WATCH NEW HOMES FOR SALE IN MANVEL TX BEING BUILT

Home sales mark a seventh straight month of gains while demand for lease properties also rises

HOUSTON — (February 12, 2020) — Fresh on the heels of a record-breaking 2019, home sales across greater Houston began the new year with a strong showing as consumers continued to take advantage of historically low interest rates. Homes priced between $500,000 and $750,000 drew the most buyers in January followed by homes in the $250,000 to $500,000 range. Activity among properties for lease also registered solid gains during the month.

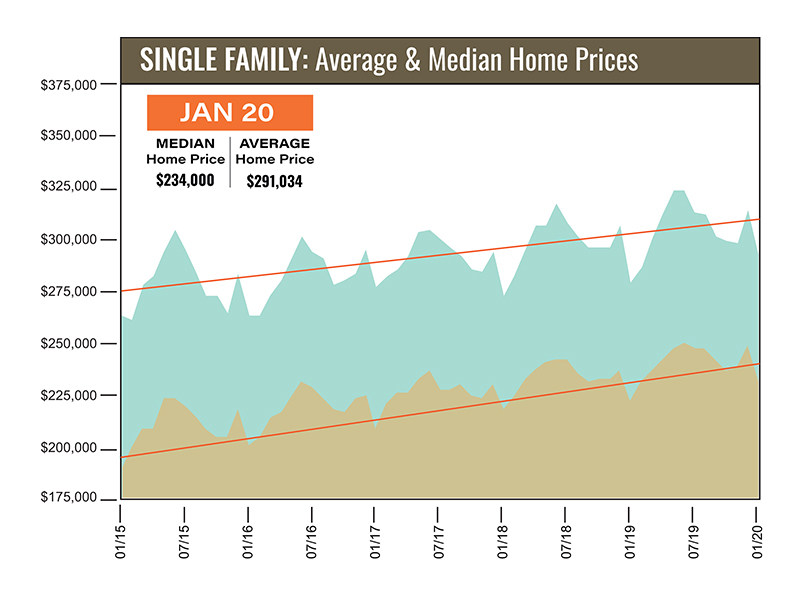

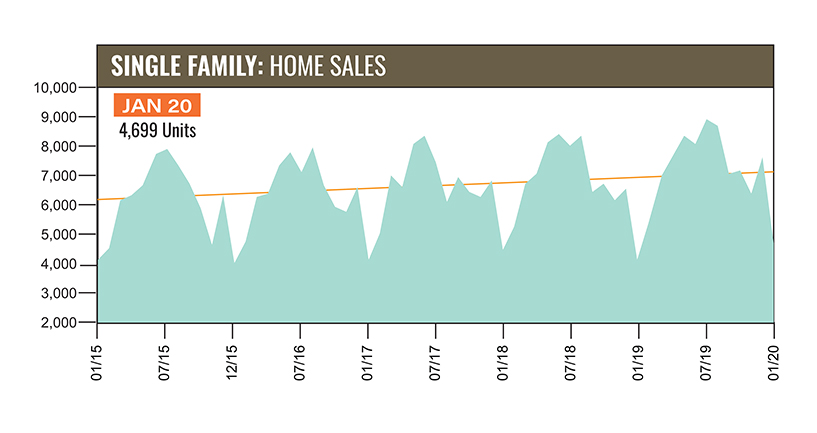

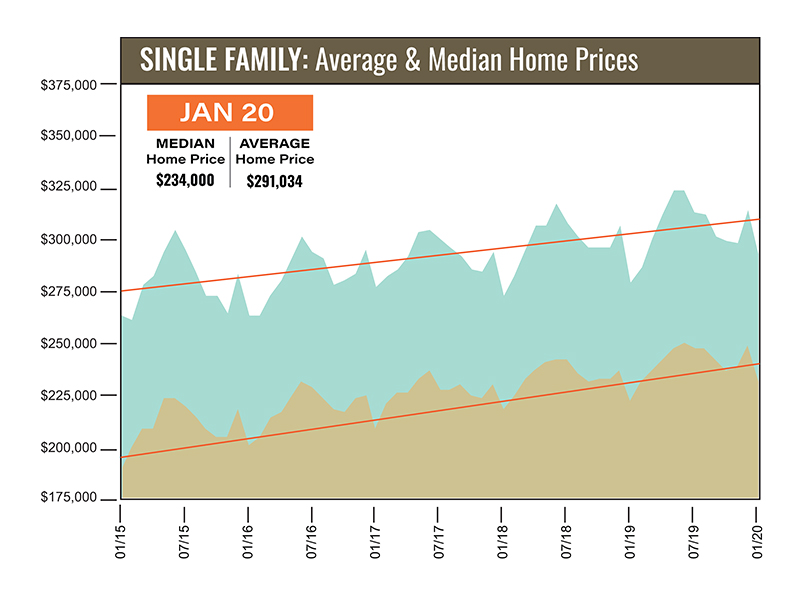

According to the latest monthly Market Update from the Houston Association of REALTORS® (HAR), 4,699 single-family homes sold in January compared to 4,112 a year earlier. That represents a 14.3 percent increase – the seventh consecutive positive month and the greatest January sales volume hike in seven years. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 4.5 percent to $234,000 and the average price climbed 4.6 percent to $291,034. Both figures represent the highest prices ever for a January.

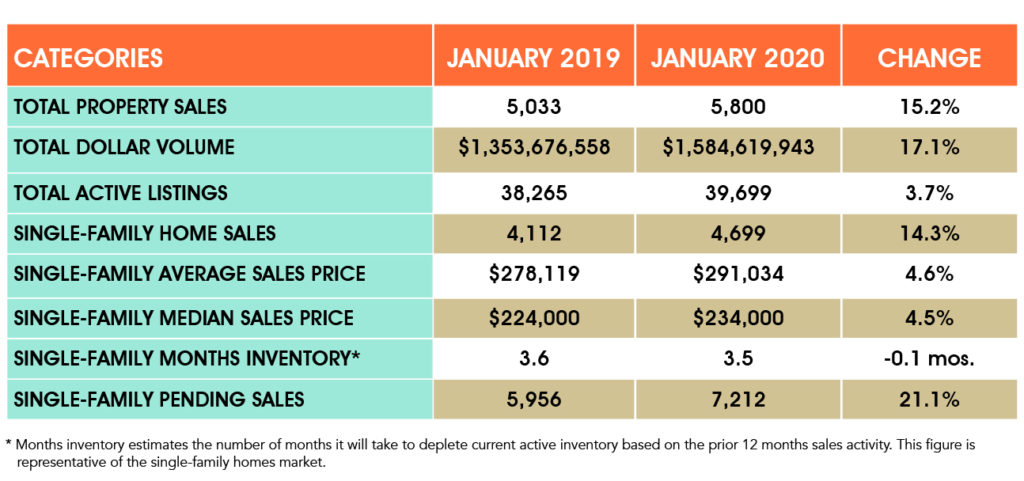

Sales of all property types totaled 5,800, up 15.2 percent from January 2019. Total dollar volume for the month surged 17.1 percent to about $1.6 billion.

"January is a traditionally slower month for home sales coming off the holidays, but the Houston market continues to benefit from low mortgage interest rates and a generally robust economy with healthy employment numbers,” said HAR Chairman John Nugent with RE/MAX Space Center. “All the January home buying activity lowered our housing inventory a little, but we expect to see that grow again as we approach the spring months when more homes typically hit the market."

The average interest rate for a 30-year fixed-rate mortgage fell to 3.45 percent last week, according to figures released by Freddie Mac. That is the lowest level since October 2016. As for the local jobs landscape, the Greater Houston Partnership (GHP) reported in its January 24 Houston Employment Update that Metro Houston created 88,000 jobs – a 2.8 percent increase – during the 12 months ended December 2019, according to Texas Workforce Commission data. The GHP also noted that Houston's unemployment rate was 3.6 percent in December, down from 3.9 percent in December 2018.

Lease Property Update

Consumers that weren’t buying homes in January were renting properties at a brisk pace. Single-family home rentals shot up 14.5 percent year-over-year while rentals of townhomes and condominiums rose 5.6 percent. The average rent for single-family homes ticked up 1.7 percent to $1,782 while the average rent for townhomes and condominiums increased 5.9 percent to $1,598.

