Homes sell briskly despite skyrocketing prices and rising interest rates, and inventory reaches the highest level of 2022

HOUSTON — (June 8, 2022) — Home sales maintained a healthy pace in May even as prices climbed to new record highs and mortgage interest rates edged further upward. Individual consumers and investment companies kept up demand, snapping up properties almost as quickly as they were listed. By the time the final closing of the month was tallied, volume of single-family home sales was down slightly under one percent compared to last year’s record pace. And thanks, in part, to an increase of new listings, housing inventory reached its highest level of 2022.

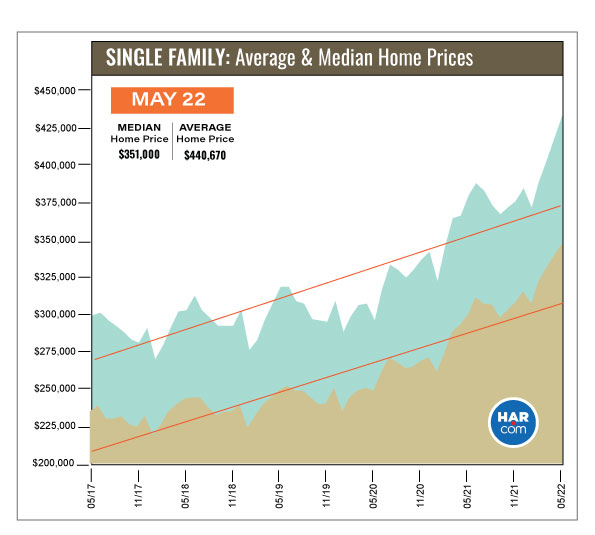

According to the Houston Association of Realtors’ (HAR) May 2022 Market Update, single-family home sales fell 0.9 percent, marking the second consecutive monthly year-over-year decline with 9,627 units sold compared to 9,714 in May of 2021. On a year-to-date basis, however, the market is running 4.4 percent ahead of 2021’s record-setting volume.

The $500,000 to $1 million housing segment was the “hot” performer of the month, registering a 38.3 percent year-over-year sales volume gain. That was followed by the luxury segment – made up of homes priced at $1 million and above – which jumped 30.2 percent. The $250,000 to $500,000 housing segment landed third place with a 10.7 percent increase.

The continued lack of below-$250,000 housing inventory has driven consumers toward more expensive properties as well as into for-lease homes [HAR’s first Monthly Rental Home Update for May will be released next Wednesday, June 15]. Mortgage rates are still on the rise with the average rate on a 30-year fixed rate mortgage up to 6.059 percent as of June 7.

