At our tax office in Orange County, CA we represent clients before the IRS to help them with tax compliance and to resolve their back tax debts. One of those options is the uncollectible status or the Currently Non-Collectible Status, CNC.

What is the Currently Non-Collectible Status, CNC?

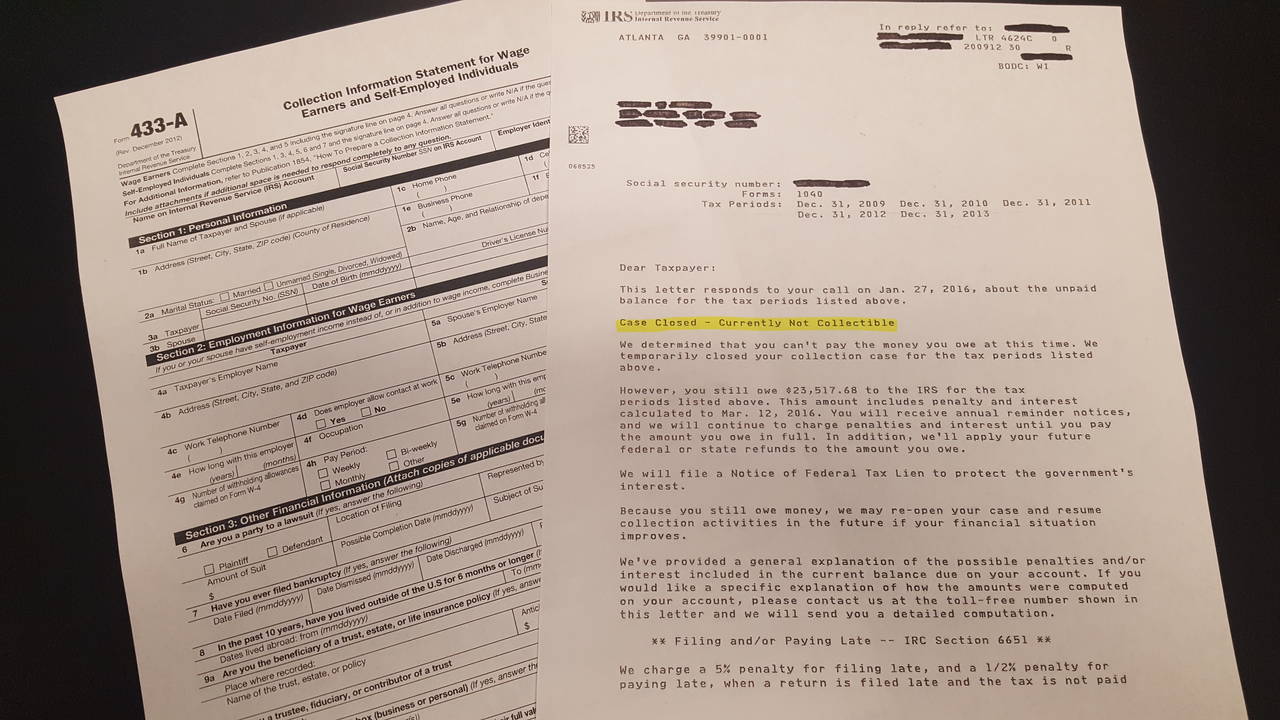

The CNC is a status the IRS will code taxpayers accounts’ when the taxpayer can prove that they have no equity in available assets and their income is lower than their IRS allowable expenses. Once taxpayers have been placed in the currently non-collectible status, the IRS will no longer take any levy actions. This means the IRS will not take money from your bank accounts or from your wages.

Keys things to know is that the CNC status does not actually resolve the back tax issue once the CNC status has been obtained. The taxpayer still owes the outstanding tax debt and the interest will continue to accrue while on the CNC status. The IRS can still file a Notice of Federal Tax Lien when a taxpayer is on the CNC status.

Why would you want to be on the IRS Uncollectible Status?

In short, you could potentially not owe the tax anymore. Since the CNC status does not stop the 10-year collection statute from continuing to run, taxpayers could benefit from obtaining the CNC status if the collection statute expiration date (CSED) expires soon. There are situations where a taxpayer obtains the CNC status, and keeps it until the CSED expires which means the taxpayer no longer has the debt with the IRS.

How to obtain the Currently Non-Collectible Status?

To obtain the CNC status taxpayers must file the Collection Information Statement (IRS Form 433) with the IRS Collection Division. The IRS Form 433 must show that your income is not sufficient to cover your allowable expenses, and you do not have any equity in available assets.

The Currently Non-Collectible status can be an effective tool to prevent the IRS from taking collection actions against a taxpayer. This may just be exactly what a taxpayer needs in a time of hardship.

If you are in Orange County, CA and need help with your taxes please reach out to me at EA Tax Resolutions. I am here to help you understand your options and navigate IRS tax debt.

800-245-0596

www.eataxresolutions.com

4630 Campus Dr #203

Newport Beach, CA 92660

Comments(1)