Facts & Numbers vs Assumptions - Part 2

I love what I do and I love crunching numbers, sometimes being creative and finding a way to maximize my clients cash assets, putting them in a good financial position for years to come. Meaning that I like to act like a financial planner, making sure that the borrower doesn't always use all of their assets, especially in today's market.

Before you continue with this post, you will need to read part 1, Planting Seeds in the Borrower's Head. If you want the cliff notes version, read the next few sentences below.

I truly believe as a loan officer, that I do my job as well as I can, with pride and satisfaction. That a realtor should not give mortgage advice deeper than the basics. The basics would be to know what programs are good in your area, and that you ask a few simple questions to make some determinations. Other than that, the realtor should not get into the rates and down payments. I hope to explain better below.

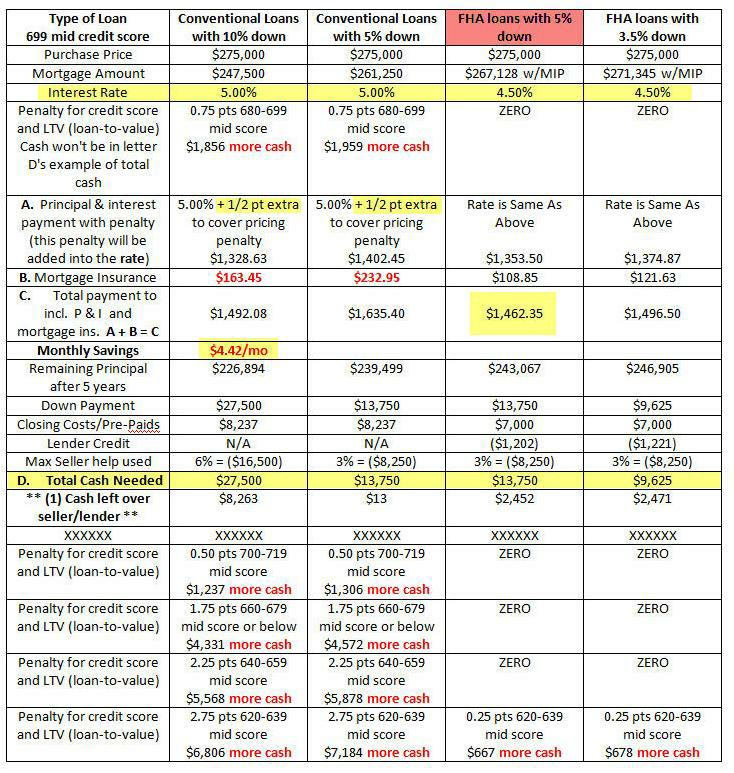

So what am I questioning? It's when a realtor makes a statement such as this one. "home buyers can receive 6% closing help with 10% down. Which benefits our buyers more, making a larger down payment or paying their cash for closing costs???" - How about possibly neither, which I will show below. The last comment was followed with this kind of comment. - "The lower interest rates often offered with 10% down compared with FHA may make the conventional more attractive. " These same statements are mentioned in part one and written by Lenn Harley.

If you remember the title of Part 1, it was Planting seeds in the borrower's head. Read my conclusion in part 1. I truly believe when you talk about such statements, that you could be planting a seed in the borrower's head. This could confuse the borrower or even worse, make them choose your thoughts without knowing the details. Let me show you what I am talking about.

Key Important Points -

- If the property is in a distressed area (declining market), the maximum LTV is 90%, which means you have to put 10% down.

- The monthly payments on the conventional loans can increase or decrease depending on the credit scores.

- Each scenario is the same profit margin. You would need a credit score of 720 + to avoid any pricing penalty.

- Most PMI companies won't go below a 680 credit score. There are a few that could go down to 660, but depending on the status of the lender with that MI company. But in all honesty, FHA loans would be the best option once you go below a 680 credit score. So why even bother with details.

The scenarios used below are based on a mid credit score of 699.

