Send to a Friend Send to a Friend

|

|

Follow Me On: |

Mortgage Marketing Guide: Markets Not a Fan of Uncertainty

| In This Issue... |

|

Last Week in Review: Despite some positive economic reports late in the week, the markets grew volatile ahead of the upcoming Fed meeting. Forecast for the Week: The Fed meets, plus key reports on inflation, manufacturing and housing. View: Finding new clients can be easy with these four tips. |

||

| Last Week in Review |

|

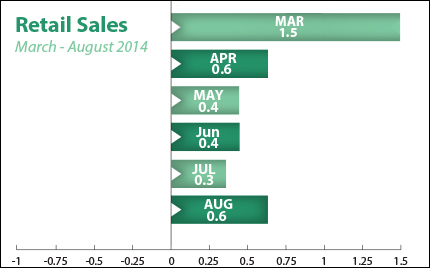

"I don't know where we're going, but we're on our way!" That quote from a Little Rascals episode applies to the markets of late, as uncertainty ahead of the upcoming Fed meeting has caused volatile movements for both Stocks and Bonds. Read on to learn how home loan rates were impacted. Consumers opened their wallets in August, as Retail Sales rose by 0.6 percent, buoyed by a surge in auto sales and partially offset by a decline in gas prices. Sales for July were also revised higher. The Consumer Sentiment Index for September also came in above expectations. Meanwhile, Initial Jobless Claims rose in the latest week, but remain relatively close to the 300,000 level they've been averaging recently. In housing news, RealtyTrac reported that foreclosure filings in August, which included default notices, scheduled auctions and bank repossessions, declined 9 percent from a year earlier, to nearly 117,000. What does all of this mean for home loan rates? Positive economic news often causes money to flow out of Bonds and into Stocks, as investors hope to take advantage of gains. However, uncertainty trumped this principle last week, as both Stocks and Bonds worsened ahead of the upcoming Federal Open Market Committee meeting. Investors are nervous about what the Fed may say regarding the end of their massive Bond-buying program, which is expected to end in late October. The program has helped boost the housing industry since its most recent inception in late 2012. However, despite the recent volatility in the markets, home loan rates still remain near 12-month lows. The bottom line is that now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients. |

||

| Forecast for the Week |

An abundance of economic reports will be released, with readings on consumer and wholesale inflation, manufacturing and housing.

In addition, the regularly scheduled two-day Federal Open Market Committee meeting takes place this week, with the Fed's monetary policy statement due to be delivered on Wednesday at 2:00 p.m. EDT. This news has the potential to shake up the markets, and could lead to added volatility in Stocks and Bonds. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond on which home loan rates are based. When you see these Bond prices moving higher, it means home loan rates are improving—and when they are moving lower, home loan rates are getting worse. To go one step further—a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds struggled in recent days but home loan rates remain near 12-month lows. I'll continue to monitor the markets and the Fed statement closely for the latest developments. Chart: Fannie Mae 4.0% Mortgage Bond (Friday Sep 12, 2014)

|

| The Mortgage Market Guide View... |

Questions, Comments or For more information you can email Christian Penner at TheMortgageTeam@ChristianPenner.com or visit us online at www.ChristianPenner.com or you can call us directly at: 561-316-6800

ChristianPenner.com

http://www.christianpenner.com/mortgage-marketing-guide-markets-fan-uncertainty/

Mortgage Marketing Guide: Markets Not a Fan of Uncertainty

Or You can click "Call Me" below to call Christian Penner directly using Google Voice

#ChristianPenner, #MortgageBrokerWestPalmBeach talks about #RealEstateWestPalmBeach. He also serves other Local Areas and provides home #MortgageSolutionsforPalmBeachGardens, #Jupiter, #BocaRaton, #Wellington and #Tequesta. #ChristianPennerMortgageBrokerJupiter has the #lowestmortgagerates and the best #homemortgage programs like; #Jumboloans, #FHAHomeLoans, #VAHomeLoans, #ReverseMortgageHomeLoans, #FreddieMacHomeLoans, #FannieMaeHomeLoans and #HARPMortgageLoans. #ChristianPennerMortgageBrokerPalmBeachGardens has Served the area for over 15 years with his #HomeLoanLending Needs and Works with #FEMBIMortgageinJupiter. You Can Also Find Him On

