What Is FICO Score, VantageScore, Beacon and an Empirica Score?

Part 16: As part of series of articles (blogs) regarding Credit and Credit Score, here we go:

Disclaimer:

Every effort has been made to make these articles as complete and as accurate as possible, but no warranty or fitness is implied.

The information provided is on an “as is” basis. The author shall have neither liability nor responsibility to any person or entity with respect to any loss or damages arising from the information contained in this book.

The author is not engaged in professional services. If professional advice or other expert assistance is required, the services of a competent professional person should be sought.What Is FICO Score, VantageScore, Beacon and an Empirica Score?

What is a FICO Score?

FICO is named for the Fair Isaac Corporation. FICO score analyzes a person's financial history to derive a number showing that person’s credit worthiness. The Fair Isaac Corporation introduced the formula for the FICO score in 1970. It took almost 12 years for the founders of the company, mathematician Earl Isaac and engineer Bill Fair, to write the formula.FICO score was “invented” in the 1970 and has become the mortgage industry standard for credit ratings. FICO score, currently, is the most established and well-respected score among lenders.

None of the other credit reports, however, are particularly relevant in the home-buying process. This is because the nation’s Mortgage lenders rely on the FICO model.

Today, FICO score is omnipresent to the point that people generically refer to all credit scores as “FICO score”.

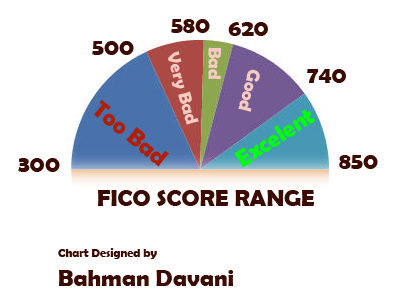

FICO score range from 300-850 and is derived from categories shown below.

· Length of credit history (15%)

· Payment history (35%)

· The Ratio of Total Debts/Total Line of available credits (30%)

· Number of Inquiries (10%)

· Types of credit (10%)

What is a VantageScore?

There are three main credit bureaus in the United States. They are Equifax, Experian and TransUnion. Each offers lines of credit-scoring products, available for purchase on their respective websites. Prices range from “free for a short trial period” to several hundred dollars per year.

VantageScore was originally developed in year 2006 by the three major nationwide credit agencies, Equifax, Experian and TransUnion, on a range from 501-900.

There was no direct or linear translation between VantageScore and FICO score. This has created confusions for some consumers, especially those who were used to FICO score on the range of 300-850.

Finally, in March of 2013, three main credit bureaus in the United States, Equifax, Experian and TransUnion, introduced VantageScore 3.0 in the direction of making credit scores easier for consumers to understand, as it abandoned the score range of 501-990 it has used since inception. With its new 3.0 model, VantageScore 3.0 has adopted the range of 300-850, making it consistent with the score range long held by FICO scores.

VantageScore 3.0 also produces scores for consumers who:

- Weren’t using credit often but did use it in the past 24 months. VantageScore requires only one month of history and an account reported to the agency within the past 2 years.

- Have no open accounts. These are often consumers who fall into the “subprime” category such as those who have been through bankruptcy and subsequently stopped using credit, or those whose only listed accounts are collection accounts or other negative information.

- Show no recent activity at all on their credit reports. The last information reported about them may have been 3 – 4 years ago. “These consumers are relatively good quality,” Davies notes. “71% have a credit score of 600 or higher. They have few delinquencies and have had accounts for a long time but don’t use them much.”

The three credit bureaus score now on a range from 300-850

What are a Beacon and an Empirica Score?

Each bureau uses a different name for its score, even if it uses the same FICO algorithm to generate the score. For example:

- Experian uses the term "FICO or FICO II",

- TransUnion uses "Empirica"

- Equifax uses "Beacon"Beacon score is a number generated by the Equifax Credit Bureau to rank an individual's credit worthiness.

Empirica score is a number generated by the TransUnion Credit Bureau to rank an individual's credit worthiness.

HOW to overcome the problems with your credit history and credit score?

Knowledge, education, awareness, practice and discipline are the essential keys to being successful on any subject. The book, "Credit Score Tips and Tricks", provides you information, tools, techniques to educate yourself and manage your credit report & credit score, and therefore manage your finances effectively at no additional cost.I have decided to bring and share with you, chapters or sections of my book, Credit Score Tips and Tricks, as series of articles here. This is the number 16 of such a series.

I also created and manage a GROUP in ActiveRain, Credit Reports and Credit Scores, Please feel free to join and share your thoughts and experiences.

Contact us about your Real Estate Questions

Comments(0)