January Monthly Market Comparison

Except for inventory, January indicators for the Houston real estate market were positive, with single-family home sales, total property sales and total dollar volume all up compared to January 2019. Pricing levels reached January highs. Month-end pending sales for single-family homes totaled 7,212. That is a 21.1 percent jump over last year. Total active listings, or the total number of available properties, rose 3.7 percent to 39,699.

Single-family homes inventory recorded a 3.5-months supply in January, down fractionally from a 3.6-months supply a year earlier. For perspective, housing inventory across the U.S. stands at a 3.0-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales jumped 14.3 percent in January with 4,699 units sold across the greater Houston area compared to 4,112 a year earlier. This marks the seventh straight month of positive sales and is the greatest January sales volume increase since January 2013 when it leapt 28.0 percent. Prices reached the highest levels ever for a January. The median price increased 4.5 percent to $234,000. The average price rose 4.6 percent to $291,034.

Days on Market (DOM), or the number of days it took the average home to sell, extended slightly from 66 to 68 days. Inventory registered a 3.5-months supply. That compares to 3.6 months a year earlier and is greater than the current national inventory level of 3.0 months reported by NAR.

Broken out by housing segment, January sales performed as follows:

- $1 - $99,999: decreased 18.5 percent

- $100,000 - $149,999: decreased 9.8 percent

- $150,000 - $249,999: increased 14.8 percent

- $250,000 - $499,999: increased 25.6 percent

- $500,000 - $749,999: increased 33.9 percent

- $750,000 and above: increased 20.0 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 3,760 in January, up 12.1 percent versus the same month last year. The average sales price increased 6.6 percent to $279,803 while the median sales price rose 4.8 percent to $220,000.

Townhouse/Condominium Update

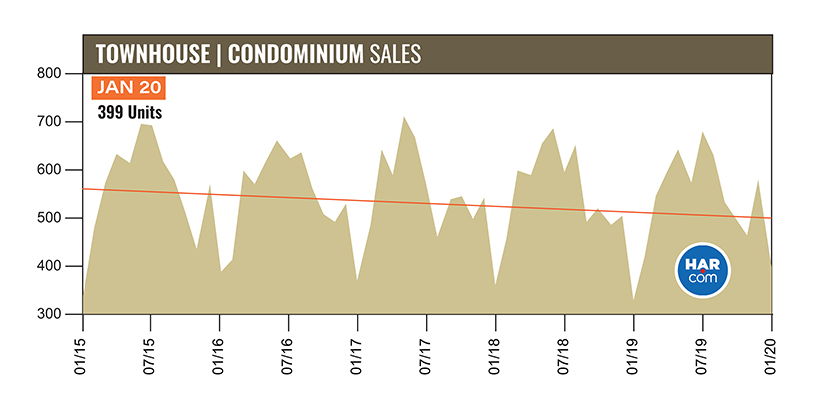

Sales of townhomes and condominiums surged for the second consecutive month, up 20.9 percent versus January 2019, with 399 units sold compared to 330 one year prior. The average price declined 3.5 percent to $186,582 while the median price slid 5.2 percent to $149,750. Inventory was unchanged at a 4.0-months supply.

Houston Real Estate Highlights in January

- Single-family home sales jumped 14.3 percent year-over-year, with 4,699 units sold, marking the seventh consecutive month of positive sales;

- Days on Market (DOM) for single-family homes extended slightly from 66 to 68 days;

- Total property sales surged 15.2 percent, with 5,800 units sold;

- Total dollar volume rose 17.1 percent to about $1.6 billion;

- The single-family home median price increased 4.5 percent to $234,000, reaching a January high;

- The single-family home average price climbed 4.6 percent to a January high of $291,034;

- Single-family homes months of inventory was at a 3.5-months supply, down fractionally from 3.6 months last January but above the national inventory level of 3.0 months;

- Townhome/condominium sales jumped for a second straight month – up 20.9 percent, with the average price down 3.5 percent to $186,582 and the median price down 5.2 percent to $149,750;

- Lease properties experienced a strong performance, as single-family home rentals climbed 14.5 percent with the average rent up 1.7 percent to $1,782;

- Volume of townhome/condominium leases rose 5.6 percent with the average rent up 5.9 percent to $1,598.

Comments(2)