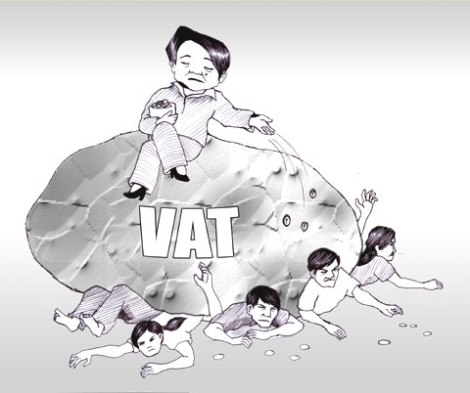

As many of you may know, the Bahamian government is looking to implement VAT (Value Added Tax) on July 1st of next year to broaden the tax base. What is VAT? Put simply, value added tax is a form of consumption tax. Many people are against this whole idea; quite frankly, I agree with them. If we look at our neighbors, St. Kitts and St. Lucia, we see the VAT negatively affected their economies, by essentially increasing their cost of living by 15%. Today, my question is, how will this VAT affect our real estate industry?

Luckily, there is some good news. There is no VAT on residential real estate. This means that there won’t (or shouldn’t) be an increase in rental prices, nor will the price of land or houses for sale go up. Now, this may sound ideal, but VAT will indirectly affect the residential real estate sector. “How?” you may ask. Well, VAT will affect the cost of the services needed to acquire residential real estate, such as Bankers’, Lawyers’, and Agents’ fees. Therefore, while the price of property won’t go up for residential real estate, we can expect to see a bump in closing costs to actually acquire residential real estate.

Let’s get to the not-so-good news. Even though the price of land and residential houses won’t be affected by VAT, the market will directly be affected by the consumers’ purchasing power. With VAT increasing the consumers’ cost of living by 15%, people will have less disposable income to use for investment purposes (such as buying property). The last thing agents want to hear is that consumers may not have enough money to invest in real estate. Please notice that the VAT will only be applicable to new houses that were built after the tax has been implemented. This means that houses that were build before the implementation of the VAT would not be affected.

Now, let’s get to the really bad news. ALL commercial real estate rentals and sales will be taxed 15%. This will have a detrimental effect on commercial real estate transactions, and by extension, the business sector. Investors wanting to open new businesses will face increased real estate costs. The effects of this must not be underestimated, as real estate is one of the largest capital expenses for any new business. Higher costs mean fewer new businesses, a lower survival rate, and fewer jobs created by the local private sector.

My advice? Take advantage of the real estate market while you can. Purchase the land you’ve had your eye on for a while. Start building the home you always wanted. You’ll be happy you started now and not during the time the VAT is implemented. You will take advantage of the low transactional costs, as well as low costs for the building materials needed.

If you’ve been looking at a home or property that you are interested in purchasing, feel free to contact me, Your Bahamian Realtor, at:

W: (242) 677-8255

M: (242) 477-0266

tristan@mariocareyrealty.com

Tristan White | Your Bahamian Realtor

Comments(0)