Hello, and welcome to Real Estate Reality Radio. The most important hour of radio every Friday from 9 to 10 on WBCB 1490 am. Thank you for joining us. For those of you who are new to the show I have spent the last 40 years in the real estate industry both as a realtor and a mortgage banker. The show is dedicated to dispelling the myths associated with Real Estate and finance in your marketplace.

Within every market there are obstacles and solutions on the path to tremendous opportunities. I believe that most people are looking for practical advice. Please feel free to call 215-740-8999 or visit peterbuchsbaum.com.

Please join us live on the web at www.wbcb1490.com or on your FREE app Tune In Radio from 9:00am to 10:00 am every Friday.

So last week we were joined by Andy Dziedzic from Financial Strategies Advisory for our Financial Fitness segment.

This week’s news has again been dominated by banks and news of their continued bad behavior. Countrywide Defrauded Fannie Mae. A jury finally decided that the former lender was guilty of knowingly selling bad loans to Fannie Mae and Freddie Mac. The used a system dubbed the “High Speed Swim Lane”. Bank of America bought Countrywide and they are now liable for the law suit. Banks too connected to fail. Shockingly two recent studies have shown that the biggest contributors to the treasury got bigger loans with better terms. What’s holding up JP Morgan’s settlement? JP Morgan wants the FDIC to pay because they claim they bought Washington Mutual from the FDIC out of receivership therefore they should get to keep the money they made from deposits but not pay the fine. Foreclosed homes still occupied! Realty Trac estimates that 47% of all foreclosures are still actually occupied. In some over saturated markets the banks let the owners stay rent free. And they think I am a nut. Millennials face hurdles buying homes. You guessed it. High student loan debt and low paying jobs are keeping many young educated people from home ownership. First time homebuyer programs like FHA have become very expensive and thus prohibitive.

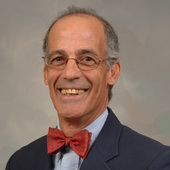

Today Eddie and I are being joined by Jay Blumenthal the tax collector from Abington Township. Jay Blumenthal. He is Abington’s Township Treasurer and Tax

Collector for the past eight years. As Township Tax Collector, Jay collects all real estate and business taxes. He has tackled the job head-on and has made many positive changes in the Tax Office. Jay serves as a full-time Township Treasurer and Tax Collector. Because Jay knows the value of your tax dollars, he has given back part of his income to the township.That is just one example of the selfless dedication Jay shows every day.

Please join us live at www.wbcb1490.com for the open discussion about why tax dollars are not punishment and who is collecting them on behalf of your township.

Each week we discuss the myths of the mortgage market. It is not about rate. A higher rate with no mortgage insurance may provide a lower payment.

Comments(0)