| |

In This Issue  |

| |

|

|

| |

Last Week in Review:Inflation news was released...and home loan rates responded.

Forecast for the Week:Earnings season continues, plus look for reports on retail sales, manufacturing, housing and more.

View:Have you ever needed to read an important text for work while you were driving? Now theres an app for that.

|

|

| |

|

|

| |

Last Week in Review  |

|

| |

|

|

| |

"Wild thing! You make my heart sing!" The Troggs. And that song lyric is certainly an apt description for the volatility in the markets these days, as the ups and downs have given people things to both sing and scream about. Here's what happened last week...and how home loan rates were impacted.

Inflation news hit the wires, with reports on both the wholesale and consumer levels. The wholesale-measuring Producer Price Index (PPI) showed that prices remained mostly unchanged during March. Remember, inflation hurts the value of fixed investments like Bonds (including Mortgage Bonds, to which home loan rates are tied)...so the lack of inflation on the wholesale side was good news for Bonds and home loan rates. Inflation news hit the wires, with reports on both the wholesale and consumer levels. The wholesale-measuring Producer Price Index (PPI) showed that prices remained mostly unchanged during March. Remember, inflation hurts the value of fixed investments like Bonds (including Mortgage Bonds, to which home loan rates are tied)...so the lack of inflation on the wholesale side was good news for Bonds and home loan rates.

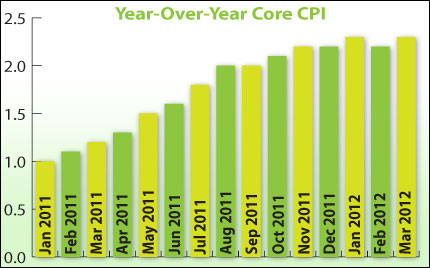

Also helping Bonds and home loan rates last week was the tame inflation data from the Consumer Price Index (CPI). The headline reading for March was right in line with estimates. When stripping out volatile food and energy, the Core CPI was also inline with estimates...but the year-over-year number was 2.3%, just slightly higher than the previous reading of 2.2%. While this raises eyebrows a bit, the Fed is still reiterating that inflation remains subdued. That being said, if the Core CPI continues to rise...which is indicative of inflation and as you can see in the chartBonds and home loan rates will have a tough time improving much further, regardless of other factors.

One key factor to keep an eye on is the labor market, as Initial Jobless Claims increased 13,000 to 380,000 for the week ending April 7. This marks the highest level since January, and the second highest reading for 2012. The Fed has acknowledged that job creations are short of their goals. In fact, last week Federal Reserve Vice Chairman Janet Yellen said that weakness in housing, the European debt crisis, and government spending cuts are likely to slow the pace of recovery and expansion. She did state that the Fed has plenty of stimulus tools to use, if economic conditions warrant another round of quantitative easing.

The bottom line is that many factors will impact the direction in which Bonds and home loan rates move in the weeks ahead. The good news is that home loan rates remain near historic lows and now continues to be a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients.

|

|

| |

|

|

| |

Forecast for the Week  |

|

| |

|

|

| |

The calendar heats up this week with reports on sales, housing, jobless claims and manufacturing:

- Right off the bat, Retail Sales will be reported on Monday - and investors will be able to gauge how consumer spending is holding up.

- In manufacturing news, the Empire State Index out of New York and the Philadelphia Fed Index will be released on Monday and Thursday, respectively.

- Housing will be in the news this week with Housing Starts and Building Permits for March being reported on Tuesday. Those reports will be followed by the Existing Home Sales report for March, which will be released on Thursday.

- The weekly Initial Jobless Claims report will be released on Thursday. The report released last week showed that jobless claims rose to their highest level since the week ending January 28. So the markets will be watching this week's release!

In addition to those reports, Corporate Earnings reports may influence the Stock markets - and as we know, the Bond markets usually move in the opposite direction.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on.

When you see these Bond prices moving higher, it means home loan rates are improving - and when they are moving lower, home loan rates are getting worse.

To go one step further - a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, it's been a wild, volatile few weeks in the markets. I'll be monitoring all the news closely to see how the markets and home loan rates respond next.

Chart: Fannie Mae 3.5% Mortgage Bond (Friday Apr 13, 2012)

|

|

| |

|

|

| |

The Mortgage Market Guide View...  |

|

| |

|

|

| |

|

| |

|

|

| |

No More Texting and DrivingThere's an App for That!

A study by the National Highway Traffic Safety Administration found that distracted driving was the leading cause in nearly 450,000 accidents and more than 5,000 highway deaths.

Unfortunately, one of the most distracting elements for drivers today is text-messaging technology. The good news is that technology can also help solve this problem. Services - like DriveSafe.ly - have sprung up that eliminate the need to read text messages AND eliminate the need to respond. That's good news regardless of whether you're receiving personal or business text messages.

Here's how it works...You download an application to your phone. Then, before you get in your car to drive, you simply turn the application on. When you receive a text message, the application actually reads it to youautomaticallyand o ut loud. So there's no need to take your eyes off the road.

Better still... the application automatically sends a reply message stating that you are driving and will respond as soon as you reach a destination that allows you to safely reply.

The application can be used on a variety of phones and there are even different plans - including a free version of DriveSafe.ly as well as family and business plans.

If you receive a lot of text messages while driving, this could be one of the most important safety steps you do this year. Take a few minutes to check it out.

After all, this simple application could save your life or the life of someone you know.

Economic Calendar for the Week of April 16 - April 20

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

| Mon. April 16 |

08:30

|

Retail Sales |

Mar

|

0.3%

|

|

1.1%

|

HIGH

|

| Mon. April 16 |

08:30

|

Retail Sales ex-auto |

Mar

|

0.3%

|

|

0.9%

|

HIGH

|

| Mon. April 16 |

08:30

|

Empire State Index |

Apr

|

17.5

|

|

20.2

|

Moderate

|

| Tue. April 17 |

08:30

|

Housing Starts |

Mar

|

700K

|

|

698K

|

Moderate

|

| Tue. April 17 |

08:30

|

Building Permits |

Mar

|

710K

|

|

717K

|

Moderate

|

| Tue. April 17 |

09:15

|

Capacity Utilization |

Mar

|

78.5%

|

|

78.4%

|

Moderate

|

| Tue. April 17 |

09:15

|

Industrial Production |

Mar

|

0.2%

|

|

0.0%

|

Moderate

|

| Thu. April 19 |

08:30

|

Jobless Claims (Initial) |

4/14

|

375K

|

|

380K

|

Moderate

|

| Thu. April 19 |

10:00

|

Existing Home Sales |

Mar

|

4.62M

|

|

4.59M

|

Moderate

|

| Thu. April 19 |

10:00

|

Philadelphia Fed Index |

Apr

|

10.3

|

|

12.5

|

HIGH

|

|

|

| |

|

|

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

You received this email as a result of your ongoing business relationship with Ricky Khamis. While beneficial to a wide audience, this information is also commercial in nature and it may contain advertising materials.

|

|

Comments(0)