Whoever said buying a house was easy? Certainly not me and maybe nobody has! After deciding where to live, you recruit a Realtor and then you find a home. Then comes the most difficult part... paying for it.

A large down payment (and hopefully at least 20% of the purchase price) is possibly the best way to get ahead when making a home purchase. It is helpful to decide years in advance the cost of your ideal home and start saving for that 20 percent. Money for your down payment can come from many places... the most common is cash from your savings account or equity from your previous home. Down payments can also come from gifts that don't need to be repaid or from loans taken against your retirement account.

Benefits to having at least 20% down include:

1. You should receive a lower interest rate with a larger down payment. The lender sees you as less of a risk and is willing to give you more money at a lower rate.

2. A 20% dow payment should allow you to avoid paying mortgage insurance.

3. The more money you put down, the less amount you have to take out in a loan, as well as a lower interest rate, therefore reducing your monthly payment amount.

Options if you aren't able to come up with 20% of the purchase price:

1. The Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) may be able to help pay your up-front cash requirements.

2. Some state and local government agencies will sometimes offer grants for home buyers that qualify. Check your local city, county and state websites for the most current programs.

3. Mortgage insurance is available that should help you qualify for the home you want to buy, but be prepared to pay for this each month.*

*If you haven’t heard, FHA announced on February 14th that it is raising the annual mortgage insurance premiums, also known as the FHA monthly mortgage insurance. These changes are mentioned in Mortgagee Letter 11-10 and become effective on or after April 18th, 2011. The new change is 25 bps increase!*

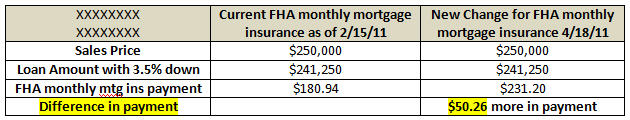

Old vs. New monthly mortgage insurance changes

This chart is from Mortgagee Letter 11-10 – Annual Mortgage Insurance Premium Changes. As you can see by the red arrow, indicating that this goes into effect on April 18th, not April 4th. So what does this all mean to those refinancing or buying new homes with a FHA mortgage?

This is based on a $250,000 sales price and the end result is that it would cost the buyer $50.26 more in their total monthly mortgage payment. You can also look at it from the flip side when qualifying buyers. This could lower the new buyers purchasing power by about $9,000. Meaning, instead of the $250,000 purchase price in the example, they can now afford a $241,000 home.

This new change is for your primary 1 to 4 unit properties. This change does not affect Title 1 loans, the HECM loan (reverse mortgages – which I am writing about tomorrow), the HOPE loan, and a few other types of FHA loans. This can also be found in the new FHA mortgagee letter 11-10.

There are also new changes to how one would have to request a FHA case number, cancellations of FHA case numbers, and a few other issues. These changes can also be found in the new FHA mortgagee letter 11-10.

Here is a quick breakdown of different purchase prices just to give you an idea how much more your mortgage payment will increase because of the new FHA monthly mortgage insurance change. In simple math, your mortgage payment will go up $10 per month for every $50,000.

So, if you are thinking about buying a home in Sandy, Draper, Salt Lake City, Holladay, Murray, Herriman, Riverton, West Jordan, South Jordan, Bountiful, Park City, Sugarhouse or the Avenues, or are in the process of doing so without at least 20% down payment of your purchase price and are thinking of getting an FHA loan, get a move on your lender quickly to avoid the additional monthly mortgage insurance.

LINDA SECRIST - LINDA SECRIST & ASSOCIATES - EVERYTHING THEY TOUCH TURNS TO SOLD

Comments(7)