The year Phoenix 2022 housing market was one of the most interesting, after experiencing two years of a frenzied housing market. Inventory levels increased. Interest rates doubled, and the number of sales declined. A lot of worry has surfaced over these changes. A few phrases have surfaced, of which "fear porn" is one amongst financial analysts.

Fear of another repeat of the housing crash has been echoed by some, however, none of the same reasons for the housing recession exist in the housing market today. To review why the housing recession occurred, let's consider which aspects existed in 2008 that do not exist today:

- Fog a mirror, get a loan. Stated income loans without any documentation caused many loans to fail.

- Predatory lending practices. Now that the mortgage industry is more regulated with more documentation. Repeated communication and disclosures help consumers understand loan products and rates.

- 80/20 lending practices created 100% financing. Coupled with (*fog a mirror" negative amortization loans, interest only loans created rising principal balances when the housing market was on the decline.

- False advertising for mortgage backed securities. Call a spade a spade - mortgage backed securities packaged as A paper were actually junk bonds.

- New construction homes cheaper than resale homes. Creating demand, overloading builders, delaying Public Reports and sales. Perfect storm for homeowners as new "investors" emerged to buy new construction and sell it when it was completed. New investors are homeowners with no history of investing in real estate.

- Home Equity Line of Credit (HELOC) used by "investors" to buy homes, increasing debt when values were declining putting strain on owner occupied housing.

- Banks reduced credit availability for many homeowners who were using HELOC's for living expenses. Robbing Peter to pay Paul.

Stated income loans have surfaced, but the key definer is that documentation will need to be supplied and none of the predatory lending practices are in play.

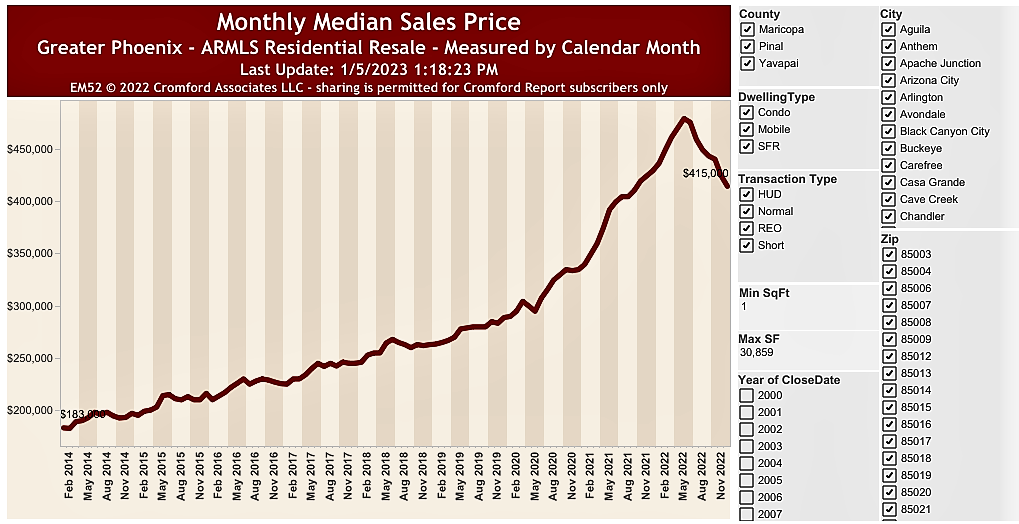

Since January, 2022, the Median price has dropped 5% as indicated in the header photo. Inventory has increased by 67%, but is still relatively low at just under 16,000 homes, single family homes, condos, mobile homes, townhomes and lofts. Price per square foot started at $284 and is now $306 per square foot - a 7% increased. The housing market is now more of a balanced market. There are still lots of buyers who will start buying again now that the holidays are over.

For this and any information about Maricopa County, Arizona, please reach out to me for data. Subscribing to the Cromford Report provides invaluable data that assists both buyers and sellers to make educated decisions!

-

Comments(4)