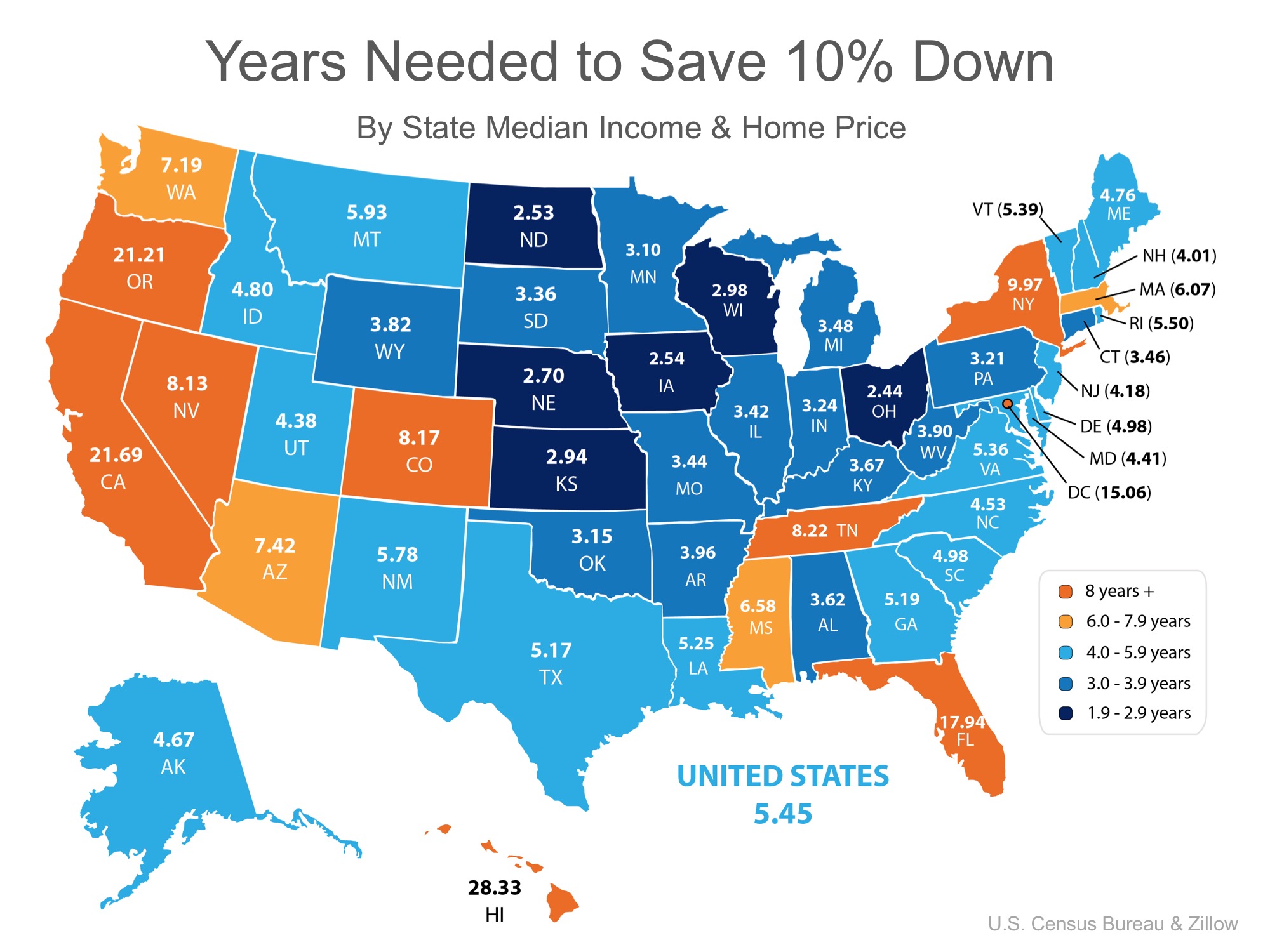

Saving for a down payment is often the biggest hurdle for a first-time homebuyer in CT. Depending on where you live, median income, median rents, and home prices all vary.

I determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

According to the data, residents in Connecticut can save for a down payment in approximately 3.46 years.

