You know how the Fed has been buying up so many Fannie, Freddie and Ginnie Mae MBS? Last year the Fed made up something like 75% of all such purchases. It will be interesting to see what happens as they stop buying. The conventional wisdom is that it will cause rates to go up, but the conventional wisdom isn't always right.

It seems like yesterday that Lomas & Nettleton was the nation's biggest servicer with about $20 billion?

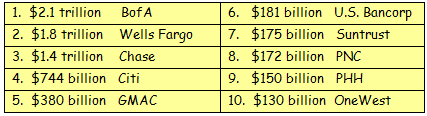

Here are the top servicers today.

Number 10 OneWest is the new name for what used to be Indy Mac Bank (a place I regretfully once worked). What kind of cash flow does $2 trillion throw off? Let's assume 35 bps of servicing income, and if my math is right, the servicing fee is about $7 billion a year or $580 million a month of gross revenue. Man that's a lot of dough for just handiling the money!

Horizon Bank in Washington State with $1.3 billion of assets has failed, and the FDIC estimates that the cost will be approximately 41% of stated assets. It seems like only yesterday when the Northwest banks were doing so well. About 30% of Horizon's portfolio was construction and land development, with another 34% in multi-family and commercial real estate. That 41% loss still seems shocking.

You always read about how the key to real estate investing is to use OPM, or Other People's Money, and here's an interesting example: Tishman Speyer paid $5.4 billion for a huge apartment complex in New York (Peter Cooper Village), and it's now worth $1.8 billion. How much of that $3.6 billion loss did the Speyer family lose? They lost only $112 million, with the big losses being taken by their investors. This will knock your socks off, but one of their biggest investors in the deal was the Church of England.

The Dornbusch Law (named after the late MIT professor of economics, Rudi Dornbusch) states that "In financial markets, things always take longer to happen than you expect - but once they happen, events unfold more quickly than you'd ever have imagined." Think back on the financial crisis of 2008-2009. Isn't this exactly how it worked?

No one's going to ring a bell announcing that the refinance boom is over, but I was surprised by the MBA refinance Index. It was 5,904 one year ago and this week it was 1,976. That's a 67% drop over the past twelve months. Should mortgage lenders be worried? It sure seems like things could be cooling down, now or in the near future.

Comments(0)