Haven't We Been Here Before?

A recent Wall Street Journal Article reports another attempt by the Federal Government to meddle in the mortage markets.

"WASHINGTON—Federal regulators are considering giving mortgage lenders protection from certain lawsuits, according to people familiar with the matter, a move designed to encourage lending to well-qualified borrowers."

Ironically it is supposed to be because banks are unwilling to lend to "well-qualified borrowers". What well-qualified buyers are not getting mortages?

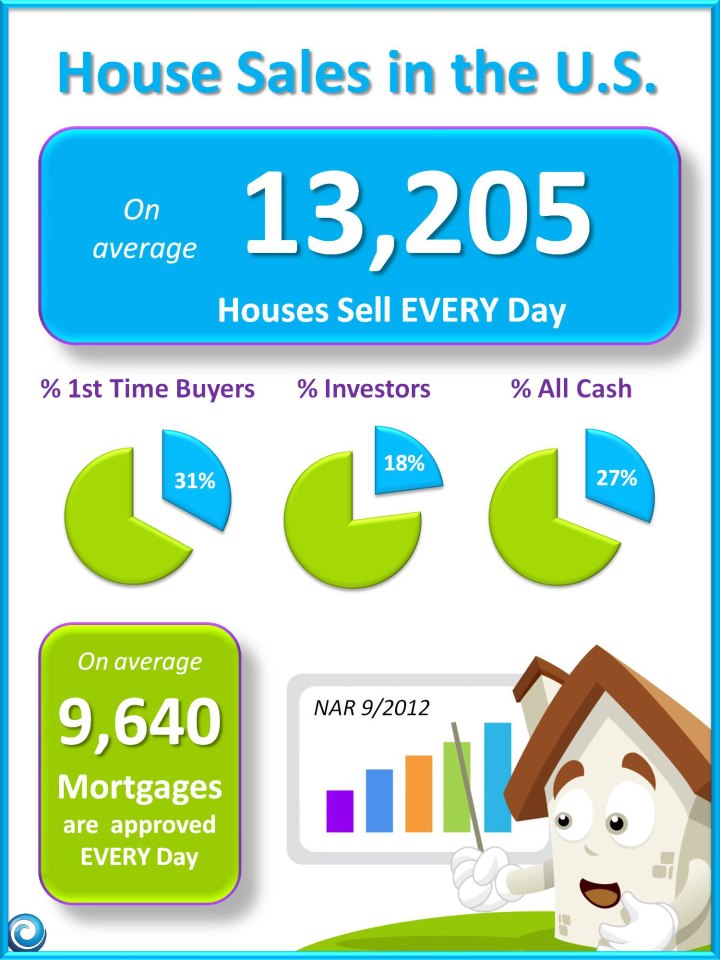

We just posted this: Banks Not Lending? Houses Sell Every Day!

So who are these "well-qualified borrowers"? We have not seen one single buyer get refused unless they had bad credit, no down payment, high debt to income ratios or all of the above!

Comments(27)