I attended a credit scoring seminar this morning in attempts to learn something new and I am glad I did. Now most of the seminar was review for me, some info jogged my memory and some of it was new. Below I have listed a few topics that I thought you could benefit from knowing.

WHAT GOES INTO A CREDIT SCORE?

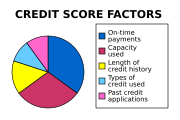

The approximate makeup of the FICO score Fair Isaac discloses to consumers

The approximate makeup of the FICO score Fair Isaac discloses to consumers

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are closely guarded secrets, Fair Isaac has disclosed the following components and the approximate weighted contribution of each:

- 35%, punctuality of payment in the past (only includes payments later than 30 days past due)

- 30%, the amount of debt, expressed as the ratio of current revolving debt (credit card balances, etc.) to total available revolving credit (credit limits)

- 15%, length of credit history

- 10%, types of credit used (installment, revolving, consumer finance)

- 10%, recent search for credit and/or amount of credit obtained recently

~DO NOT pay off old collection accounts and Charge-Offswith balances owing (over 2yr old) until you get to escrow or settlement

~A 30 Day late Payment that is 1 month old, indicates higher risk than a paid collection from 3 years ago.

~One of the Fastest ways to improve a credit score is pay down the outstanding balances on each of your credit cards to 30% of the maximum credit limit.

WWW.OPTOUTPRESCREEN.COM

Removes Consumer's name from Pre-Screen Lists sold by the four National CRA's - Experian, Equifax, TransUnion and Innovovois. Consumer may opt-out for 5yrs or permanently - Also, limits junkmail and ELIMINATES pre-approved credit card offers and possible identity theft from addresses on discarded offers. - I recommend everyone do this.

WWW.MYFICO.COM

This is the only website where the consumer can be assured of ordering and recieving thier own credit report with ACTUAL FICO scores. The cost is $15.95/bureau and is $47.85 for all 3. The free credit score websites have generalized scores.

Hope you learned something. :)

Comments(10)