If Gross Domestic Product (GDP) measured uncertainty and indecision in the housing market, the government would be reporting record numbers right now. And while all homebuyers and sellers are affected by this uncertainty, its most debilitating effects are likely with “move-up buyers “who have the need, wherewithal and desire to buy a bigger home. Powerful motivators notwithstanding, these buyers find themselves lacking not only the confidence to make a decision, but, perhaps more importantly, the basic framework for identifying and evaluating the relevant factors. Armed only with a vague sense of potential further declines in real estate values, the decision to wait is all but inevitable. And all it takes is next month’s Case-Schiller Index to reflect even a fractional decline in housing values to “validate” the prudence of procrastination.

The problem, of course, is not that the decision to wait is necessarily the wrong decision, but that any decision of this magnitude affected by a complex interplay of variables requires a more thoughtful analysis than is typically brought to bear. Absent this, the potential for further declines in real estate values is twice over-weighted in the decision-making process, once when considered in isolation (since the netting effect of the reduced value of the buyer’s current home is rarely explicitly considered) and again when considered in relationship to other offsetting factors such as the potential for increased financing costs if interest rates increase. This latter factor is more difficult to quantify, yet often more consequential to the long-term implications of the decision because its effects are operable over a much longer period of time (assuming a typical 30 year mortgage) and over a larger component of the equity equation (assuming that a significant portion of the purchase is financed).

The good news is that through the magic of Excel, a thorough analysis that properly considers all of these factors can be achieved with limited effort or specialized know-how. With minimal data, a potential move-up buyer can quantify their assumptions about real estate and interest rate trends, provide specific data about the current home’s equity and future home’s target price and immediately see the implications on future equity of buying now, vs. waiting for the market to “hit bottom”. Armed with better information, these buyers can move beyond a reflexive paralysis to a more nuanced and informed decision based upon all of the relevant factors.

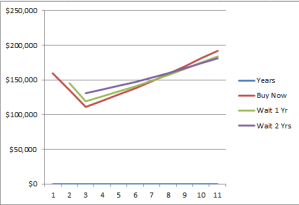

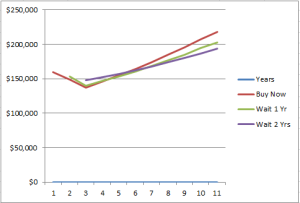

A Picture Paints A Thousand Words

These two charts illustrate the estimated net equity in a new home under two different sets of assumptions over a 10 year period. In both charts, interest rates are expected to increase by a modest ½% per year over the next two years while real estate values are expected to decline 5% and 3% per year in Figures 1 and 2, respectively. While this analysis alone will not (and should not) be compelling for every buyer, it does clearly show that a modest increase in interest rates will create a greater drag on equity within the first 5 to 10 years after purchase even under very pessimistic real estate pricing trends. Buyers who anticipate being in their new home for at least 5 years may very well be empowered to buy the home they’ve been dreaming about since 2007.

Want your own copy of the Move-Up Evaluator? Click on the link below.

Want to know more? Click on the screencast link below for a guided tour.

| http://screencast.com/t/fbGokMcgO |

Comments (2)Subscribe to CommentsComment