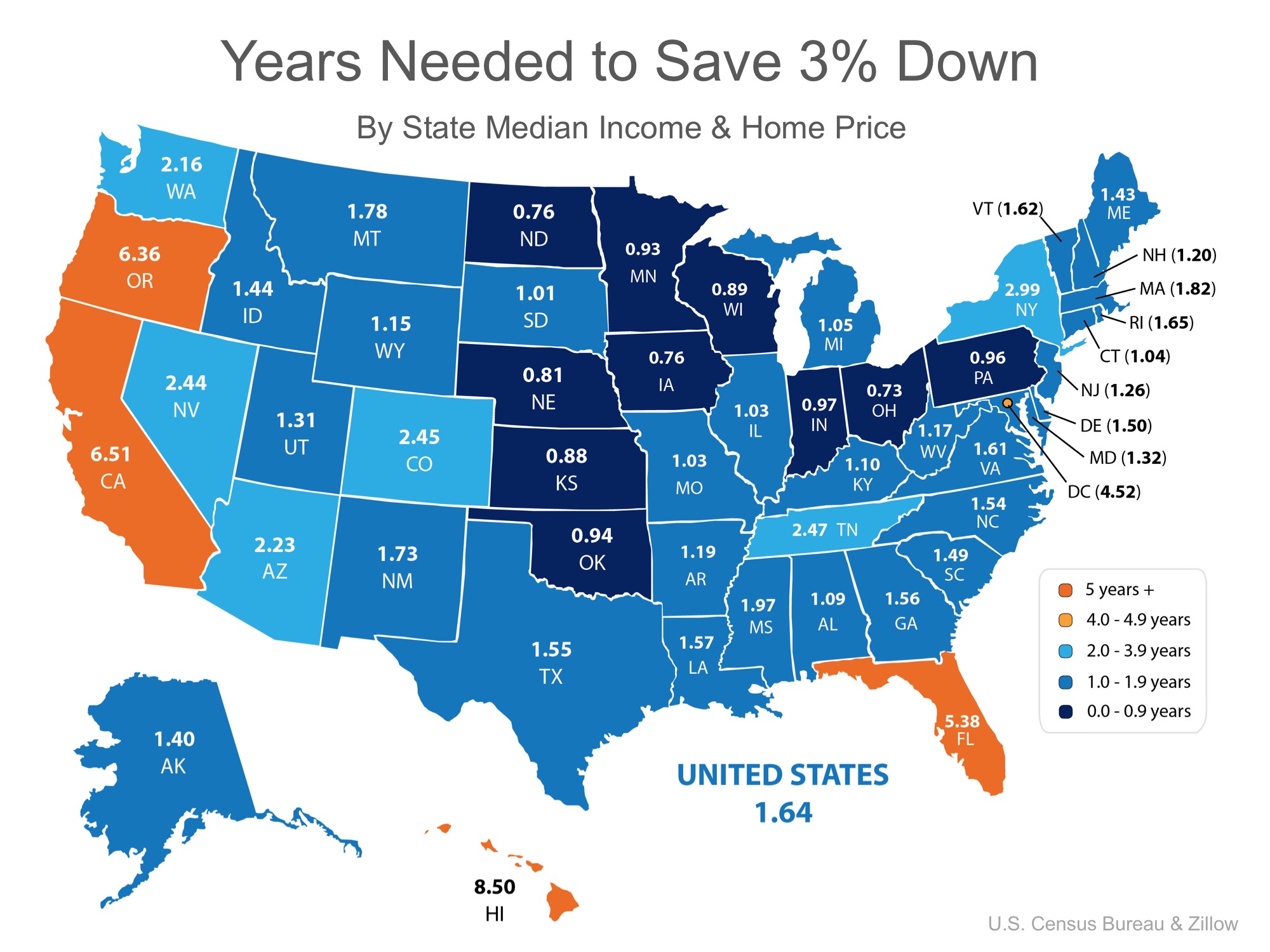

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 3.46 years but rather just a little over 1 year.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today. Contact a Real Estate professional from Dave JOnes Realty who can assist with any of your Real Estate needs!

Comments(0)