Understanding & Executing a Successful Property Tax Appeal in Bergen County, NJ

By Dave Miller - RE/Max Integrity

Misconception: You are really not appealing your taxes, you appealing your property's assessment. The assessment is the value the town has put on your house in order to calculate the taxes. Multiply the assessment by the town's tax rate and you get the total property tax amount.

If your assessment is $450,000, times a tax rate of 2.385, your taxes would be $10,732. Typically every year the tax rate goes up. That's why your taxes go up. The assessment is usually only done about every 10 years so at any given time your assessment may be high or low - this is why the State gives municipalities a 15% leeway of error.

Otherwise the assessments would have to be redone every couple years as the market changes which would cost hundreds of thousands of dollars, which would in itself, increase your taxes because the property owners would be paying for it.

If you think your house is worth close to or more than the assessment then you probably have a lousy appeal. If your unhappy with your taxes, then your beef is with the Mayor & Council, Governor, Senators, etc. & not with the tax assessor.

That being said, if your assessment far exceeds your homes value, then you have the right to challenge that number. If you're not sure what your home is worth, you can e-mail with your homes basic parameters & I can give you a ballpark figure to see if it's worth an appeal.

Email: Dave@DaveMillerRealEstate.com

I say probably because every town has it's ‘equalization ratio' which means if your house is assessed at market value but the town on average assesses homes at 70% of value, then you have a reason to appeal. I have the full equalization chart for every town in Bergen County on my web site.

The next step is to find at least 3 legitimate comparable sales. Homes that are similar to yours and preferably in the same area that have sold for less than you are being assessed for - this will help establish market value and hopefully convince the County Commissioner at the appeal to rule in your favor. Again, I can help with this, just shoot me an e-mail.

Understanding & Executing a Successful Property Tax Appeal in Bergen County, NJ

You should also use photographs of other factors such as a gas station, fire station, cell tower, traffic light, busy street/traffic, etc., anything that my help the commissioner to understand your situation. For more detailed information read ‘What is Good Evidence' in Bergen County Board of Taxation's ‘Understanding Tax Appeal Hearings'.

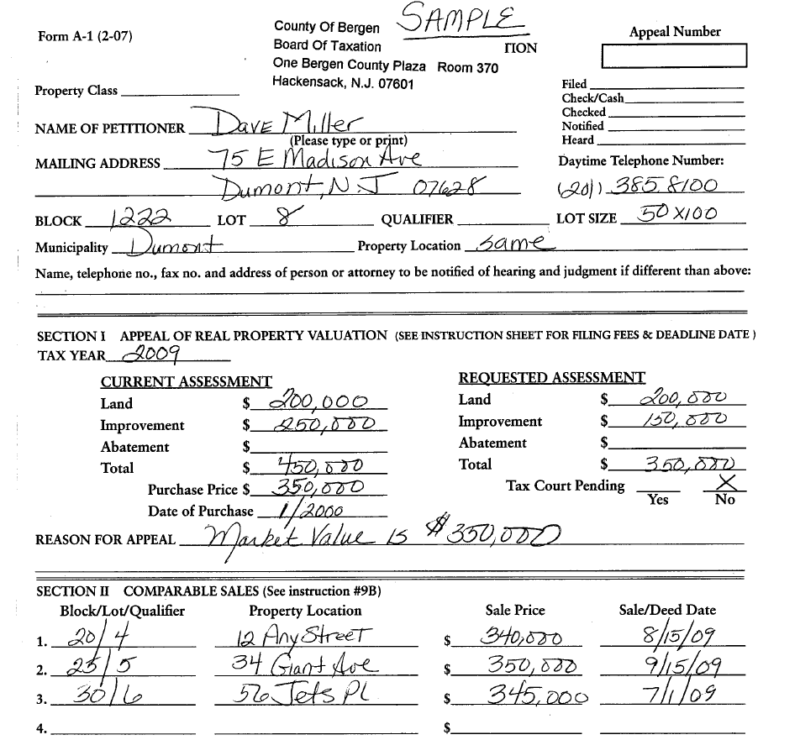

Filling out the paperwork is easy. Here is a sample appeal form filled out.

Understanding & Executing a Successful Property Tax Appeal in Bergen County, NJ

I have a blank copy on my web site www.DaveMillerRealEstate.com along with terrific reference materials from the County. I highly recommend you read through this material. Starting with Understanding Tax Appeal Hearings

Many people ask me if they should hire an attorney or get an appraisal. This can get expensive and the Appraiser must be present to testify. See Important Reminders for Tax Appeal Hearings. The cost to appeal is only $25 but you'd have to take a half day off work. I think if you do your homework you can do it yourself. It can be quite interesting. I recommend sitting up front as many people may go before you and it's more interesting if you can hear what's being said. Plus you can get an idea of what to do & what not to do. Be brief & to the point. The commissioner is listening to hundreds of appeals & he/she will appreciate your brevity. Remember; don't complain about your taxes! You're appealing your assessment!! Good luck! Dave Miller

Dave Miller

RE/Max Integrity

75 East Madison Avenue

Dumont, NJ 07628

201-385-8100 x 14

Understanding & Executing a Successful Property Tax Appeal in Bergen County, NJ

Comments(2)