Falling Traps:

Watch for these warning signs when you are seeking a LOAN MODIFICATION:

- A guaranty to stop the foreclosure process. . no matter your circumstances!! You should not allow anyone take chances on your future. . no one can guarantee you this . .only the investor that owns your loan!

- They instructs you not to contact your lender, lawyer or credit or housing counselor. .and let them do ALL THE TALKING for you. . .this is your future at hand. .don't trust a clerk with 100 files to work on your file and give up at the very first busy signal.

- They want to collects a fee before providing any services to you. . HELLO? don't pay unless you see results first!

- They recommend that you make your mortgage payments directly to their loan modification company. . rather than your lender. CALL YOUR LENDER FIRST and ASK THEM THIS and see WHAT THEY TELL YOU!

Remember, in a loan modification, you are buying your home again. . .at what price?

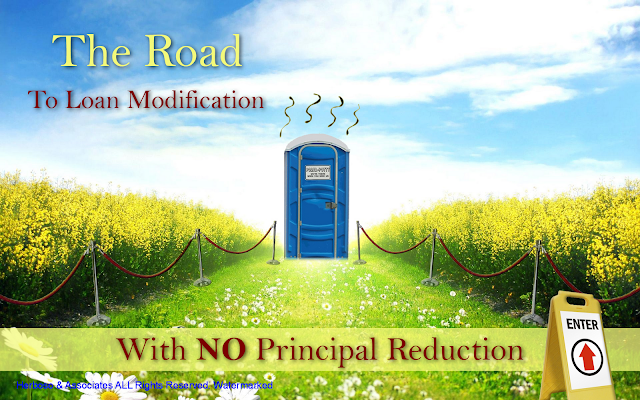

After interviewing over 200 distressed homeowners in the last 3 years. . I can assure you without a doubt that a LOAN MODIFICATION with no PRINCIPAL REDUCTION can only benefit your BANK!

Fernando Herboso

Broker for Herboso & Associates llc

301-246-0001

Get the facts from a distressed property expert that has the ability to help you avoid a foreclosure by doing a Short Sale today!

MD DC and VA

Comments(4)