Wednesday, April 9, 2008

5 POSITIVE FACTS ON TODAY’S HOUSING MARKET

Although the media has raised concerns about today’s housing market, the current conditions can be beneficial for several reasons. Here are five things to keep in mind during your home search. 1: Homebuilding is cyclical.

1: Homebuilding is cyclical.

Everyone knows the housing market is in a down cycle, but what many people may not understand is this: Homebuilding is a cyclical business, as are the airline and automotive industries. The last housing downturn occurred in the late 1980s and early 1990s. New home sales began recovering in 1992 and continued growing until the next peak in 2005.

Despite short-term market cycles and fluctuations, long-term home values have increased historically. On average, the value of a home nearly doubles every ten years, according to research from the National Association of REALTORS®.¹ And the Federal Deposit Insurance Corporation reported that between 1978 and 2003, the nationwide House Price Index grew an average of 5% per year.²

So what does this mean for you? It’s a sound reminder to think about your long-term goals. While today’s market may not be optimal for investors seeking a quick turnaround profit, it could be an ideal window of opportunity for people who are seeking a place to live out their lives and build memories, dreams and futures.

2: Great financing opportunities. With low interest rates and a variety of loan programs geared toward current needs, many homebuyers may be able to take advantage of outstanding opportunities. For example, temporary changes are being made to FHA loans, which could potentially increase the loan amount that buyers may qualify for. This means that many customers shopping in markets where homes were previously above the FHA loan limit may now be able to apply and qualify.

For more information on FHA and other loan programs now available, visit us at www.ImYourLender.com.

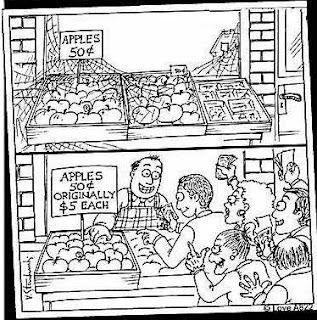

3: Buyers are in the driver’s seat. In today’s market, you can get more for your money. You’ll have outstanding choices when it comes to homes and locations. You can get more value, with the beautiful design features you’ve always dreamed of. You can enjoy more personal attention and customer care, with associates working closely with you to help you find the home of your dreams.

Most people have heard the phrase “Buy low, sell high.” The market could change at any time—and judging by historical standards, it’s only a matter of time before the cycle shifts again. So why wait for prices to go up when you could be living in the home of your dreams right now?

4: Local market conditions vary. Homebuyers today are flooded with national economic news that is not necessarily representative of their local market. Every area is different, as are many neighborhoods within a given area.

Pay attention to factors like an area’s economic standing, employment centers, schools, transportation and nearby amenities. These factors can have a substantial impact on home prices. Other ways to add value to your purchase? Choose features that will make your home stand out in any market, such as a great homesite, a three- or four-car garage, and desirable design options like granite countertops and hardwood flooring.

5: Tax advantages and lifestyle benefits. Paying rent each month makes no financial investment in your future. Your rent goes to your landlord, and is gone forever. On the other hand, when you buy a home, you should be investing money in your own future. It’s “The American Dream,” and one way the Federal Government encourages pursuing it is by offering tax benefits for homeownership.

If you itemize your tax return, the interest and property taxes you pay each year may be deducted from your gross income. This can reduce your taxable income, in effect lowering the taxes you pay. You may also be able to write off “points” you pay when you first finance your home purchase. You should contact a local tax consultant for advice on which tax advantages you might qualify for.

Perhaps most important of all, though, are the lifestyle benefits homeownership can provide. When you buy a new home, you’re investing in something far more valuable than any stock or bond can offer. You’re investing in memories. A home is a place where you can throw dinner parties, game nights and sleepovers; a place where you can play a game of catch in the backyard or sit on the front porch and watch the neighborhood kids play.

That’s the kind of investment that is worthwhile in any market.

Tuesday, March 25, 2008

Million Dollar Homes at Bargain Prices

Now could be a great time to buy a million dollar home in a nice area at a bargain price.

Now could be a great time to buy a million dollar home in a nice area at a bargain price.

Forbes magazine has identified Rancho Santa Fe, Calif., Marco Island, Fla., Castle Rock, Colo., Annandale, Va., and Bergen County, N.J., as five high-end areas where million dollar foreclosures abound.