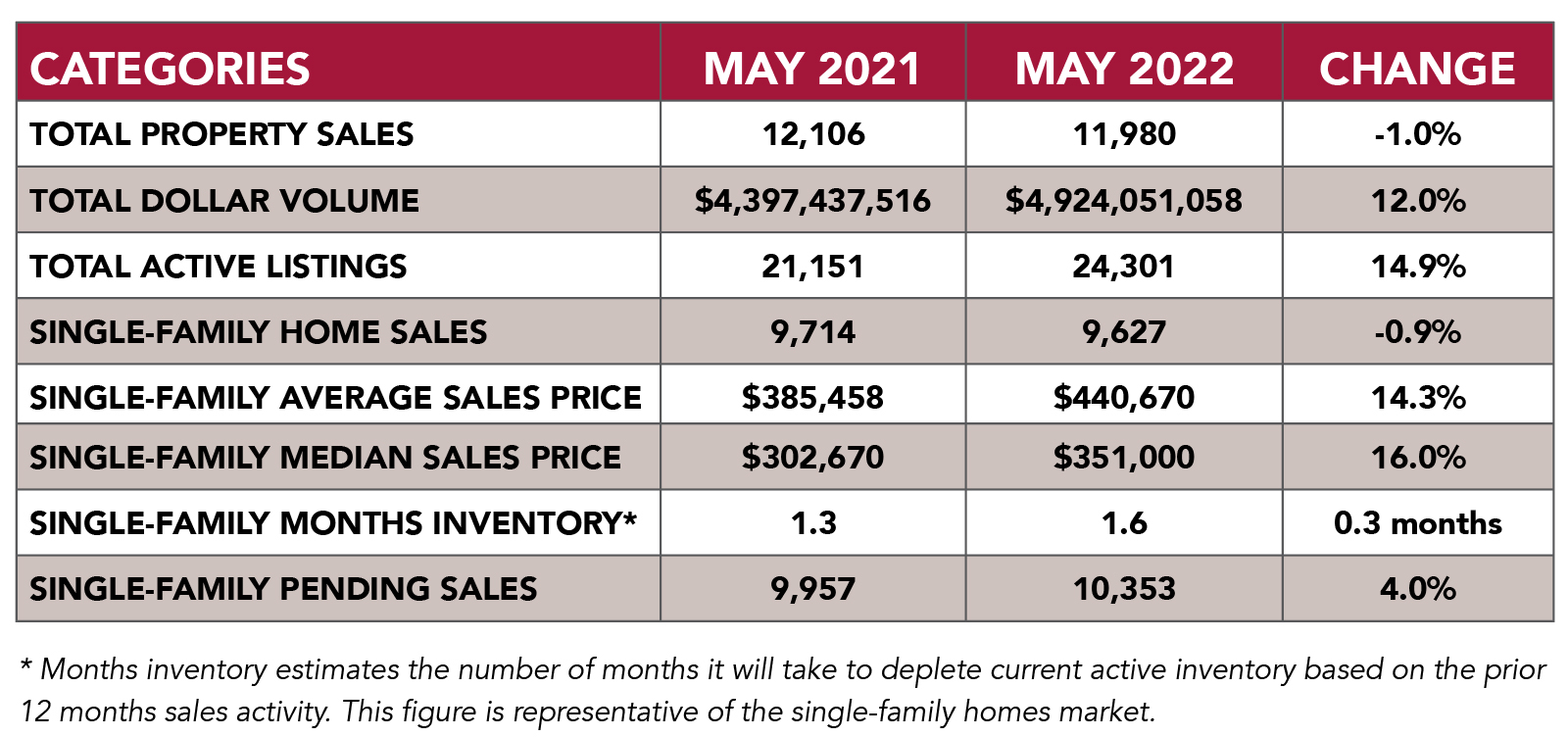

The march into record territory continued in May, with buyers pushing Houston home prices to new highs. The average price of a single-family home rose 14.3 percent to $440,670 while the median price jumped 16.0 percent to $351,000. The average price for a single-family home in Houston first broke the $400,000 mark in March of this year.

“Conditions appear to be calming a bit across the Houston housing market, so we are not seeing the frenetic pace of buying we did a couple of months ago with dozens of competing offers on new listings,” noted HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “New listings increased nine percent in May, helping boost inventory to its highest level of the year, so hopefully we can begin to see signs of normalcy in terms of supply, demand and pricing in the months ahead.”

For the second month in a row, the ‘Close to Original List Price Ratio’ for single-family homes broke the 100 percent mark, rising 100.9 percent — the highest percentage ever. That means that a majority of buyers paid above list price for homes on the market. The ratio first broke the 100 percent mark last summer, as high-dollar buying began to permeate the market. It was up 100.6 percent last month.

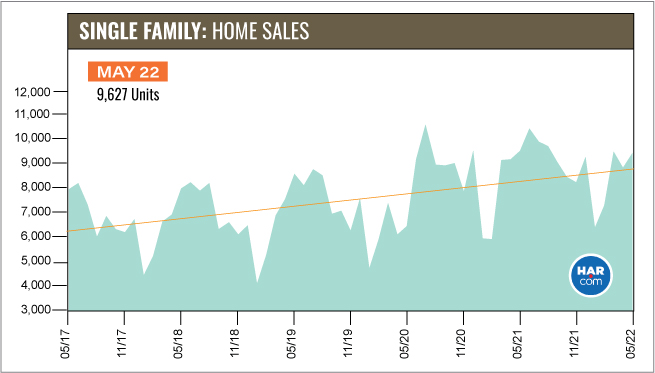

May Monthly Market Comparison

Between home prices reaching historic highs and mortgage interest rates on the rise, the Houston real estate market eased up a bit in May as some consumers put off purchases or turned to rentals as an alternative. Single-family home sales declined a fractional 0.9 percent, however on a year-to-date basis, sales are 4.4 percent ahead of last year’s record pace.

