Can’t tell you how many times, clients come by our office in Orange County, CA in need of tax help and have no idea where all their documents are. This should not stop you to settle your taxes. Copies of the tax forms like W-2 or 1099 Misc. and others are filed with the IRS, and you have access to them! Not only are these available, these are important to obtain when trying to settle your back taxes. It reminds us what income you have made throughout the years and serves as a guide on where to obtain additional information, if need be.

What are IRS Transcripts?

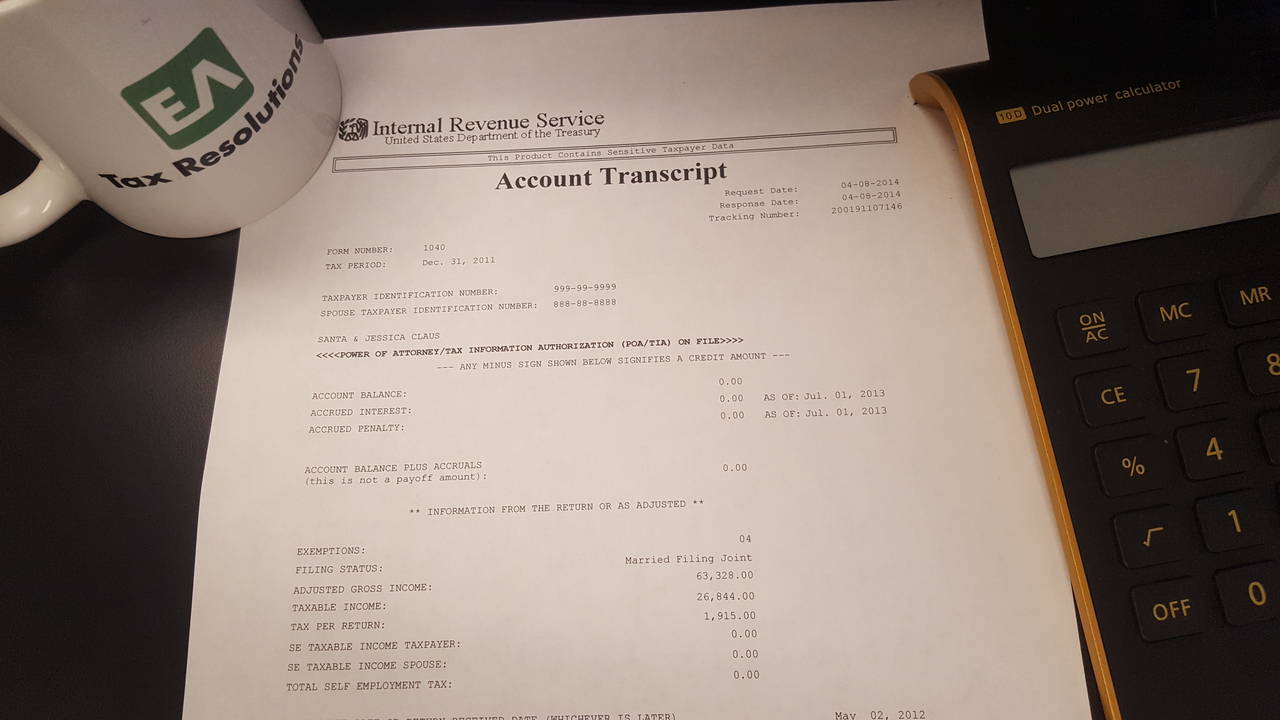

IRS Transcripts are records of information that is being recorded at the IRS on your account. They obtain information like any tax balances, tax payments made, income that has been reported by third parties, and any collection actions taken.

The more commonly used IRS transcripts by tax practitioners are:

- Wage and Income Transcript

- Account Transcript

- Tax Return Transcript

Wage and Income Transcript will let us know any income that has been that has been reported by third parties. This will include W-2, 1099, 1098, and others. This can help serve as a guide on where to look next for either additional income or deductions. With this information, we can then prepare tax returns to get into tax compliance.

Account Transcript show us a history of any transactions that have happened on any given tax year. It will give us clues as to where your tax account is at any given time. Tax balances, penalties charged, payments made, dates of tax return filing, just to name a few. Reviewing the IRS Account Transcript is a key element of the process to settle your tax debt, as we need to be sure there are no errors on any tax balances and find out when your debt will expire for any resolution options.

Tax Return Transcript is just as it sounds, a copy of the tax return filed. It is not a complete tax return; however, it does serve a great guide as to be sure we are not missing any amounts from year to year.

How to obtain IRS Transcripts?

- IRS Website Online

- By Mail

- Phone - 800-908-9946.

- Tax Practitioner

Tax transcripts are an important thing to obtain when trying to settle your back taxes. They will help with preparing your tax returns, ensuring accurate balances on your account, and provide an insight to the date your balances will become uncollectible by the IRS.

If you are in need of help with your tax debt, feel free to call our office to learn more about us and how we can help.

Anthony Fontana EA

800-245-0596

4630 Campus Dr #203

Newport Beach, CA 92660

Comments(1)