The Top Indicator if You Want To Know Where Mortgage Rates Are Heading

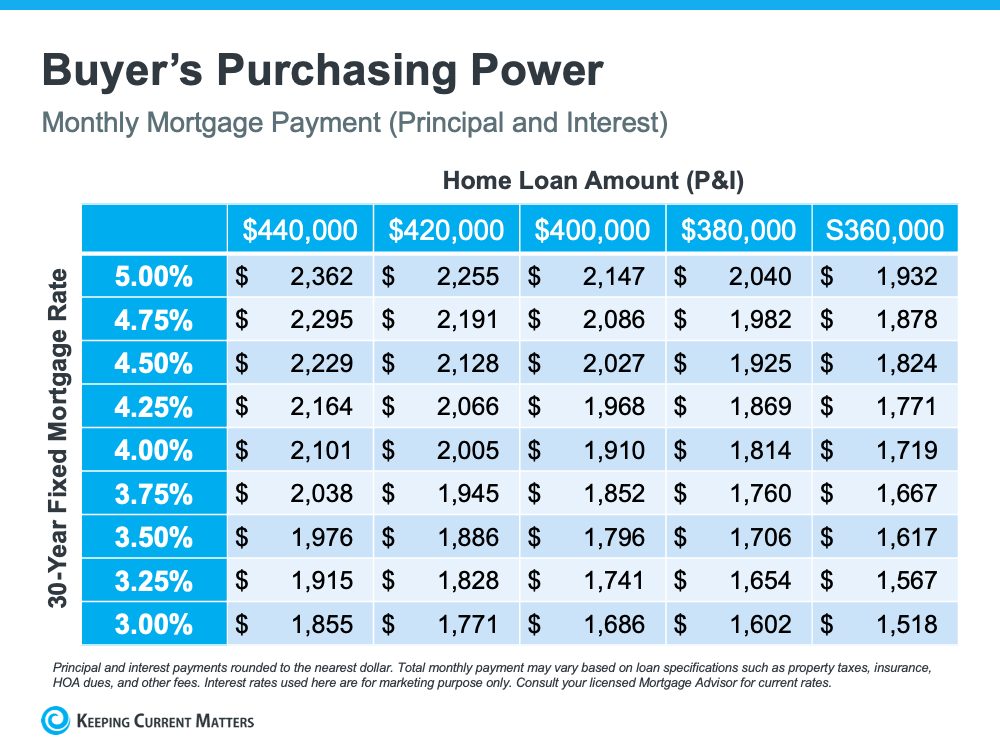

Mortgage rates have increased significantly since the beginning of the year. Each Thursday, Freddie Mac releases its Primary Mortgage Market Survey. According to the latest survey, the average 30-year fixed-rate mortgage has risen from 3.22% at the start of the year to 3.55% as of last week. This is important to note because any increase in mortgage rates changes what a purchaser can afford. To give you an idea of how rising mortgage rates impact your purchasing power, see the table below:

How Can You Know Where Mortgage Rates Are Headed?

