I received a phone call from one of my short sale clients the other day. He owns a condo worth $60,000 which he owes $140,000 on. When we first met we discussed the various options open to him and he assured me he had already looked in to bankruptcy but had ruled it out since the only thing really holding him down were his two mortgages on the condo.

I listed the condo and found him a cash buyer (a must since with a value this low and an investor ratio that is high it is pretty much impossible to get a loan there), who was willing to take the property as is (also a must considering the condition) and who was willing to commit (in writing) to hanging in while I obtained short sale approval on both loans.

I obtained short sale approval on both loans-no cash contribution required, no promissory note required, deficiency forgiven. My client was delighted. He was within reach of his goal of getting out from under.

But wait…the buyer’s title search showed a Division of Employment Security lien for almost $3000 bucks on the unit (this was somehow missed when I had the Current Owner Run done when I first listed the property…grrrr!).

So, I girded my loins and went in to battle with the Division to try to get them to move off their position that they won’t lift the  lien without full payment. Even the Evil Empire known as the IRS will lift a lien to allow a short sale and prevent a foreclosure. Well, the Division of Employment Security makes the IRS look like a charity organization. It took all week but I finally got them to knock the required payment down substantially. Great!

lien without full payment. Even the Evil Empire known as the IRS will lift a lien to allow a short sale and prevent a foreclosure. Well, the Division of Employment Security makes the IRS look like a charity organization. It took all week but I finally got them to knock the required payment down substantially. Great!

Well, maybe not…Turns out my client knew all about the lien but didn’t feel the need to tell me (even though I specifically asked). Apparently, he thought it was going to magically disappear.

Also turns out he doesn’t want to pay it and he’s now thinking of filing bankruptcy and letting the property go to foreclosure after all, since the attorney he just talked to told him it will only cost him a grand and he’ll be able to get another loan to buy another property in two years…no problem.

Now, I can’t argue about the cost of the bankruptcy (although $1000 sounds suspiciously low to me) but the part about being able to get another loan –no problem- in two years after a foreclosure is pure horse pucky and I tell him so. I also tell him that he needs to do what is right for him but I would like him to make his decision based upon accurate information regarding how this will affect him in the future.

He says he doesn’t understand how the attorney can be wrong. I tell him, “In the attorney’s defense this has been a bit of a moving target but I’ll send you the current guidelines”. (I don’t tell him the “moving target” last changed in April 2010 and the attorney should have caught up with them by now.)

So just for the record, conventional guidelines indicate the following:

With a foreclosure there is a 7 year wait, no matter how much you put down, UNLESS you can PROVE extenuating circumstances.

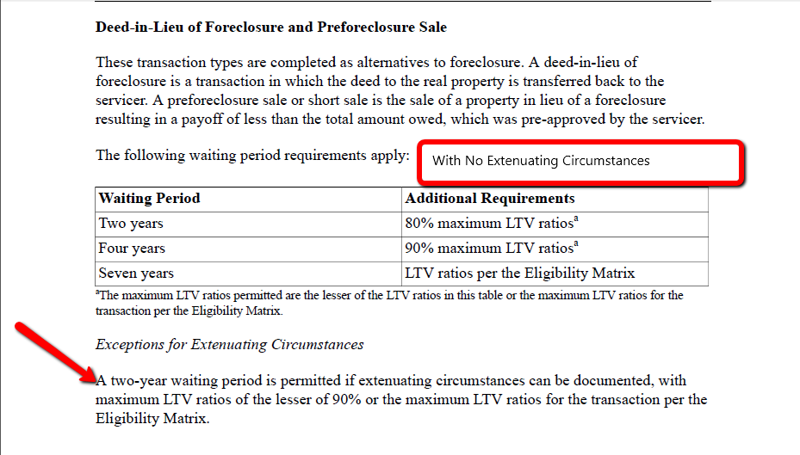

With a short sale you can obtain another loan in 2 years, WITHOUT PROVING ANYTHING, if you put 20% down and in 4 years, WITHOUT PROVING ANYTHING, if you only want to put 10% down. If you can PROVE extenuating circumstances it shortens up to 2 years for a short sale.

Here are the Fannie Guidelines - straight from the Seller's Guide:

THIS IS FOR FORECLOSURE:

THIS IS FOR SHORT SALE:

Further extenuating circumstances are defined as a major nonrecurring event that was beyond the borrower’s control that led to a sudden, significant and prolonged reduction in income or catastrophic increase in expenses (as in a medical situation).

The guidelines go on to say that if a prospective borrower claims extenuating circumstances as the reason they defaulted on their previous financial obligations they must be able to provide acceptable back up documentation or it may be determined that “financial mismanagement” was the real reason behind the default.

These guideline changes…lengthening the wait post foreclosure and shortening the wait post short sale were put in to place specifically to encourage people to participate in their lender’s loss mitigation efforts by cooperating with a Short Sale.

Further, although it may seem to some that the “banks” are as difficult to deal with as ever on a short sale, the truth is they have improved and, in any event, if there is difficulty it is most likely going to come from the Servicer (“bank”, to the uninitiated) and not the Investor.

(Hint to potential short sellers – ask the agent you are talking to if they can help you find the Investor on your loan. If they look at you blankly…run away. They have no idea what they are doing.)

Now I ask you, in a lending environment where credit worthy buyers with good job histories are complaining that they had to jump through hoops to get their loan.........

........how easy do you think it is going to be to PROVE extenuating circumstances?

I pull up the Guidelines and send them to my vacillating client.

I hope he makes the right choice.

Comments(5)