How to calculate an FHA mortgage payment has evolved again, now that the most recent Monthly Mortgage Insurance changes have been implemented via HUD Mortgagee Letter 2015-01.

How to calculate an FHA mortgage payment

Step 1: Determine the loan amount

· Purchase Price x .965 = Base Loan Amount (assuming the Borrowers opt for the minimum 3.50% down payment)

· Base Loan Amount x .0175 = Up Front Mortgage Insurance Premium (UFMIP)

· Base Loan Amount + UFMIP = Final Loan Amount

Step 2: Determine the monthly payment

1. Principal + Interest Payment Calculation

· Click here to access a free mortgage payment calculator for principal + interest payments

2. Property Taxes = Purchase Price of home x 0.0125 divided by 12 months (this number will be revised once the specific mathematical "tax factor" for the subject property is identified). For now, use 1.25% for budgeting purposes.

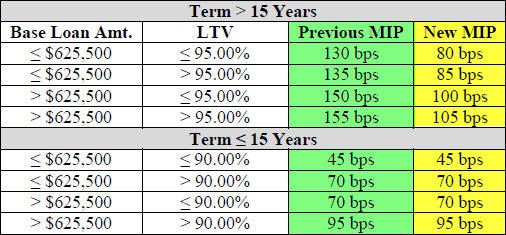

3. Monthly Mortgage Insurance (MMI) = Base Loan Amount x 0.0085 divided by 12 months

· Note: If the down payment is 5.00% or more, you will use 0.0080 instead of 0.0085 (see chart below for additional MMI options & scenarios)

4. Homeowners Insurance - For now, feel free to estimate roughly $60.00 - $80.00 per month (this number will vary depending on your insurance coverage amounts and insurance company)

· Note: Other names for this insurance include "Hazard Insurance" and "Fire Insurance" (these terms all refer to the same type of insurance)

5. Homeowners Association (HOA) Dues (Condominiums): This payment (when applicable) will vary depending on which condominium you choose.

· Note: If you buy a condominium, you can expect your Homeowners Insurance to be slightly lower (closer to the $35.00 - $45.00 per month range)

Total FHA Mortgage Payment (add the total of numbers 1-5)

By following these simple steps, you now know how to calculate an FHA mortgage payment. Additional Monthly Mortgage Insurance (MMI) options are listed below (based on variances of loan amount, LTV (down payment), and amortization term) which were updated on January 26, 2015. NOTE: MMI is also referred to as MIP (which stands for Mortgage Insurance Premium).

An important distinction to make from FHA loans of the past, is that the duration of time that the Monthly Mortgage Insurance (MMI) must be maintained has changed significantly:

Below is a breakdown of the historical changes to FHA MMI over the years. For a full explanation of the changes (including definitions of the types of FHA Mortgage Insurance requirements), click here.

Lastly, did you know that FHA loans are available for Borrowers with less-than-perfect credit? You might be surprised just how low your credit score can be to still qualify for an FHA mortgage loan! Click here for details!

For more information and transparency about mortgage items like this, please feel free to contact me directly. In the meantime, I do hope this information was useful in helping you to learn how to calculate an FHA mortgage payment.

Comments(0)