The leverage based economy: $1,000,000 home for $2,000 a month even with higher rates. The addition of Goldman Sachs and Visa to the DOW reflect our leverage based economy.

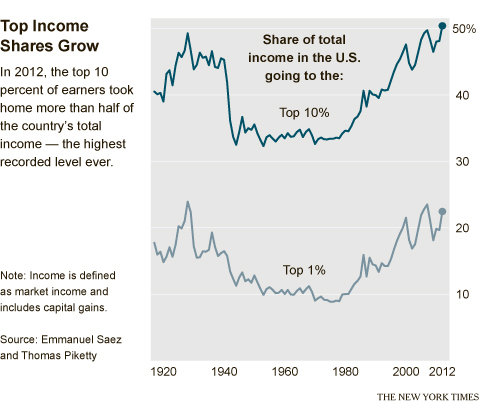

It was interesting to see Goldman Sachs and Visa being added to the DOW 30 Index. The importance of this highlights the massive amount of leverage in our economy. Those benefitting from low rates are large investors with the ability to use financial arbitrage and have the ability to keep ahead of inflation. For the last few years, that pathway has come through hedge funds and Wall Street picking up loads of investment properties scattered in the wreckage of the bursting housing bubble. Another interesting piece of data came out regarding wealth distribution in the United States. The top 10 percent of earners took in half of the country’s total income, a new record that goes back to the early 1920s, pre-Great Depression. Those with the ability to access high leverage products, like many clients of Goldman Sachs, have done extremely well since the recession ended in 2009. For others, not so much. In fact, you can still purchase a $1,000,000 home today for $2,000 a month. Find out how via the wonderful world of leverage.

Higher rates put a minor dent into high income leverage

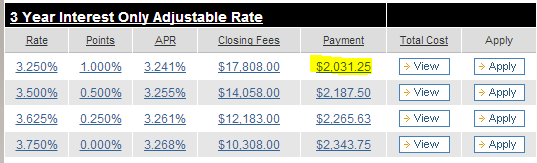

A few months ago we discussed how it was feasible to purchase a $1,000,000 home for a payment of $1,900 a month. Since rates have shot up overall since then, I thought it would be interesting to see how the higher rate market impacted the interest only segment:

Assuming you purchase a $1,000,000 home with $250,000 down, you can get your monthly principal and interest payment down to $2,031. Not bad for grabbing onto a million dollar property. Taxes and insurance will add on another $1,000 or so per month so your total PITI will be in the $3,000 to $3,200 range. In these low rate environments, a buyer at this level can offset a large portion of their tax burden by leveraging this debt and writing off interest and taxes for example. This can be a big windfall for higher income families. A high mortgage is beneficial if your income is above $200,000. Why? The IRS maximum for mortgage interest debt is $1,000,000. In the mortgage above, you are paying $24,372 in interest alone which is a nice deduction to have especially at a higher marginal tax rate. Ultimately wealthier families are going to have access to better tax planning and methods of sheltering income. Real estate provides some of the largest government subsidies in our economy especially in California (i.e., mortgage interest, taxes, Prop 13, non-recourse state, etc).

Cash investors are chasing lower priced properties for renting them out but a good portion of cash buyers are buying to live in the property. Last year, all-cash purchases in California above the $500,000 mark rose 35 percent from 2011. This year it is up as well. This figure is important because these are unlikely to be investment properties since the higher the price, the harder (and smaller) the pool of potential renters you can find.

Make no mistake though, the bulk of buying is going to investors looking for rentals or flips and this market is frothy like a rabid squirrel. For example, last month in SoCal 29.4 percent of all sales went to cash buyers. Of those, 27.4 percent were “absentee” meaning these people were not slated to live in the property. That is a large portion of the market. Cash buyers paid a median $328,000 so they are definitely chasing lower priced properties to flip or rent out.

The gains flow to the top

We’ve talked about the shrinking middle class in California and how wealth disparity is growing dramatically. This week, we have additional data confirming this massive change:

Source: NY Times

The top 10 percent of income earners captured half of all income in the country, the highest amount ever. Keep in mind that some areas are becoming targeted locations for wealth. It is interesting to see neighborhoods where new residents that just bought are working professionals with high incomes yet are moving into areas where people would not have the ability to buy their own home today if they had to. I’ve seen this in Pasadena where you have someone that bought for $200,000 many years ago all of a sudden having a neighbor in a similar model home paying $1,000,000. The above chart highlights that the middle ground is becoming much smaller.

So it is interesting that we now have Goldman Sachs and Visa in the DOW. Probably an accurate depiction of our leverage based economy. Max it out via credit cards, auto loans, college debt, or a giant mortgage. If you are a big bank and can get your hands on cheap debt from the Fed, then you can plow that money into real tangible assets in real estate.

What is interesting is that in the last bubble, leverage was offered out to anyone with a pulse. Today, it is only a select few that can leverage this playing field and they are doing it. This is how we get massive investor money flowing into real estate.

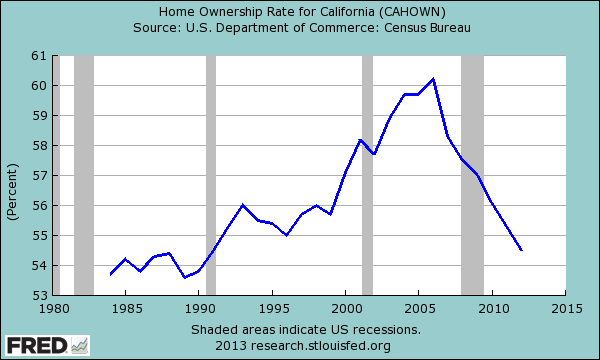

What impact has this had on California home ownership?

There is little need to guess what is happening here. Just follow the money. This is more evidence that the middle class is being constrained in the US, especially in high cost areas of California.

Comments (1)Subscribe to CommentsComment