to get answers to your mortgage loan questions and determine your eligibility for this No Money Down Loan Program.

Comments(1)