FHA Mortgage Loans have helped people from all over the country achieve their goals of homeownership. On many levels, FHA loans have provided more leniency on qualifying approval parameters than other loans on the market. For example, FHA loans have allowed lower down payments, higher debt-to-income ratios, and/or lower credit score requirements than Conforming (Conventional) loans for several years running.

WIth that said, like most things in life...there comes a price for this benefit. FHA Mortgage Loans come equipped with 2 separate types of Mortgage Insurance Premiums:

- Up Front Mortgage Insurance Premium (UFMIP) -- A one-time lump sum charge based on a percentage of the loan amount. Most Borrower's opt to finance the UFMIP by rolling this cost into their loan (as opposed to paying the UFMIP out-of-pocket).

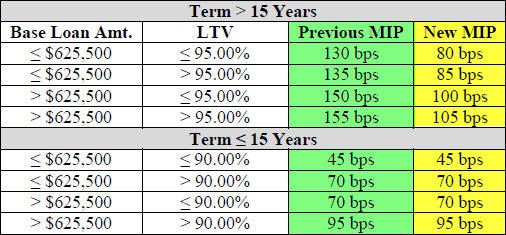

- Annual Mortgage Insurance Premium -- This premium is often referred to as a Monthly Mortgage Insurance (MMI) Premium due to the fact that the annual cost is broken down into 12 monthly payments per year. In the chart below, you will see this referred to as MIP (Monthly Insurance Premium).

As with most terms of the mortgage industry, change is constantly occuring. Interest rates fluctuate, approval guidelines are updated, and yes, FHA Mortgage Insurance Premiums also adapt to the market. For the first time in years, FHA Mortgage Insurance Premiums are dropping...and significantly! Below is a summary of these postive changes effective January 26, 2015:

Below is a historical timeline of the FHA Mortgage Insurance Premium changes:

These recent changes can significantly improve your cash flow! See below for examples:

Are you eligible for an FHA Streamline Refinance? If so, we will cover the closing costs associated with your loan and pass the savings on to you immediately. What can you do with the monthly savings?

- PAY DOWN YOUR MORTGAGE FASTER - by paying the same payment you are currently making (I can provide amortization tables to show you the details on how much faster you will payoff your mortgage).

- ASSET ACCUMULATION - consider taking the monthly savings and directing it to an interest-bearing savings or investment account. I can provide referrals to local Financial Planners who can show you how quickly your account can grow.

- IMPROVE YOUR CASH FLOW - simply take this new "found money" and use it for personal reasons each month.

Please feel free to contact me directly for more information about how these reduced FHA Mortgage Insurance Premiums may benefit you. As you can see from the historical chart above, these new Mortgage Insurance Premiums might not last long!

Comments(5)