Fannie Mae has resently made a change to ther Loan Level Price Adjusters, and in several areas the 2015 Fannie Mae Loan Level Price Adjustments (LLPA) are more costly than the LLPA's they are replacing. LLPA's are additional points accessed by Fannie Mae on Mortgage Loans. The LLPA's are credit score and loan to value sensitive, so as credit scores and down payments decrease the LLPA's increase.

Fannie Mae has resently made a change to ther Loan Level Price Adjusters, and in several areas the 2015 Fannie Mae Loan Level Price Adjustments (LLPA) are more costly than the LLPA's they are replacing. LLPA's are additional points accessed by Fannie Mae on Mortgage Loans. The LLPA's are credit score and loan to value sensitive, so as credit scores and down payments decrease the LLPA's increase.

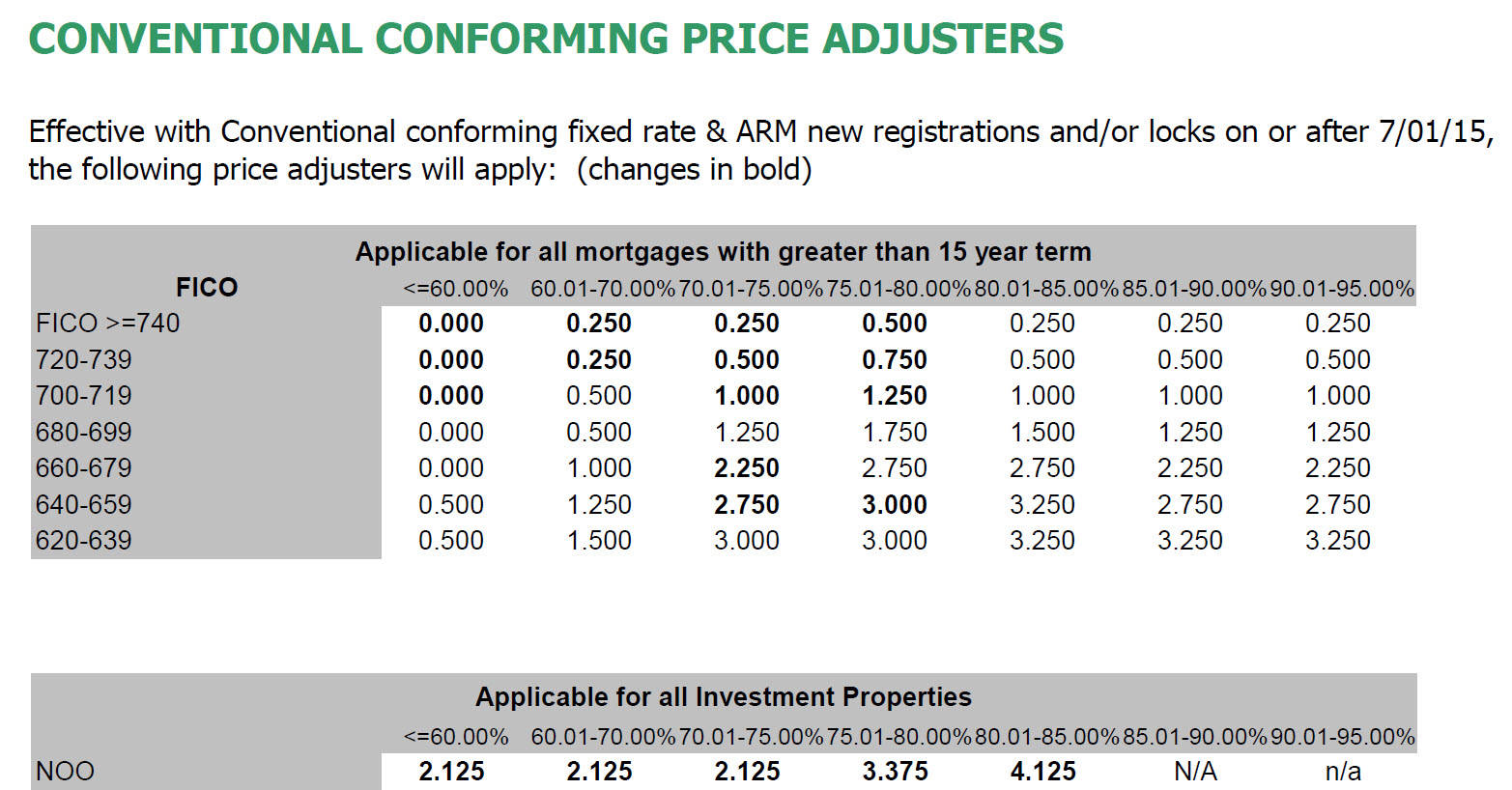

As Fannie Mae Loan Level Price Adjustments (LLPA) factors increase, fewer Borrowers will be able to obtain a Fannie Mae backed Mortgage due to the increase in closing costs. The chart below I will help to make it a little clearer why this will be an issue for several Burrowers.

As you can see from the above chart, if a Borrower is purchasing a home with a Conventional Mortgage backed by Fannie Mae, and has a Middle Credit Score of 740 or higher, with a downpayment of 20% to 24.09%, they will be assessed .500 points by Fannie Mae. The points charged on a Fannie Mae backed loan increase at every 20 point decrease in the Borrowers Middle Credit Score. So if this same Borrower's Middle Credit Score drops below 740 the Fannie Mae charge increases to .750 points. Should the Middle Credit Score drop below 700 the Fannie Mae charge jumps up well over 1 point, all the way to 1.250.

As the Borrower's Middle Credit Score drops, the Borrower could actually find themselves in a position in which the Lender will not be able to approve the loan due to lack of funds to close. Also the Fannie Mae LLPA cost may cause the loan to become a High Price Loan, meaning the Total Costs of the Loan exceed 5%.

Until Fannie Mae lowers their LLPA factors, Fannie Mae may not be an option for Borrowers with sub average Credit Scores. Forcing those Borrowers to continue to look to FHA as the vehicle for their Mortgage needs.

Personally I find the 2015 Fannie Mae Loan Level Price Adjustments (LLPA) to be unreasonable. A Borrower who has a Credit Score of 740 or higher is a great borrower. This is a Borrower who manages his/her money extremely well. Furthermore, to be charged a .500 point when they are making a 20% downpayment, is unfair. Penalizing such a Borrower with points is something I fail to understand, and feel is unnecessary.

Even with the recent changes by FHA, Fannie Mae should be the favorable Loan Product, but not as favorable as it can be due to the Fannie Mae Loan Level Price Adjustments (LLPA). Fannie Mae needs to reconsider their LLPA factors in order to make it possible for more Borrowers to qualify for Fannie Mae Mortgages. Otherwise FHA will continue to be the option for Borrowers with lower credit scores and down payments.

*************************************************************************************

Info about the author:

George Souto NMLS# 65149 is a Loan Originator who can assist you with all your #FHA, #CHFA, and #Conventional #mortgage needs in Connecticut. George resides in Middlesex County which includes #Middletown, #Middlefield, #Durham, #Cromwell, #Portland, #Higganum, #Haddam, #East Haddam, #Moodus, #Chester, #Deep River, and #Essex. George can be contacted at (860) 573-1308 or gsouto@mccuemortgage.com

Comments(23)