Traditionally good borrowers with strong credit scores previously purchased a lot of these homes. In many cases, the foreclosure has come about because the homes are now worth significantly less than the inflated prices the owners originally paid. The homes have sunk into negative equity situations and the previous owners don’t want to make the payments, so they walk away, says Wendell Cox, founder of Demographia, a housing research company.

But foreclosures are not all bad news for the high-end real estate market. Nelson Gonzalez, a practitioner with Esslinger-Wooten-Maxwell, specializing in Miami Beach, says that the rash of foreclosures in Florida, which has the second-highest foreclosure rate in the country, has driven interest from out-of-town and foreign buyers looking to snag a deal.

"They think that every house in Florida is in foreclosure," he says. "The offers we're getting are fairly decent, but the sellers are not coming down yet."

Source: Forbes, Matt Woolsey (03/13/08)

Monday, March 24, 2008

Fed’s Bold Move Building Confidence

Liquidity, easy credit and steadiness are the main factors that the market was missing these last couple of quarters.

The Fed and the government are trying their best to bring investor confidence back by establishing different programs to lend money to investment banks and securities dealers, and by periodically slashing the Fed Funds rate and Discount Rate. That’s why the first half of the short week was completely dominated by news from the Fed. It started with an emergency move on Monday morning to cut the Discount Rate from 3.5% to 3.25%. In addition, the Fed established the Prime Dealer Credit Facility so that primary securities dealers can directly borrow money from the Fed and set up a $30 billion line of credit to assist JP Morgan. On Tuesday, The Federal Reserve cut its Fed Funds rate by three quarters, from 3% to 2.25%, and the Discount rate again by three quarters, from 3.25% to 2.50%. Investors have shown their support for the Fed’s move and both stocks and the Dollar rallied in response.

Thursday, March 20, 2008

Why Fed Rate Cuts Do Not Equal Lower Mortgage Rates

I have had several clients of mine call me whenever the Fed lowers rates, only resulting in me being the "bearer of bad news" when I tell them that rates actually went up as a result of the Federal Reserve cutting rates. Here is an great explanation as to why this is...

I have had several clients of mine call me whenever the Fed lowers rates, only resulting in me being the "bearer of bad news" when I tell them that rates actually went up as a result of the Federal Reserve cutting rates. Here is an great explanation as to why this is...

The Federal Reserve has been on a rate cutting spree once more. Many mortgage applicants are calling their mortgage representative and expecting a lower interest rate. Others who have been waiting to refinance are puzzled as to why mortgage rates have not moved lower during the recent five Fed rate cuts. This is difficult to explain to consumers who have watched a 2.25% reduction by the Fed with very little benefit in mortgage rates.

Is a Fed rate cut really good news for mortgage rates? The facts may be surprising. The Fed can only control the Discount Rate and the Fed Funds Rate. This is very different from mortgage rates. A mortgage rate can be in effect for 30-years while a rate set by the Fed can change from one day to another.

It is often said history repeats itself. And if history is any teacher, we can learn from what happened to mortgage rates the last time the Federal Reserve was in a rate-cutting cycle.

The last time the Fed was in a lengthy rate cutting cycle was back in 2001 from January 3, 2001 to December 11, 2001. In the span of 11 months, they cut the Fed Funds rate 11 times with eight of those cuts by 50bp. This resulted in a total of 475bp or 4.75% in short-term interest rate cuts taking the Fed Funds Rate from 6.00% down to 1.75%. Now most uninformed people would naturally think because the Fed cut rates by so much during this time that mortgage rates would follow suit and trend lower as well. Not so. Mortgage rates actually moved higher during this time of significant rate cuts because inflation, the arch enemy of bonds, gradually rose.

Now let’s take a look at what happened with the Fed’s most recent cutting cycle, the first since 2001. On September 18, 2007 the Fed cut the Fed Funds Rate by 50bp. The mortgage bond market briefly enjoyed a “knee-jerk” reaction to the Fed move by closing higher that day, but lost 140bp over the following two sessions. Then on October 31, 2007 the Fed lowered the Fed Funds rate by 25bp. The mortgage bond market responded by losing 78bp over the following five trading days. On December 11, 2007 the Fed once again lowered rates by 25bp and the mortgage bond market lost 88bp in the next three days. So far this year, the Fed delivered a surprise 75bp rate cut on January 22, 2008 and mortgage bonds lost a whopping 144bp in just 2 days. Eight days later and as widely expected, the Fed cut rates by 50bp. Within 13 days from that 50bp cut, mortgage bonds lost 269bp.

