"One big factor that's changed mortgage lending is widespread use of automated underwriting software, which is required for lenders to be able to sell loans on the secondary mortgage market. This software takes certain things into account, like credit scores, that weren't considered before." - Mark Steele, President of Howard Hanna Mortgage Services in Pittsburgh

As home buyers, you may be feeling the pressure of tougher restrictions when trying to receive approval for a real estate loan. What advice can I give you? Know your credit score. Why? Everything these days is becoming more credit scored focused. Following I will give you advice on how to find your credit score, what is a good credit score, and how to approve a low credit score.

What is a credit score? In lay mans terms a credit score rates buyers' creditworthiness. Lenders, Banks, Credit Card Companies, etc. use credit scores to evaluate the potential risk posed by lending money to consumers. They will use this information to decide if you qualify for a loan, at what interest rate, and what credit limits. *Remember- Credit Scoring is not only limited to banks but some mobile companies, insurance companies, and even employers will check your credit score.

How do I find my credit score? G.M. Filisko, author of "Tough Terrain" featured in the latest Realtor magazine says "By Law, every individual is entitled to one free credit report a year." Three major credit ranking agencies he recommends are Experian, Equifax, and TransUnion.

What is a good credit score? Scores range from 300-850, any score above about 720 is considered good.

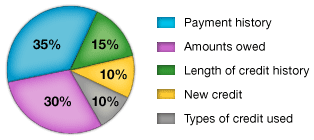

What affects a credit score? A large number of factors can determine a credit score but the biggest is generally the amount of credit you've used and your record of paying the credit back on time. Factors that can bring down your credit score: applying for credit at many places within a short period of time (you know your Sears Card, Macys Card, Dillards Card, etc. that you signed up for? Those all count against you.), maxing out your credit scores, late payments, having few lines of credit with low use (this may seem odd but it leaves lenders will little information to judge your ability to repay). See the below diagram from myfico.com for a general idea of how your credit is scored:

How do you improve a low credit score? This will not happen overnight; there is no "quick fix". In fact it is best to manage credit responsibly over time for the best effect. So over the long haul be sure to, 1. Pay your Bills on time (this is MAJOR), If you are having troubles be sure to contact your creditors or a legitimate credit counselor, Keep balances low on credit cards, Have few open accounts without moving your money around too much, Don't open new credit cards that you do not need, and have credit cards but remember to manage them responsibly.

Comments(1)