Reno-Sparks Home Prices - What's Next?

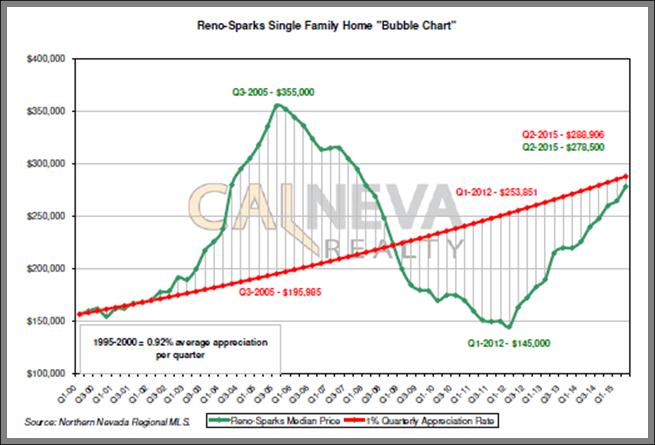

With the rapid rise the local area has seen in home prices since early 2012, a common question we are hearing from clients looking to buy or sell homes is: Are we in a bubble? and... of course, When might it burst? For starters, scan the chart below:

Reno Sparks Home Prices - A 15 Year Look Back (click for full size PDF)

Where Are We Now?

The green line shows the median price, by quarter, of Reno-Sparks single family homes - if it looks a little scary, trust me, it was while navigating these lines every day! The red line shows a sustainable rate of median home price growth - it is a growth rate of 1% per quarter which is just a bit more than the actual growth rate of .92% per quarter from the first quarter of 1995 through the fourth quarter of 1999.

At the end of the most recent quarter ending June 30, 2015, the housing price has managed to climb its way back up to within $10,000 of the 'steady line' in red. So, by historical standards, we are nearly back on track to where we might have been without all of the craziness of bubbles and bursts!

A Time To Reflect

With a closer look at the chart, you will notice that the home prices did not begin to rapidly appreciate until the first quarter of 2012. The peak of the chart shows home prices topping out at the 3rd Quarter of 2005. Well, if you are counting out the timeline, that was a 3.5 year run! Next, considering that the market hit the bottom in Q1 of 2012 and we are now, again, 3.5 years out after having realized another very aggressive rise in prices, this is a unique reflection point. In the same 3.5 year period, we have just experienced a market climb of about 85% of the climb into the 2005 market peak - both steep by any measure.

Why Might This Be Different?

So, if in the future, the median price (green line) continues to climb well ahead of the red line, we would, then, be building back into a bubble. There are some key differences to consider between today's real estate market and that of the rising bubble last decade:

Lending Practices - While interest rates have remained low throughout this entire cycle, lending practices have been significantly tightened since the crash that began in 2005. "Stated Income" loans, for the most part, do not exist today but were common 10 years ago. If you have taken out a mortgage recently, you also know, first hand, that the lending guidelines require a great deal more scrutiny on your income, credit, and sources for down payment funds. These changes and others are, of course, for the better and I hope they will keep us from repeating the recent history of the last 10 years.

Regional Economic Growth - The lending practices are national in scope. On the other hand, within the Greater Reno-Tahoe region, there have been many recent economic announcements and activities that did not exist during the last housing rise. At the top of the list is the Tesla Gigafactory announcement and construction commencement which is expected to bring 6,500 jobs to the region by 2020. In Tesla's wake, there is the new Switch data center, and a new recognition from companies on a national and international scale that this may be a place for them to establish a Western US presence.

The Answer

If I had the precise answer, I would be a wealthy man! We may be buckling up for the next roller coaster or we may settle into a growth pattern that would better equate to a Sunday joy ride. Keep in touch and we'll keep you updated along the way!

Subscribe to The Greater Reno-Tahoe Real Estate Report and we'll keep you updated once a quarter.

Comments(0)