Please refer to the Table below.

|

Wednesday, March 19, 2008

What the Federal Rate Cut Means for Homeowners

The Federal Reserve’s rate cuts aren’t doing much to lower mortgage rate for new buyers, but they could help holders of existing adjustable rate mortgages.

The Federal Reserve’s rate cuts aren’t doing much to lower mortgage rate for new buyers, but they could help holders of existing adjustable rate mortgages.

Rates on home-equity lines of credit, credit cards and auto loans have all dropped. In addition, millions of homeowners won't face higher rates as their adjustable-rate mortgages reset.

Applicants for new mortgage are likely to continue to pay more. Mortgage rates typically follow the 10-year Treasury and have historically traded at about 1.8 percentage points above the 10-year Treasury yield. Those Treasurys currently yield about 3.451 percent. But investors, including pension funds, insurance companies and bond mutual funds, are demanding a greater premium these days for mortgages over less risky U.S. Treasurys.

The best advice for those seeking a mortgage: shop around. All mortgages aren’t priced alike, experts say.

Source: The Wall Street Journal, Jane J. Kim and Ruth Simon (03/19/2008)

Complete Article

Tuesday, March 18, 2008

FEDS CUT RATES BY .75%, WHICH PUTS PRIME AT 5.25%!!!

The Federal Reserve Board, slashed its key lending rate by 75 basis points Tuesday to jumpstart the sagging economy and boost confidence in the U.S. financial system.

The Federal Reserve Board, slashed its key lending rate by 75 basis points Tuesday to jumpstart the sagging economy and boost confidence in the U.S. financial system.

The central bank's action, which drops the federal funds rate target down to 2.25% from 3% -- its lowest level since December 2004 - was the latest in a series of extraordinary moves by the Fed carried out in the last week against a background of turmoil and crisis.

The Fed said the size of the rate cut was enough to promote growth, but left the door open to future cuts. Wall Street had expected the central bank to cut rates by a full percentage point, which would have been the largest cut since 1982. .

"Today's policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity," the Fed said.

Last Tuesday, the central bank announced a $200 billion loan program that would allow the nation's biggest banks to borrow Treasury securities and post mortgage-backed securities as collateral. The financing gave 20 top investment banks 28-day loans at what amounted to wholesale rates — at or slightly below the Fed's benchmark rate on overnight loans between banks.

Henry Paulson Jr., the Treasury secretary, vigorously endorsed the Fed's rescue efforts on Sunday and made it clear he was much less worried about the "moral hazard" of bailing out a Wall Street firm than he was about a chain reaction of defaults if Bear Stearns were to abruptly collapse.

"The right decision here, I am convinced, was the decision that the Fed made, which was to do things, work with market participants to minimize the disruptions," Paulson said on "This Week With George Stephanopoulos" on ABC.

Saturday, March 15, 2008

Median prices of Valley homes are all over the map

Catherine Reagor and Ryan Konig

Catherine Reagor and Ryan Konig

The Arizona Republic

Mar. 15, 2008 06:16 PM

The north-central Phoenix neighborhood ZIP code 85021, peppered with historic homes, posted a 16 percent increase in its median price during 2007.

• Condominium prices in the west Phoenix ZIP code 85037, which is at the junction of the Loop 101 and Interstate 10, climbed 21 percent. This area is also south of Glendale's sports stadium hub and the new Westgate shopping center.

• The central Ahwatukee ZIP code 85042 saw home prices climb 9 percent.

• None of the ZIP codes in Tempe, surrounded by other communities, fell by double digits. The median condo price in ZIP code 85281 climbed almost 11 percent.

• The median home price in the Mesa ZIP code 85207 climbed 17.7 percent, to $365,000.

• The median price in north Scottsdale's 85262 ZIP code, home to high-end golf developments, increased almost 7 percent, to $1.1 million.

"The bottom of the housing market may occur in 2008 or 2009, but a full recovery will probably take three to five years," said Elliott Pollack, an Arizona economist and real-estate investor. "This slowdown ends when housing prices stabilize."

Comments(0)