There has been much recent discussion about how the Trump and House Republican’s proposed tax bill will affect the real estate market, what affect it will have on future home sales and the market as a whole.

Miami and the state of Florida falls in a unique position different than many other states, which I will focus on in hopes of breaking down the complexities for my local buyers, sellers and investors. Due to the fact that Florida has no state or local income taxes, proposed changes to eliminate deductions of these taxes will not directly affect locally based Miami homeowners. Given that the median home value in Miami Dade County is $276k, the proposed capping of the property tax deductions at $10k will also not impact the vast majority of local homeowners, though this will be felt by those who own homes assessed over $500,000.

Additionally affecting those with homes over $500,000 will be the proposition to reduce the allowed deduction on mortgage interest to only cover the interest paid on the first $500,000 as opposed to the $1,100,000 as it is now. This means that a homeowner paying 4% interest on a $750,000 mortgage would be able to deduct just $20,000 as opposed to current $30,000.

Though the proposed plan calls for a 30 percent limit on interest deductibility for businesses, real-estate investors will be exempt and retain the ability to claim deductions for interest paid on their rental properties. Some worry that this will turn America into a nation of tenants renting from privately funded landlord real estate investors. This is actually good news for the majority of property owners in cities such as Miami Beach as well as most of Miami’s coastal real estate where practically 75 percent of all of these properties are investment or vacation properties. Additionally, if these ‘vacation homes’ are actually ‘investment properties’, the ability to deduct mortgage interest and passive losses will remain as long as one stays within the IRS guidelines of keeping personal use at less than 10 percent of the time actually rented each year. While it is general consensus that increased homeownership is best for communities, this exemption will help keep rentals more affordable for those who prefer to rent.

The proposed tax plan will also have an effect on those who like to stay on the move - capital gains deductions will require primary homeowners to live in a property for five years to deduct up to $500,000 in capital gains (or $250,000 if single) as opposed to the required two years as it stands now. (Specifically this calls for living 5 out of 8 years compared to the existing 2 out of 5 years).

While this part of the plan may delay the decision of some homeowners to move more frequently, I don’t expect these new restrictions to impact purchase price levels nor the desirability of homeownership. The consumer will still want the status and forced savings plan of homeownership.

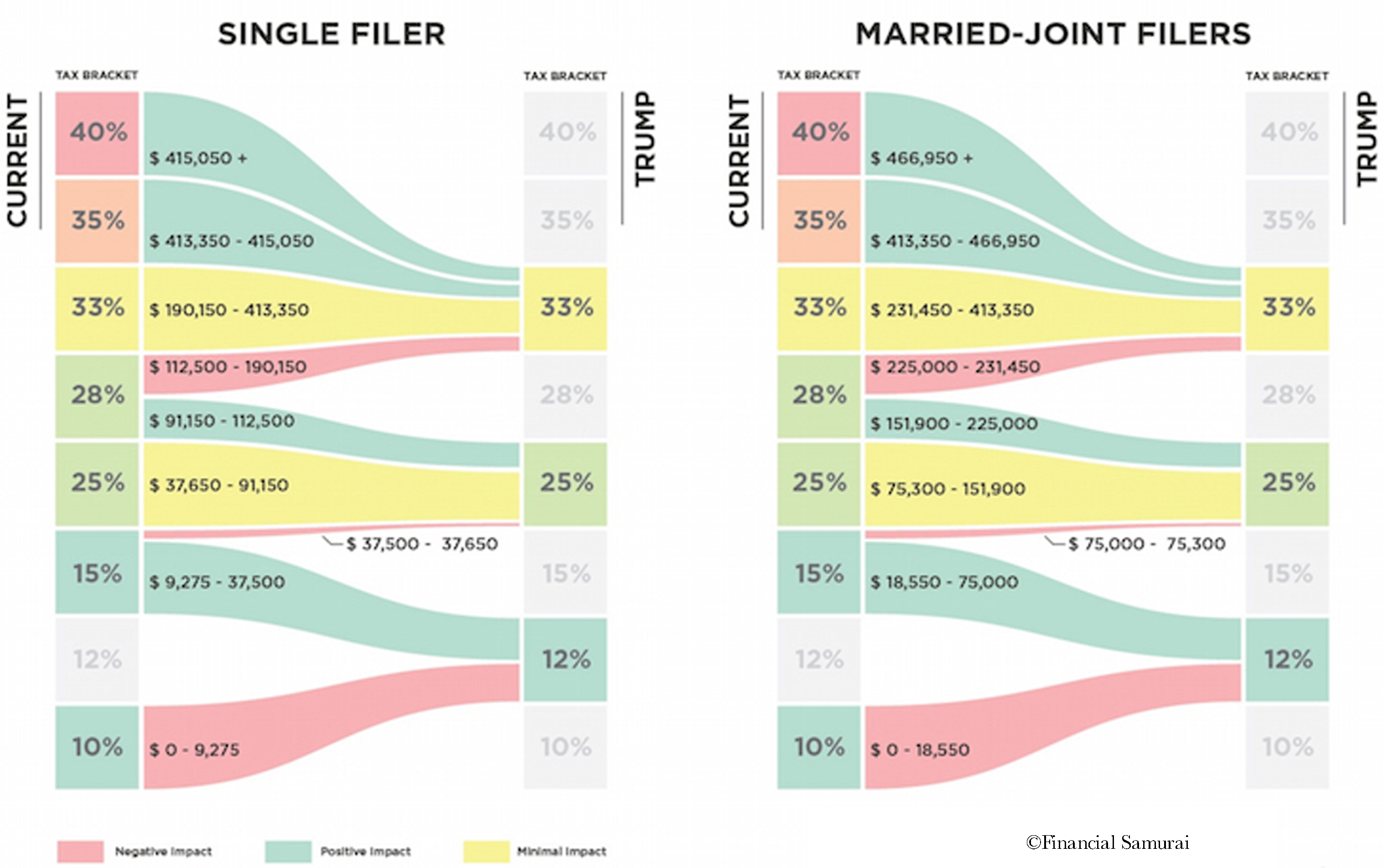

As was the design of this tax plan, those with higher value home values will likely feel the effects the most. Regardless of homeownership, all Americans will enjoy the proposed doubling of the standard deduction to $12,000 for individuals and $24,000 for married couples, which should offset the change in real estate related allowable deductions for a vast majority of U.S. homeowners.

As this relates to the Florida real estate market in general, there is good probability that we will see homeowners in high taxation states, such as California, New York and New Jersey, considering to permanently move to Florida. While the plan favors real estate investors and may actually cause a reduction in homeownership rates in some states, I do not expect the plan to have a negative impact to the Miami real estate market.

Miami is dependent on investors, both foreign and domestic. As has become blatantly evident during the current and past market downturns, investors are crucial for our real estate markets to continue to develop, grow and improve. We remain a city with exceptional value compared to other major U.S. and global metropolitan areas. Miami’s incomparable quality of life, lifestyle, and attractive tax structure should continue to allow us to remain a thriving city and I do not expect the majority of us to be negatively impacted by the proposed changes in the tax code.

Comments(2)