No one can say they haven’t been warned. Pretty much everyone except our President believes that sea level rise is no myth. While it’s widely agreed that climate change is happening, most people still seem to think that a rise of inches per year does not affect them today. Unfortunately, we now have proof that there is indeed a financial impact, and it’s happening now. A federal climate report noted that the sea has risen about eight inches since 1900, and is accelerating, with three inches accumulated since 1993. Scientists predict the oceans will rise an additional three to seven inches by 2030, and as much as 4.3 feet by 2100.

In a study that will be published in the Journal of Financial Economics, researchers at the University of Colorado at Boulder and Pennsylvania State University compared properties that are virtually the same except for their exposure to the seas. They concluded that vulnerable homes have sold for 6.6% less than unexposed homes. The most at risk properties, those that stand to be flooded after seas rise by just one foot, were selling at a 14.7% loss.

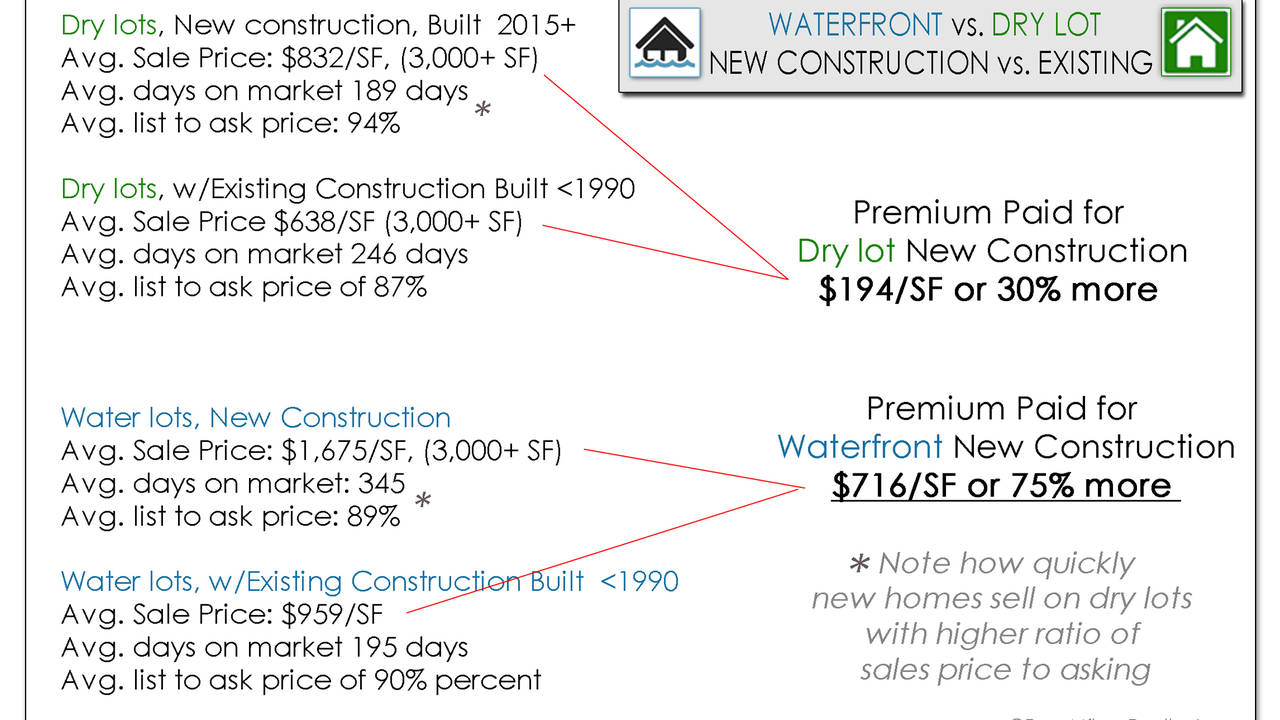

Local Miami real estate expert, Ross Milroy, has analyzed recent home sales in what is perceived to be the one of the most vulnerable cities to sea level rise, namely Miami Beach, and has found evidence that supports this study. We can confirm that impact on home values from climate change is indeed a fact of life in South Florida. We’ve reported in the past how sea level rise is slowly eating away at properties, acting in a way like eminent domain where once useable land is now underwater and is becoming public access. We’ve also reported how sea level rise is making it significantly more expensive to insure and difficult to finance coastal properties while taxpayers are footing the cost to raise streets. From what we can deduct from this recent analysis, the inevitable sea level rise is making a considerable difference in resale prices between water lots with existing construction as opposed to new construction. This significance can truly be seen when the numbers are compared to dry lot re-sales vs. dry lot new construction in Miami Beach.

When we compared what homebuyers are willing to pay for newly constructed waterfront homes and villas (adhering to new building codes aimed at combating sea level rise), compared to waterfront homes with existing construction, we found on average that buyers are paying an additional $716/SF, a premium of 75 percent. Comparatively, buyers are only paying 30% more for dry lot new construction — also worth noting is how quickly new homes sell on dry lots with higher ratios of sales price to asking.

We know that buyers are historically willing to pay higher prices in South Florida for waterfront homes and condos and for newer construction, in fact, in our study last year, we found that waterfront condos are commanding as much as 101% more. The most dramatic new revelation to come from this study is just how much value buyers are now placing on homes that are better prepared for sea level rise. On one hand, it’s promising to see that buyers and builders are starting to pay attention to the effects that sea level rise will bring, and are now investing in its mitigation – on the other hand, one must ask the question, is too late for the many current owners of once valuable waterfront homes?

South Florida is not alone in this troubling scenario. Home prices and property values are feeling the effects up the Eastern Seaboard. The Washington post reported this week about South Carolina resident Elizabeth Boineau who owns a 1939 Colonial style home that sits a block and a half from the Ashley River in an affluent neighborhood. Following listing her home at just under $1M a year ago, and consequently dropping the price 11 times, she has decided there is no other option than to tear it down – keeping up with the cost of repairs from consistent flooding was just too much. The point is that the value of the her waterfront home today is simply only the value of the land.

While these numbers can certainly be worrisome, it’s important to note that buyers in general are not ready to hang up the dream of beach house living. Another study by the nonprofit First Street Foundation has identified a potential $465 million loss in Miami-Dade County. But despite these potential losses, overall home prices are generally continuing to go up; it’s just that those houses that have already flooded or are at more severally at risk to flood are not appreciating as fast, and in many cases, the existing functionally obsolete home is worthless.

The bottom line is, we’re still able to mitigate the majority of these issues. We can build higher, stronger and more water resistant – but it all comes at a cost. For those willing to incur these costs in order to continue to enjoy waterfront living, savvy buyers should look to waterfront houses and land that are best prepared to handle the sea… and yes, there’s already a name for that: “climate gentrification,” as recently coined by Harvard researchers.

RELATED:

- Nature Gets in the Field of Eminent Domain as Coastal Flooding Becomes Reality

- Water Views vs. City Views: In Miami, What’s the View out your Window Worth?

- Sea Levels Rise, Streets Rise, Taxes Rise

- Irma’s Got Nothing on Miami’s Real Estate Market

Comments(0)