The last step in most Minnesota closings is receiving instructions for homesteading. Don’t tuck it into your folder and forget about it… homesteading can provide valuable benefits and it doesn’t cost anything unless you forget to do it!

Minnesota offers a Homestead Market Value Exclusion for people who own and live in their home as their primary residence. As long as you purchase and occupy your home by December 1 and file by December 15, your property will be classified as Homestead for taxes payable the following year. There is no filing charge, and you only have to do it once. It remains in effect as long as you own and maintain the property as your primary residence.

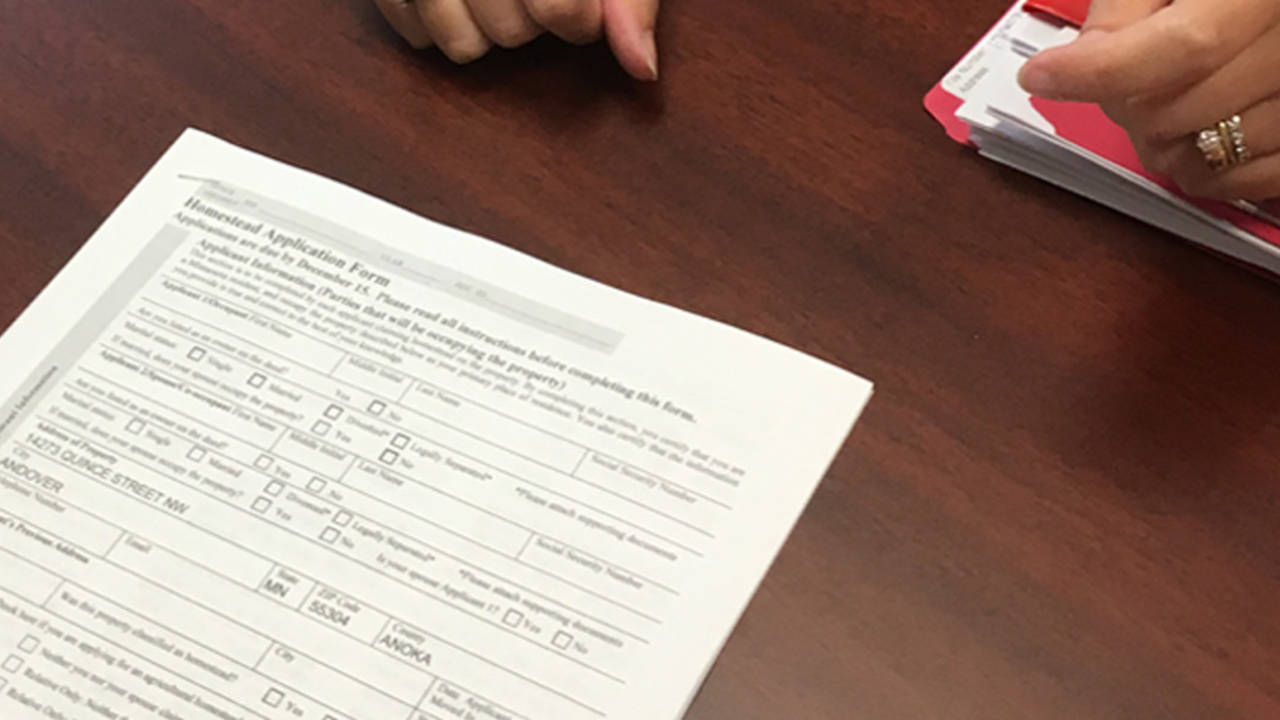

You should receive the necessary paperwork at closing… application, copy of deed and CRV (Certificate of Real Estate Value)… as well as information on where to file (such as at your City Hall). If your property is occupied by a qualifying relative such as a son or daughter or parent, it may also qualify for homestead even if you don’t live there yourself… in this case you would also need to submit a Non-Occupant Co-Owner/Relative form.

What are the benefits of homestead status?

- It provides a classification rate of 1.00% on up to $500,000 in taxable market value (this rate is 1.25% for non-homestead residences)

- It is one of the qualifying factors for homeowners to receive the Minnesota Property Tax Refund

- It qualifies you for other programs such as the disabled veterans’ market value exclusion and senior citizens’ property tax deferral

- It could save you money on your insurance, as insurance rates are typically lower for principal residences

- When you sell it provides an exemption from capital gains tax on the the first $250,000 for a single person and $500,000 for a married couple

- Your homestead (or a portion of those assets) may be exempt from being seized and sold to pay a judgment, debt or liability

-

It may reduce the Taxable Market Value of the property, thereby reducing your taxes

I remember our son called a couple years after they bought their first home, concerned that their taxes had gone up. They bought at the end of December so had until December of the following year to file for taxes payable the next year… they forgot about it and paid the penalty of higher taxes for a year.

If you can’t find your paperwork needed for filing or have more questions, here is a link information on Homestead Classification from the Minnesota Department of Revenue.

Comments(0)