Mortgage rates, inflation and lack of affordable inventory interrupt Houston’s seven-year run of record-breaking home sales. TIP: Use a new home builder that is offering cash to buy down the interest rate. Contact James Potenza james@newhomejames.com for a list of builders.

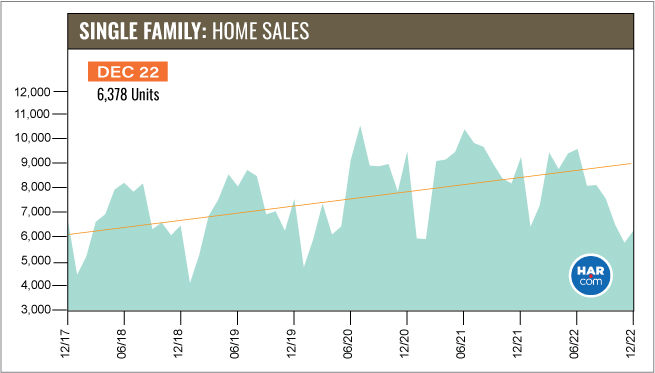

HOUSTON — (January 11, 2023) — Despite charging through a pandemic with no let-up in sales, Houston real estate could not withstand the powerful economic headwinds that began swirling in 2022 and ultimately ended a long and much-admired record-setting run. On top of limited affordable housing inventory, mortgage rates were perhaps the biggest culprit, rising throughout most of the year as the Federal Reserve drove a steady campaign of interest rate hikes to tame soaring inflation. The move prompted many consumers to postpone homebuying plans – in many cases diverting to the rental market which thrived as a result. While mortgage rates have fallen steadily since surpassing seven percent in November, home sales continue to slow and will likely remain down through at least the early part of 2023.

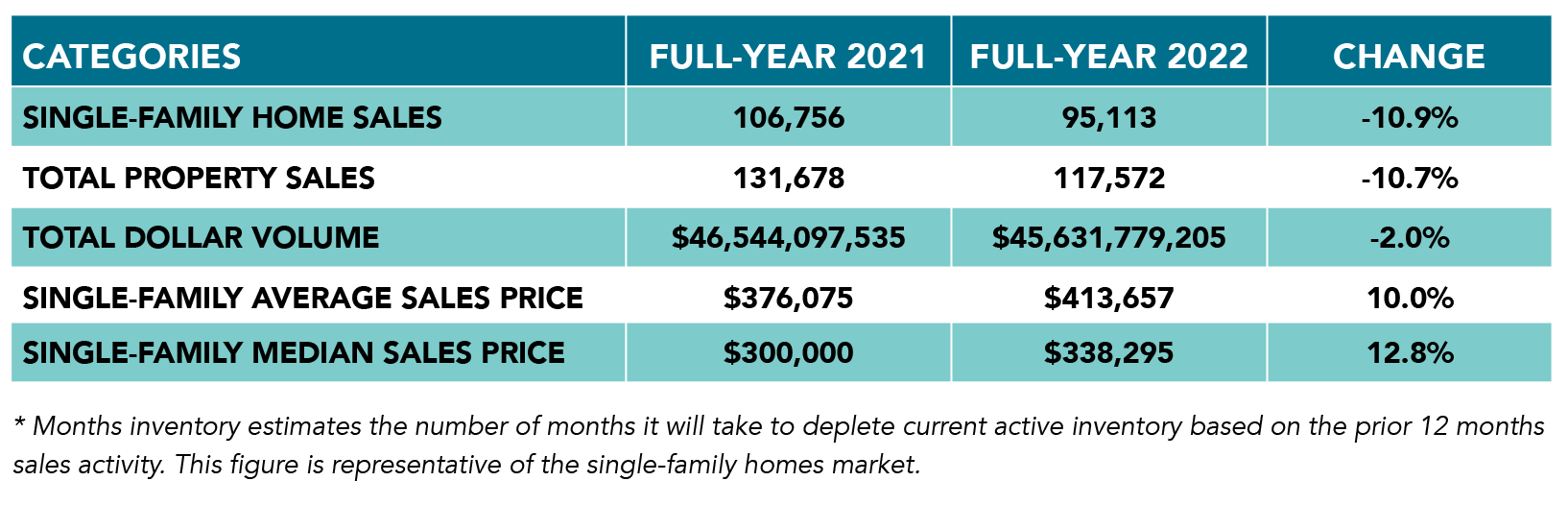

Single-family home sales for 2022 were down almost 11 percent compared to 2021’s record pace, marking the first year that Houston housing has been in the red since 2015. Despite the sales slowdown, prices rising to new highs in the $400,000s kept 2022’s total dollar volume close to last year’s record level.

According to HAR’s December/Full-Year 2022 Housing Market Update, single-family home sales fell 10.9 percent to 95,113. Sales of all property types totaled 117,572, down 10.7 percent from 2021. Total dollar volume dropped just 2.0 percent to $45.6 billion versus $46.5 billion in 2021.