Now, there are a few other scenarios, such as lender paid mortgage insurance (LPMI) or 80/10 or lender paid closing costs (which you increase the interest rate which pays for some closing costs), and a few other mortgage insurance programs. But I just wanted to give you an idea on the statements that were mentioned above and how one needs to be careful in what they state to the buyer.

On another note, FHA is trying to reduce the seller help from 6% to 3%. HUD seeks public comment on three main issues for FHA loans. In the examples above, I decided to pretend that FHA's seller help was reduce to 3%.

Reminder : - Comparing 10% down conventional with 3.5% down FHA - In regards to the money that you don't use on the FHA loan, you either save it as cash on hand or you could invest it. You can usually get a 6% to 7% return on your money. If you have a decent idea or work with a good financial planner, you could get 9% to 10%. If you really know what you are doing and or are aggressive, you could get like 12% return. And please don't read into those that sell you the idea to pay down your house off in half the time. There are some scams out there. They work, but not as advertised. Secondly, you will be writing off less interest if you pay off your house quicker. And the interest write off on the interest rate itself, depending on your interest rate, might not be as much as you think. Just food for thought and showing the complexities when comparing different types of mortgages.

Key Important Reminder -

Lender Overlays and different PMI companies (private mortgage companies) have different guidelines and rules. Also, when doing a conventional loan with MI, you will also have to send the file to the MI company to be underwritten. So even if your company says yes, the MI company could still say no. On FHA loans, it's just underwritten once.

Conclusion : Many would think and or assume that with 10% down on a conventional mortgage, that it could be cheaper in interest rate and in payment than on a FHA mortgage with 3.5% down. And in some cases, even though your down payment is more with a conventional loan, it could cost you more out of pocket or possibly more within the price of the home because some sellers will tack on the seller concessions onto the price. And look at the fact that you added about $6,000 of upfront mortgage insurance on the FHA loan, yet the FHA loans look to be cheaper all the way around. And you can compare the principal balances after 5 years and how much cash that you kept in your pocket with a lower monthly payment. Food for thought.

Cash is King - I highlighted the FHA loan scenario with 5% down. As you can see, the mortgage payment would actually be about $30 less than when putting 10% down. What I hear so many people focus on is the fact that they don't want to be underwater on the property. People, buying a home is suppose to be an investment and in many cases, a long term investment. This is a whole other topic, but it needs to be discussed. You just never know what will be around the corner and having a larger savings could save you down the road. I wrote an excellent series on this topic. Click on the Cash is King link. Part 2 of 3 -

Numbers don't lie, uneducated facts or assumptions do.

UPDATE : I had originally worked on this post starting at 3:30 am this morning and had most of it done by 7 am. But I didn't submit it because I had to check out one issue and then the day got away from me. But Mr. Stevens of FHA has announced new upfront mortgage insurance changes and changes for the monthly. In my opinion, the 5% comparisons, FHA loans will still be the best option, even with a credit score of 699 or less. In regards to the 10% down on conventional loans? The payment might be better by $100, but still keeping in mind that you are keeping $13,000 in your pocket. You need to think of the trade off and your future. Here is the link to the letter from FHA. Bill approved to give FHA the ability to change upfront and monthly mortgage insurance. I will be writing about this tomorrow and giving examples. thanks

_____________________________________________________________________________________________________

FOLLOW ME ON FACEBOOK

- FHA Loans - USDA Loans - VA Loans -

- Energy Efficient Mortgages -

- Conventional Loans - 203 k loans -

- FHA Home Loans - Mortgages -

Experience & Knowledge at its BEST !!!

Follow me on:

_____________________________________________________________________________________________________

For more information on FHA loans, please go to this link. The FHA Expert

For important mortgage insight to watch for, please read : Consumers need to be aware of these Red Flags!

For information about FHA myths & FHA rumors, please read : FHA Myths & Rumors

Copyright © 2010 by Jeff Belonger of Infinity Home Mortgage Company, Inc

Comments(12)