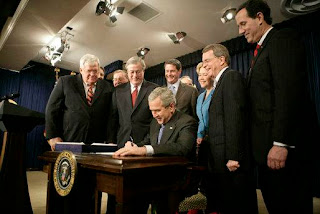

Do you remember the Tax Relief and Health Care Act of 2006?

This signed legislation will allow 2008 and 2009 homebuyers to deduct premiums paid for mortgage insurance - which typically is required when homebuyers purchase a home with less than a 20% down payment.

This new insurance premium deduction will only apply to mortgage insurance contracts issued in 2008 and 2009 and is only available to taxpayers whose adjusted gross income does not exceed $110,000 ($55,000 for married taxpayers filing separately).

For more information about H.R. 6111 (look in Act 419-Code 163-6050H) , contact your CPA or tax attorney.

From the author of The Patterson Files

Comments(1)