Pamela Madore

The Pamela Madore Group

http://pinkhouseteam.com

Don't Panic. Anything can be fixed given time.

Credit Reports can look like a tangled mess sort of like those formulas that geniuses write on black boards.

It takes someone experienced in reading a credit report to help you understand what it says. And know this---not everyone can plainly show you what it means nor show you how to fix it.

There are many credit repair companies but in my view you are perfectly capable of fixing your own credit report with a little understanding of how the process works.

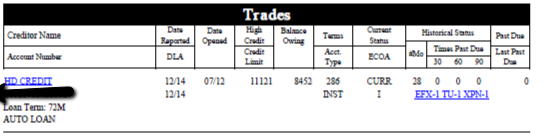

A credit report will typically start with all your good stuff first. The information reported is:

Type of credit (loan or revolving)

When you opened the credit

The high balance

The current balance

The payment

How many months you have paid on it

And if you have been 30 or 60 or 90 days late and if so, how many times

Lenders pay money to report to the credit bureaus. It costs money to do so. In the above example, perhaps the creditor only reported to 2 or the 3 bureaus. As you can see, that would cause a discrepancy in your score.

Typically the next thing that is listed are the open accounts that you have but have had late payments on them. If it shows that you have been 30 days late, then probably you were. There isn't much that you can do about it now. How long ago it happened will determine how much it will affect your score.

The next section is the most complicated and convoluted and has the most misinformation and discrepancies in it. This is the section of collections and/or charge-offs.

Mortgage industry experts estimate that 350,000 to 400,000 applicants are overcharged every year when lenders incorrectly label them as high risk borrowers because of their credit scores.

Encyclopedia of Retirement and .Fiance.

Why would they say "cost"? The answer is that the lower your score the higher your interest rates.

The section with the collections and charge-offs is the area that gets us. Trying to sort through it can be a nightmare. For instance, you may have a collection with Suddenlink for $122 dated back in 2008, But then somewhere in there Suddenlink sold the collection to ABC Collection agency. In the meantime Suddenlink forgot to mark it a zero balance because they sold it. Now you have two issues. Suddenlink and ABC.

How about the car repo where the bank said that they sold it for enough to pay off your balance and yet they still say you owe $3000?

You can sort any of these out with a little legwork and direction from someone that knows. And sometimes you will need to in order to get your credit score into a place where you can buy a house.

Call me and let me go over your report with you.

Specializing in finding buyers for our sellers.

A credit report will typically start with all your good stuff first. The information reported is:

Type of credit (loan or revolving)

When you opened the credit

The high balance

The current balance

The payment

How many months you have paid on it

And if you have been 30 or 60 or 90 days late and if so, how many times

Lenders pay money to report to the credit bureaus. It costs money to do so. In the above example, perhaps the creditor only reported to 2 or the 3 bureaus. As you can see, that would cause a discrepancy in your score.

Typically the next thing that is listed are the open accounts that you have but have had late payments on them. If it shows that you have been 30 days late, then probably you were. There isn't much that you can do about it now. How long ago it happened will determine how much it will affect your score.

The next section is the most complicated and convoluted and has the most misinformation and discrepancies in it. This is the section of collections and/or charge-offs.

Mortgage industry experts estimate that 350,000 to 400,000 applicants are overcharged every year when lenders incorrectly label them as high risk borrowers because of their credit scores.

Encyclopedia of Retirement and .Fiance.

Why would they say "cost"? The answer is that the lower your score the higher your interest rates.

The section with the collections and charge-offs is the area that gets us. Trying to sort through it can be a nightmare. For instance, you may have a collection with Suddenlink for $122 dated back in 2008, But then somewhere in there Suddenlink sold the collection to ABC Collection agency. In the meantime Suddenlink forgot to mark it a zero balance because they sold it. Now you have two issues. Suddenlink and ABC.

How about the car repo where the bank said that they sold it for enough to pay off your balance and yet they still say you owe $3000?

You can sort any of these out with a little legwork and direction from someone that knows. And sometimes you will need to in order to get your credit score into a place where you can buy a house.

Call me and let me go over your report with you.

Pamela Madore

Keller Williams Realty

3955 S Soncy Amarillo TX 79199

806-290-1920

Comments(0)