“While disappointing, it was no surprise that 2022 ended the way it did given the economic forces that affected the market during the latter half of the year, most notably inflation, mortgage rates and persistently low inventory,” said HAR Chair Cathy Treviño with Side, Inc.

“We have been in uncharted territory since the pandemic, but have generally held strong, and I anticipate the market returning to healthier levels later this year, especially with inventory levels improving, mortgage rates easing and prices moderating.”

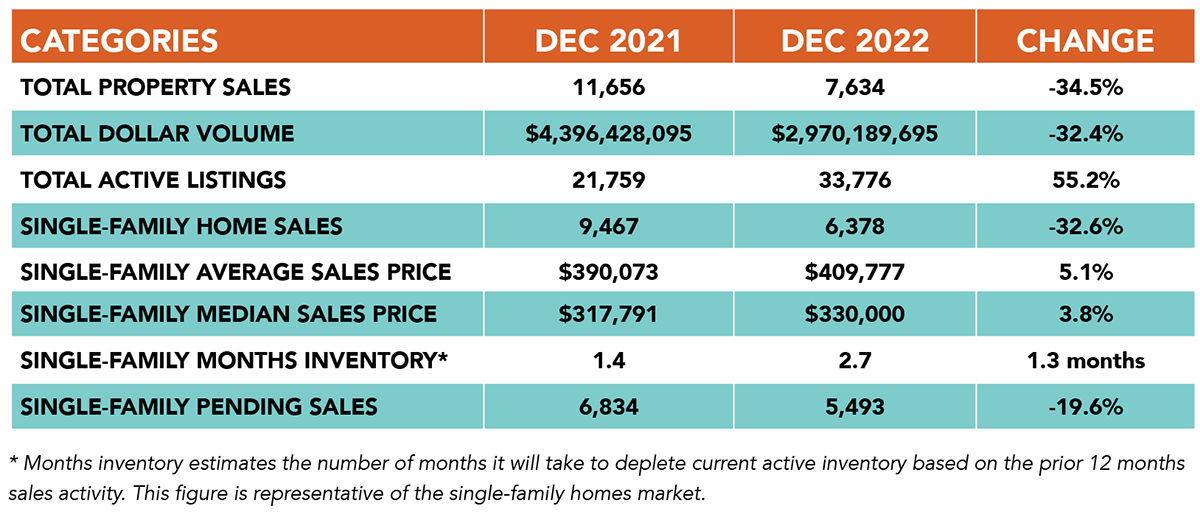

For the month of December, single-family home sales dropped 32.6 percent. That marks the ninth straight monthly decline of 2022 and the steepest. Sales volume fell in all segments of the market, with the greatest drop, 42.8 percent, among homes priced between $150,000 and $250,000. That was followed by the $1M and above segment, which saw a 34.8 percent year-over-year decline.

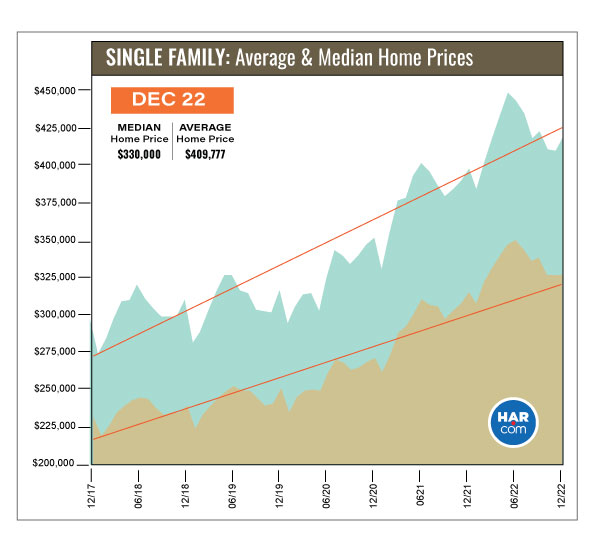

The median price of a single-family home – the figure at which half of the homes sold for more and half sold for less – was $330,000 in December. That is the third straight month it has held at that level and is 3.8 percent higher than last December. The average price of $409,777 was up 5.1 percent compared to last year.

2022 Annual Market Comparison

The Houston real estate market began 2022 with strong momentum coming off the second year of the pandemic in record territory. However, conditions changed when the average price soared to a record high of $438,301 in May and the median price jumped to its own all-time high of $353,995 in June. Between that and a stubborn lack of inventory, many would-be homebuyers found themselves squeezed out of the market, especially as efforts by the Fed to stave off inflation drove mortgage rates from the three percent range in April to more than seven percent in November. Monthly sales volume tapered, falling in April and every month thereafter. This ultimately made 2022 the first year of declining sales since 2015.

On a positive note, an uptick in new listings eventually provided a measurable boost to inventory levels, pushing it past the 2.0-months supply level for the first time in two years. It reached a 2.0-months supply in June and by December was at a 2.7-months supply. Its highest level was 2.8 months in October and November.

