Here is the latest news from our mortgage partner Shawn Huss at First Place Bank. If you have any real estate needs in Greater Cincinnat please call our office at 513-549-7469.

|

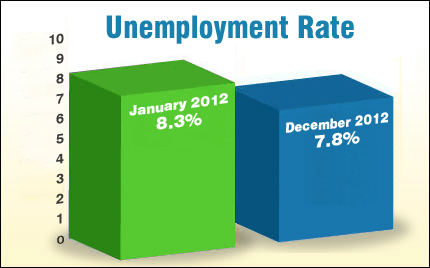

Time will tell. And as 2013 marches along, time will tell us what impact avoiding the Fiscal Cliff had on our economy...and if our labor market will continue to improve. Read on for details, and what they mean for home loan rates. |

|

Forecast for the Week |

|

|

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. Chart: Fannie Mae 3.0% Mortgage Bond (Friday Jan 04, 2013)

|

|

The Mortgage Market Guide View... |

|

|

|

Brain Power Boosters for Busy People Economic Calendar for the Week of January 07 - January 11

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email: SHUSS@FPFC.NET

If you prefer to send your removal request by mail the address is:

Shawn Huss is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

|

Comments(0)