Of all the monthly housing metrics for May, only single-family home sales and total property sales experienced declines. Active listings (the total number of available properties) jumped 14.9 percent and total dollar volume for May rose 12.0 percent to $4.9 billion.

Helped by a 9.0 percent increase in new listings, months of inventory reached a 1.6-months supply, the highest level since October 2021 when it was 1.7 months. Housing inventory nationally stands at a 2.2-months supply, according to the latest report from the National Association of Realtors (NAR). A 6.0-months supply is traditionally considered a “balanced market,” in which neither the buyer nor the seller has an advantage.

Single-Family Homes Update

Single-family home sales dipped 0.9 percent in May with 9,627 units sold across the Greater Houston area compared to 9,714 a year earlier. Strong sales among higher-end homes once again pushed pricing to historic highs. The median price climbed 16.0 percent to $351,000 while the average price rose 14.3 percent to $440,670. The average price first broke the $400,000 mark in March of 2022.

Days on Market, or the actual time it took to sell a home, dropped from 35 to 29 days. Inventory registered a 1.6-months supply compared to 1.3 months a year earlier. That is the greatest supply of homes in 2022. The current national inventory stands at 2.2 months, as reported by NAR.

Broken out by housing segment, May sales performed as follows:

- $1 - $99,999: decreased 35.7 percent

- $100,000 - $149,999: decreased 27.6 percent

- $150,000 - $249,999: decreased 43.3 percent

- $250,000 - $499,999: increased 10.7 percent

- $500,000 - $999,999: increased 38.3 percent

- $1M and above: increased 30.2 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 7,902 in May. That was statistically unchanged from the same month last year. The average sales price jumped 14.1 percent to a record high $444,548 while the median sales price climbed 15.7 percent to $350,000, also a record high.

For HAR’s Monthly Activity Snapshot (MAS) of the May 2022 trends, please click HERE to access a downloadable PDF file.

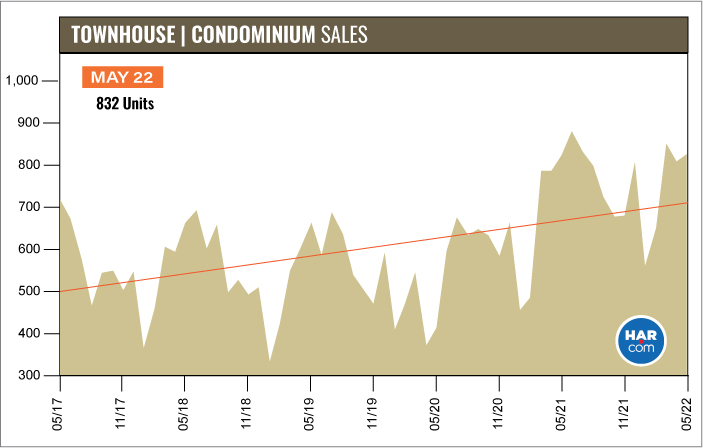

Townhouse/Condominium Update

Townhouses and condominiums barely held to positive territory in May. Sales volume rose a fractional 0.4 percent with 832 closed sales versus 829 a year earlier. The average price increased 14.4 percent to $272,381 and the median price was up 8.8 percent to $229,000. Both figures are below the historic highs reached last month. Inventory fell from a 2.4-months supply to 1.4 months.

Houston Real Estate Highlights in May

- Single-family home sales declined 0.9 percent year-over-year;

- Days on Market (DOM) for single-family homes dropped from 35 to 29;

- The ‘Close to Original List Price Ratio’ for single-family homes reached 100.9 percent — the highest ever as a majority of buyers paid above list price for homes on the market;

- Total property sales were down 1.0 percent with 11,980 units sold;

- Total dollar volume increased 12.0 percent to $4.9 billion;

- The single-family average price rose 14.3 percent to $440,670, the highest of all time, and the third time that pricing has exceeded $400,000;

- The single-family median price increased 16.0 percent to $351,000 – also a record;

- Single-family home months of inventory registered a 1.6-months supply, up from 1.3 months a year earlier. That is the greatest supply since October 2021;

- Townhome/condominium sales edged up 0.4 percent with the average price up 14.4 percent to $272,381 and the median price up 8.8 percent to $229,000.

Comments (1)Subscribe to CommentsComment