|

In a similar start to last week’s edition, “We are coming out of a busy week.” This week, however, showed the economic cracks I have been predicting.

Silicon Valley Bank (SVB) “collapsed” making it the 2nd biggest bank failure in the U.S. In a nutshell (I’ll try to make this short), SVB was taking in all of these deposits, and a lot of them were from startups. With these deposits (and thanks to fractional reserve banking) they invested that money, and they did so in “risk-free” long-term treasuries.

Treasuries are risk-free if you hold them to maturation. However, in an environment of rising interest rates, the price of those treasuries decline because the yield they were providing is no longer as attractive as they were in a low-rate environment.

At the same time, those startup companies that had deposited with SVB started to withdraw deposits due to trying to survive in a tougher economic environment. SVB later announced that it need to come up with over $2 billion dollars to shore up its balance sheet.

With the help of social media, there was a bank run on SVB and SVB couldn’t pay up (since they put the money in long-term treasuries that were worth significantly less). Why didn’t a large bank hedge its bets in an OBVIOUS rate-increasing environment? Great question.

The Fed has stepped in (the first of many to come). They will not bail out SVB but will cover all depositors. The details will be clearer tomorrow. Two other banks also closed, one heavily associated with Crypto and we will see if these three are the sign of things to come.

Even though the startups who deposited with SVB will get their money back, it’s a matter of when. In the meantime, many have employees/costs that they must pay. We should see how this spreads economically in the coming days/weeks but many regional banks may already be in trouble.

As if that wasn’t enough, we have a huge week ahead of us with CPI numbers coming out Tuesday and PPI numbers Wednesday. With the higher unemployment rate, possibly lower inflation, and the Fed beginning to intervene – the stars may be aligning for a lower interest rate environment. But we must remember that this “good news” is sadly at the misfortune of many.

Here is what is in store for this week

Monday

- Fed closed door meeting

- Fed details on SVB assistance

Tuesday

Wednesday

- Retail Sales

- PPI

- Business Inventories

- Homebuilders Survey

Thursday

- Jobless Claims

- Import Price Index

- Housing Starts

- Building Permits

- Philadelphia Fed Manufacturing

Friday

- Industrial Production

- Capacity Utilization

- US Leading Economic Index

- Consumer Sentiment

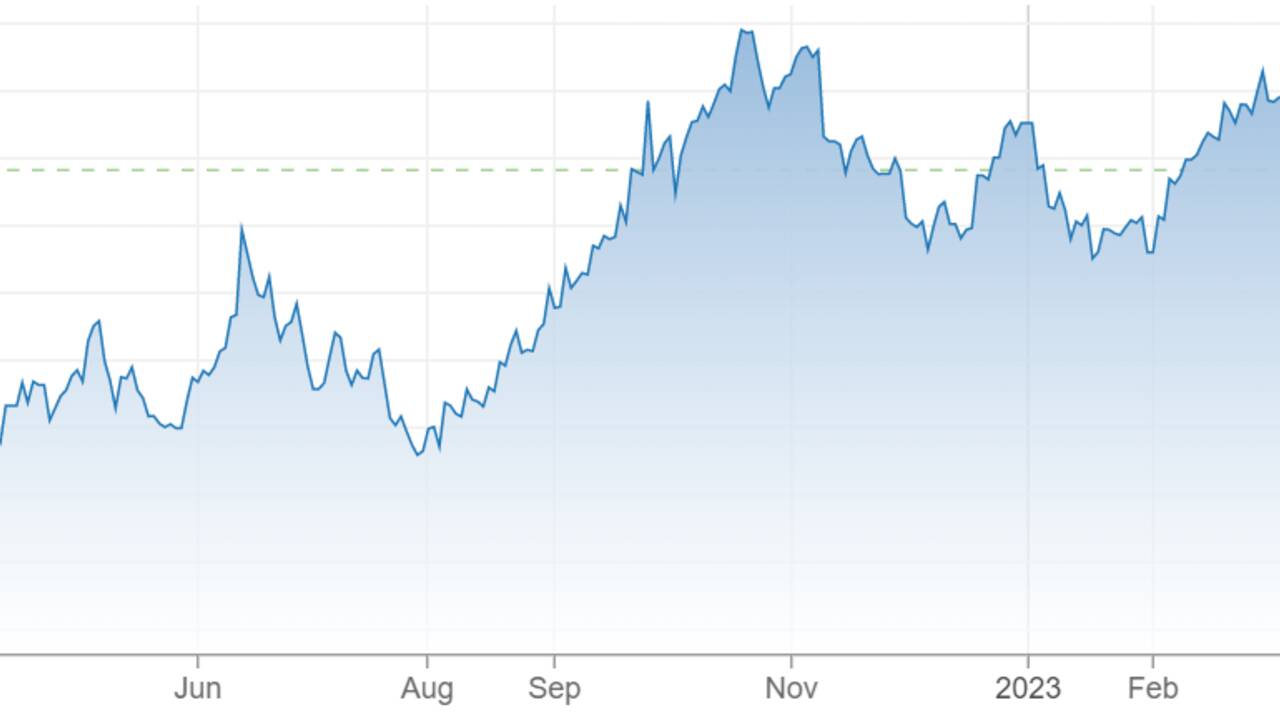

Chart Check

We were well on our way to testing the October/November highs. But when the SVB news came out and the higher unemployment numbers, the markets took a turn.

|

Comments(4)