June had the year’s strongest sales volume with 9,844 single-family units sold.

By the time the books were closed on December transactions, 95,113 single-family homes had sold across greater Houston in 2022. That is a 10.9 percent decline from the 106,756 homes sold in 2021.

On a year-to-date basis, the average price rose 10.0 percent to $413,657 while the median price increased 12.8 percent to $338,295. Total dollar volume for full-year 2022 fell 2.0 percent to $45.6 billion.

Houston’s lease market had a generally strong 2022 as prospective buyers secured homes to rent until they are prepared to resume the buying process. HAR will report on those trends in the December 2022 Rental Home Update, to be released next Wednesday, January 18.

December Monthly Market Comparison

The Houston housing market generated mixed results in December. Single-family home sales, total property sales and total dollar volume fell compared to December 2021 while pricing rose. Month-end pending sales for single-family homes totaled 5,493, down 19.6 percent versus one year earlier. Total active listings, or the total number of available properties, surged 55.2 percent from a year earlier to 33,776.

Single-family homes inventory grew from a 1.4-months supply to 2.7 months. For perspective, housing inventory across the U.S. currently stands at a 3.3-months supply, according to the latest National Association of Realtors (NAR) report.

For HAR’s Monthly Activity Snapshot (MAS) of the December 2022 trends, please CLICK HERE to access a downloadable PDF file.

December Single-Family Homes Update

Single-family home sales totaled 6,378, down 32.6 percent from December 2021. That marked the ninth consecutive negative sales month of 2022 as well as the steepest decline. The median price rose 3.8 percent to $330,000. The average price increased 5.1 percent to $409,777. Pricing gains slowed significantly during the last three months of 2022 compared to the double-digit jumps that prevailed during the first six months of the year. Days on Market (DOM), or the number of days it took the average home to sell, rose from 38 to 57.

Broken out by housing segment, December sales performed as follows:

- $1 - $99,999: decreased 22.3 percent

- $100,000 - $149,999: decreased 29.1 percent

- $150,000 - $249,999: decreased 42.8 percent

- $250,000 - $499,999: decreased 29.7 percent

- $500,000 - $999,999: decreased 19.6 percent

- $1M and above: decreased 34.8 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 4,235 in December. That is down 42.4 percent versus the same month last year. The average sales price increased 3.8 percent to $402,556 while the median sales price was flat at $310,000.

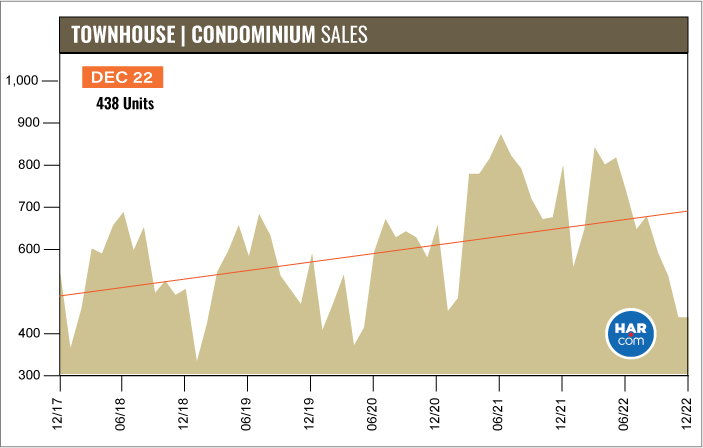

Townhouse/Condominium Update

In June, townhome and condominium sales experienced the first decline, and the trend continued throughout the rest of 2022. December volume fell 46.1 percent with 438 units sold versus 812 a year earlier. The average price dropped 6.6 percent to $241,502 while the median price fell 2.3 percent to $214,999. Inventory improved from a 1.7-months supply to 2.0 months.

Houston Real Estate Highlights for December and Full-Year 2022

- 2022 marked the first year of declining home sales for the Houston market since 2015, with 95,113 single-family homes sold versus 106,756 in 2021 – a decline of 10.9 percent; .

- Total dollar volume for full-year 2022 fell just 2.0 percent to $45.6 billion;

- December single-family home sales fell 32.6 percent year-over-year with 6,378 units sold;

- Total December property sales dropped 34.5 percent to 7,634 units;

- Total dollar volume for December fell 32.4 percent to $2.9 billion;

- At $330,000, the single-family home median price rose 3.8 percent;

- The single-family home average price climbed 5.1 percent to $409,777;

- Single-family homes months of inventory expanded 2.7-months supply;

- Townhome/condominium sales spent the latter half of 2022 with declining sales, and in December, volume fell 46.1 percent with the average price down 6.6 percent to $241,502 and the median price down 2.3 percent to $214,999;

- Townhome/condominium inventory grew from a 1.7-months supply to 2.0 months.

Comments(0)