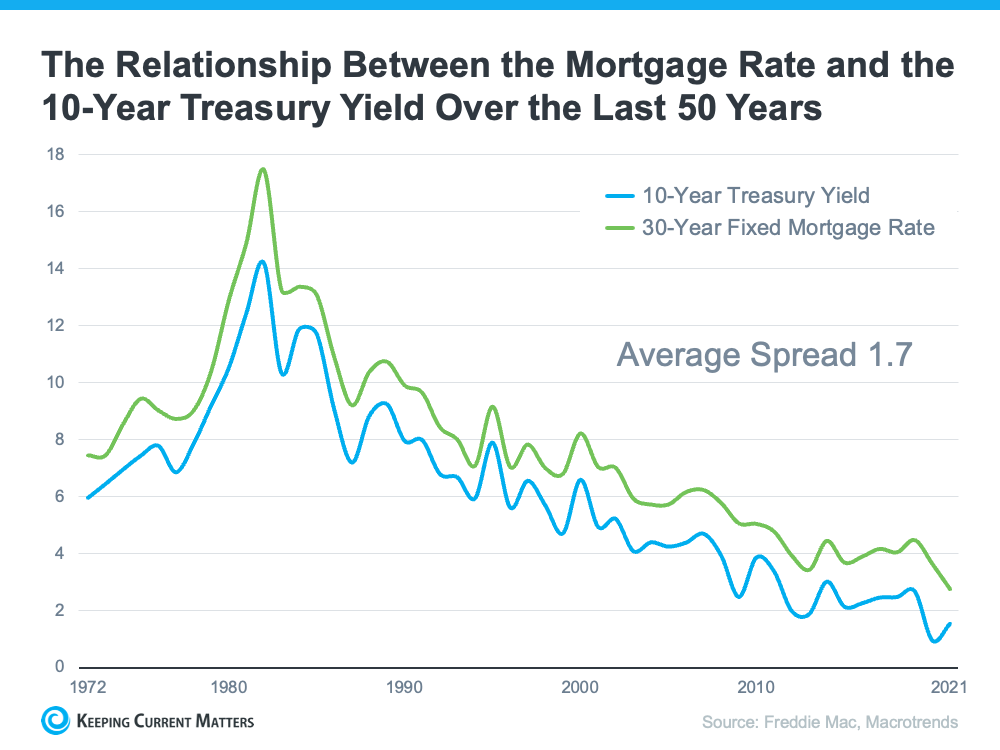

While it’s always difficult to know exactly where mortgage rates will go, a great indicator of where they may head is by looking at the 50-year history of the 10-year treasury yield, and then following its path. Understanding the mechanics of the treasury yield isn’t as important as knowing that there’s a correlation between how it moves and how mortgage rates follow. Here’s a graph showing that relationship over the last 50 years:

This correlation has continued into the new year. The treasury yield has started to climb, and that’s driven rates up. As of last Thursday, the treasury yield was 1.81%. That’s 1.74% below the mortgage rate reported the same day (3.55%) and is very close to the average spread we see between the two numbers (average spread is 1.7).

Where Will the Treasury Yield Head in the Future?

With this information in mind, a 10-year treasury-yield forecast would be a good indicator of where mortgage rates may be headed. The Wall Street Journal just surveyed a panel of over 75 academic, business, and financial economists asking them to forecast the treasury yield over the next few years. The consensus was that experts project the treasury yield will climb to 2.84% by the end of 2024. Based on the 50-year history of following this yield, that would likely put mortgage rates at about 4.5% in three years.

While the correlation between the 30-year fixed mortgage rate and the 10-year treasury yield is clear in the data shown above for the past 50 years, it shouldn’t be used as an exact indicator. They’re both hard to forecast, especially in this unprecedented economic time driven by a global pandemic. Yet understanding the relationship can help you get an idea of where rates may be going. It appears, based on the information we have now, that mortgage rates will continue to rise over the next few years. If that’s the case, your best bet may be to purchase a home sooner rather than later, if you’re able.

Forecasting mortgage rates is very difficult. As Mark Fleming, Chief Economist at First American once said:

“You know, the fallacy of economic forecasting is don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.”

However, if you’re either a first-time homebuyer or a current homeowner thinking of moving into a home that better fits your changing needs, understanding what’s happening with the 10-year treasury yield and mortgage rates can help you make an informed decision on the timing of your purchase.

At Charles Stallions Real Estate Services we use our TRI-merge System and its accuracy is beyond reproach. We use the MLS, Zillow, Tax Rolls, and the appraisal evaluation system with one other secret sauce to come up with the TRUE VALUE of your home.

Thinking of SELLING, If I sell your home YOU PAY US $2995. Flat Fee. If you want your home sold through MLS add 2.5%. Our average selling time is 10 days, with sellers saving an average of $12077 with a 98.7 asking price ratio. We use a 28 step Selling System for accuracy, transparency, and the best marketing tools available today.

Call or Text Charles Stallions NOW 850-476-4494 for a free over the phone evaluation or Email: charles@charlesstallions.com for a complete package to review, no high-pressure sales pitch or obligations

How to get a Mortgage and FREE Credit Report

Thinking of Buying, We can help you relocate, find a job, a daycare, great places to eat, shop, and play along the gulf coast. It all starts by clicking here. Put my over 27 plus years to work in your best interest.

Sign up for our Monthly Newsletter about what’s happening here on the gulf and homes for sale.

Bottom Line

We are ambassadors to the Gulf Coast of Florida got a question just email us or text us.

Hello, Our family of licensed agents can show you ANY home listed by us or any other company and the best part is the rebates and money you SAVE! We have many homes that are Coming Soon or off-market for different reasons and can be seen exclusively so don't miss out. Our Team would love to show you around our local Gulf Coast Area, from Pensacola to Pace, Gulf Breeze to Navarre, and all beaches in between we are ambassadors to the Gulf Coast.

Charles Stallions, CBR, CRS, CSR, and a licensed broker/ owner representing buyers and sellers in Pensacola, Pace, and Gulf Breeze Florida. Text, Call or Email, "answer" to Charles for the answer to the two most important questions you need to ask YOUR next real estate agent.

Comments(3)