Minneapolis, MN: Not every potential home owner fits the cookie cutter guidelines of most traditional loans, especially the self-employed person. The mortgage industry had plenty of alternative options for self employed right up until the housing crash in 2007, including bank statement loans, stated income loans, and no proof of income loans.

Government mandated changes to the mortgage industry after the crash killed most of those programs, leaving some people with no loan options whatsoever.

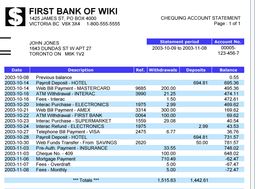

Read more about NON-QM bank statement loans

Fast forward to today, and slowly the non-conforming loan industry, now called Non-QM loans, is making a comeback, albeit looking much different than years ago.

True stated income loans, NINA, NINJA, SISA, and other true no proof of income loans do not exist anymore in the owner occupied home mortgage world, but a popular option that HAS returned is using your bank statements as qualifying income.

Bank statement loans today come in many varieties, but generally consist of the following basic requirements:

- Must be self employed

- Use 100% of personal bank statement deposits as income

- Use 50% of business bank statement deposits as income

- At least 12 months of consecutive statements needed

- Loan amounts over $100,000

- Loans of 90% loan-to-value or less

- Interest rates are higher than standard loans.

There is no one set of rules for these programs like you find with standards loans (FHA, VA, Fannie Mae, Freddie Mac). Because of this, you will find all sorts of slight variations between lenders the few major investors offering these bank statement loan products.

The good news is that at least there are some options again for those home owners who don’t fit the traditional loan model.

Other Alternative Loan Options

Along with bank statement loans, you can now generally find loans that qualify simply off your liquid assets, and does not require a job, or proof of income. For rental properties, we have rental property loans that require no personal income to qualify, just a rental analysis (does the property cash flow?).

Ready to apply for a bank statement loan?

It's easy.  Simply contact a local experienced mortgage broker in your area. Don't bother with the big banks or Internet lenders, they don't offer these loans.

Simply contact a local experienced mortgage broker in your area. Don't bother with the big banks or Internet lenders, they don't offer these loans.

We offer these bank statement loans for properties located in Minnesota, Wisconsin, Iowa, North Dakota, and South Dakota only.

Simply complete our Online application. You'll be applying directly with me, Joe Metzler, an experienced, multiple award winning Loan officer with over 20-years in the the business.

-----------------------------------------

-----------------------------------------

Joe Metzler is a Senior Mortgage Loan Officer for Minnesota based Cambria Mortgage. He was named the 2014 Minnesota Loan Officer of the Year, and Top 300 Loan Officers in the Nation for 2010, 2015, 2016. To finance with Cambria Mortgage your local preferred mortgage lender for Minnesota, Wisconsin, Iowa, North Dakpta, and South Dakota, simply call (651) 552-3681, or APPLY ONLINE. NMLS 274132. Equal Housing Lender. Learn more about me HERE.

Comments (1)Subscribe to CommentsComment