Breaking News: Expected Over 50% Of All Homeowners Underwater in Their Homes!

I am re-blogging this very interesting article about Mortgage Statistics and what we can expect going forward. As an advocate for consumer empowerment in Real Estate...I feel that information is the key to home buyers and sellers making educated decisions. Thank you to Tim & Julie for taking the time to gather this data and share it with us all.

Please feel free to share your opinions and leave comments.

Kristi L. Ross PA

Hawk Beach Realty

386-931-5822

Note: This is a follow-up on last weeks blog post When Will Home Prices Rebound (2020..2030..Longer?). Read that post on TimandJulieHarris.com now.

Breaking News: Negative Equity Data from First American CoreLogic shows that Nearly One-Third Of All Mortgages Are Underwater.

Here are the bullet points….

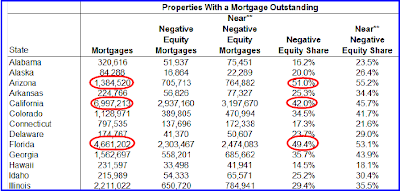

• More than 15.2 million U.S. mortgages, or 32.2 percent of all mortgaged properties, were in negative equity position as of June 30, 2009 according to newly released data from First American CoreLogic. As of June 2009, there were an additional 2.5 million mortgaged properties that were approaching negative equity. Negative equity and near negative equity mortgages combined account for nearly 38 percent of all residential properties with a mortgage nationwide.

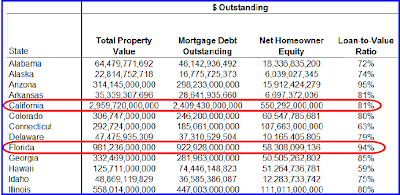

• The aggregate property value for loans in a negative equity position was $3.4 trillion, which represents the total property value at risk of default. In California, the aggregate value of homes that are in negative equity was $969 billion, followed by Florida ($432 billion), New Jersey ($146 billion), Illinois ($146 billion) and Arizona ($140 billion). Los Angeles had over $310 billion in aggregate property value in a negative equity position, followed by New York ($183 billion), Miami ($152 billion), Washington, DC ($149 billion) and Chicago ($134 billion).

• The distribution of negative equity is heavily skewed to a small number of states as three states account for roughly half of all mortgage borrowers in a negative equity position. Nevada (66 percent) had the highest percentage with nearly two?thirds of mortgage borrowers in a negative equity position. In Arizona (51 percent) and Florida (49 percent), half of all mortgage borrowers were in a negative equity position. Michigan (48 percent) and California (42 percent) round out the top five states.

There are some interesting tables and graphs in the article that inquiring minds are investigating. Here are some partial alphabetical lists.

Negative Equity Share

Property Values and Loan-To-Equity Ratios

Nevada, not shown has a near-negative equity share of 68.9% and a Loan-To-Value ratio of an amazing 115%!

Mortgages – Select States

- California has $2.4 trillion in mortgages debt. 42.0% of the properties have negative equity.

- Florida has $923 billion in mortgage debt. 49.4% of the properties have negative equity.

- Illinois has $447 billion in mortgage debt. 29.4% of the properties have negative equity.

- Arizona has $298 billion in mortgage debt. 51.0% of the properties have negative equity.

- Nevada has $149 billion in mortgage debt. 65.6% of the properties have negative equity.

- Nationwide there is $10.1 trillion in mortgage debt. 32.2% of the properties have negative equity.37.6% of the properties have “near-negative” equity.

Summary……32-37% Of All Mortgage Holders Are Stuck, Unable To Sell. What does this mean for Realtors? Simple, if you are not listing and selling Short sales you are making it so you will be cut out of nearly 40% off all available listings? Get started NOW, watch the FREE Agent Short Sale Secrets video and grab your FREE Short Sale Secrets crash course book.

California alone has $2.4 trillion in mortgages debt. 42.0% of the properties have negative equity! Nearly half of all home owners (with Mortgages) are upside down in their homes!Nationwide there is $10.1 trillion in mortgage debt. 32.2% of the properties have negative equity, another 5.4% are nearly underwater. Don’t believe the green-shoots story…we are no where near the end of this real estate correction.

If underwater sellers want to sell they have 3 choices:

1) Foreclosure.

2) Bringing cash to the closing to make up the difference between what is owed vs what the home sells for.

3) Short sale. For many reasons a short sale is often the best solution for the seller. Clearly, there is an enormous demand for agents who know how to do short sales. Agents, watch the FREE How-To do short sales video now.

When will the housing markets recover to peak 2006 values? Experts are expecting the recovery to take 10+ years. Read this story here.

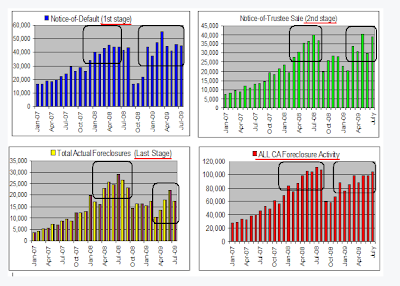

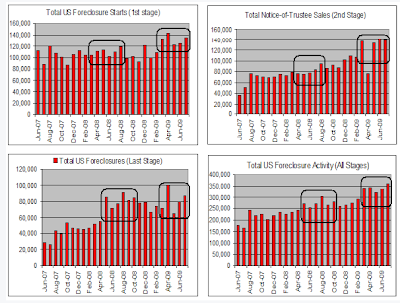

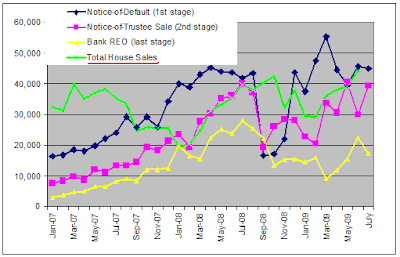

We have been warning HREU students for over a year that the biggest wave of foreclosures would come in late 2009…early 2010…

And it appears that we were correct.Realtors: its NOT too late for you to become a REO listing agent. The biggest opportunites to make money listing and selling REOs (bank owned homes) has yet to come. Watch the FREE Agent REO Secrets Video NOW. Learn how to list REOs.

California Foreclosures

Nationwide Foreclosures

California Pent Up Foreclosure Demand

Why will the foreclosures (and REOs) hit harder now than ever?

- The number of people underwater in their mortgages is increasing NOT decreasing.

- The stigma of a foreclosure is all but gone. Now if you lose your home to a foreclosure you are called a ‘foreclosure victim’.

- The reported nationwide unemployment figure is 9.4% with the real unemployment above 16% and rising.

- Wages are falling.

- The jobs market will suffer losses for another year.

- Notices of Default and Trustee Sales are high and rising.

- People now see ‘walking away’ from their homes as a prudent financial move vs. being irresponsible.

Agents, what do you think....? What will happen to how people think about real estate...owning a home...if 50% of all homeowners (with a mortgage) are upside down? Share your thought, post your comments:

Comments (0)Subscribe to CommentsComment