I find it funny that in 2007, every other news story on local television here in Central Florida, was another story of the “sub prime meltdown” and the imploding Florida market. But that is the way of TV media – exploit a story until it dries up, or people are so sick of hearing about it – then move on to the next one! Here we are in 2008.

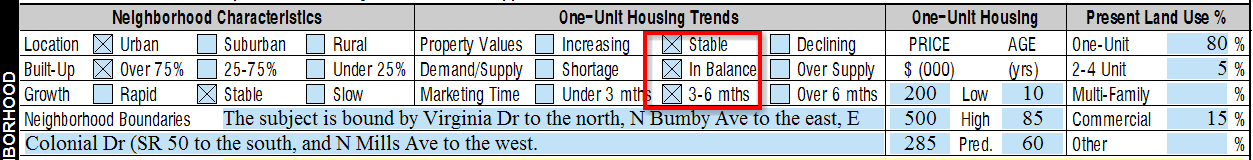

Many of my clients are now requiring me to prove that a market here is NOT declining! It is ironic that back in 2005 and 2006, I had to show extra comparables to support my value – since many sales prices were well above listing prices as bidding wars ensued. Today, however, an underwriter has immediate distrust if they see “Stable” and “In Balance” marked on my report!

However, I would predict that in spite of ensuing foreclosures and escalating ARM loans, we begin to see a new perspective coming from the media in the coming year. Now, 2008 will be that year of optimism as commercial areas have continued to develop and new interest in home ownership is contrasted against the “bubble” of 2007! And yet – it all boils down to perception! Now that buyers will finally get off the fence, perceiving that the down trend of 2007 is over, they will begin a new momentum of positive change in the single family housing market, creating shorter marketing times, thus creating more stable list price vs. sales price ratios, and thus creating once again, an upward trend in the market!

Sometimes you get the feeling that some big entity is in control of it all. As long you continue to hear the bad news, it is all you see. But once some good news is reported, and the populace picks up on it, they take that to the market and bring a wave of momentum – just as they did to bring a halt to the buying in late 2006-2007! This new year will bring comments like, “at least we are seeing stability unlike the 2007 market!” And through it all, good honest appraisers will be here to help guide both lenders and consumers with fair evaluations.

My hope for the new year is that the down turn has weeded out some of the shadier aspects of our industry. I hope that high pressure sales people from the sub prime market have gone into business in another industry since quick and easy products are no longer available from most major lenders. And perhaps a bit of sanity will come back to an industry I love so much!

But then again, I am reminded of the tag line from the Sci-Fi series Battle Star Galactica: “All this has happened before and all this will happen again” That seems to best fit this trend in American society. The key is to learn to hang on weather the roller coaster is going up, or going down!

Happy New Year!

Richard D Ferris

Comments(20)