Facebook at: http://Facebook.com/YourMortgageBanker

- - -

- - -

ChristianPenner.com

http://www.christianpenner.com/mortgage-marketing-guide-markets-fan-uncertainty/

Mortgage Marketing Guide: Markets Not a Fan of Uncertainty

#Markets

#Inflation

#Fed

#HomeLoanRates

#MassiveBondBuyingProgram

#BoostTheHousingIndustry

#FederalOpenMarketCommittee

#MortgageBackedSecurities

#ChristianPenner #MortgageBanker #mortgage #mortgagerates #mortgageloans #getpreapproved #westpalmbeach #wellington #westpalmbeachmortgagebroker #wellingtonmortgagebroker #loans #preapproval #westpalmbeachloans #palmbeachloans #browardloans #getamortgageloan #mortgagelender #mortgagelenders #browardcounty #palmbeachcounty #dadecounty #florida #realestate #westpalmbeachrealestate #wellingtonflorida #wellingtonfl #realestate Christian Penner #ChristianPenner Christian Penner Home Loan Company #ChristianPennerHomeLoanCompany Current Mortgage Rates #CurrentMortgageRates FHA loan #FHAloan FHA loans #FHAloans FHA Mortgage Financing Specialist #FHAMortgageFinancingSpecialist FHA Mortgage Lenders #FHAMortgageLenders FHA VA Financing Specialist #FHAVAFinancingSpecialist Harp Refinance #HarpRefinance Home Finance Mortgage #HomeFinanceMortgage Home Loan #HomeLoan Home Loan Company #HomeLoanCompany Home Mortgage #HomeMortgage Home Mortgage New #HomeMortgageNew Lenders Mortgage #LendersMortgage Mortgage #Mortgage Mortgage Banker #MortgageBanker Mortgage Banker West Palm Beach #MortgageBankerWestPalmBeach Mortgage Broker #MortgageBroker Mortgage Broker Florida #MortgageBrokerFlorida Mortgage Broker West Palm Beach #MortgageBrokerWestPalmBeach Mortgage Broker West Palm Beach #MortgageBrokerWestPalmBeach Mortgage Brokers #MortgageBrokers Mortgage Brokers West Palm Beach #MortgageBrokersWestPalmBeach Mortgage Companies #MortgageCompanies Mortgage Company #MortgageCompany Mortgage Lender West Palm Beach #MortgageLenderWestPalmBeach Mortgage Lender West Palm Beach #MortgageLenderWestPalmBeach Mortgage Lenders #MortgageLenders Mortgage Loan Lender #MortgageLoanLender Mortgage Loan Lenders #MortgageLoanLenders Mortgage Loans #MortgageLoans Mortgage Rate #MortgageRate Mortgage West #MortgageWest Palm Beach Mortgage Broker #PalmBeachMortgageBroker Palm Beach Mortgage Broker #PalmBeachMortgageBroker Palm Beach Mortgage Company #PalmBeachMortgageCompany Real Estate #RealEstate Real Estate #RealEstate Real Estate Home #RealEstateHome Real Estate Home #RealEstateHome Real Estate West Palm Beach #RealEstateWestPalmBeach Realtor #Realtor Realtor West Palm Beach #RealtorWestPalmBeach Refinance #Refinance Refinance A Mortgage #RefinanceAMortgage Refinance Home Loans #RefinanceHomeLoans Refinance Mortgage Lenders #RefinanceMortgageLenders VA Financing Specialist #VAFinancingSpecialist VA Home Loan Expert #VAHomeLoanExpert VA Home Loans #VAHomeLoans Markets #Markets

Comments(0)