If you follow the news, you may be aware that the Federal Reserve has cut interest rates six times since September 2007. Many people assume that those interest rate cuts translate into good news for mortgage interest rates. But that's not the case. In fact, mortgage rates are higher now than they were three months ago.

Why is that the case? Because mortgage interest rates are actually tied to the performance of mortgage-backed securities, NOT the Fed. The Fed's role is to keep inflation in check and regulate the nation's financial institutions but it doesn't set mortgage interest rates.

One of the tools the Fed uses to control inflation and economic growth is adjusting the Discount Rate and the Fed Funds rate. Movement with those rates can affect the Prime Interest rate, which in turn can affect rates on credit cards, home equity lines of credit or adjustable-rate mortgages. However, the long-term mortgage rates (ie your 30 year fixed rate) don't always correspond.

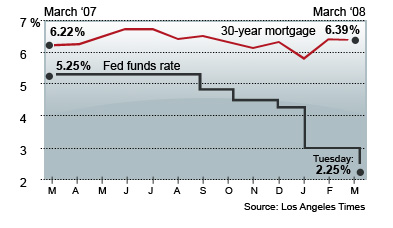

The chart below shows that mortgage interest rates have actually increased from March 2007 to March 2008, even though the Federal Reserve cut interests rates six consecutive times, slashing three full percentage points in the process.

Long-term mortgage rates are set daily by individual lending institutions and are based on the trading activity of mortgage-backed securities (MBS), which are traded daily. MBS are bonds that represent mortgages currently in place. For instance, let's say you have a 30-year fixed rate mortgage of $200,000 at an interest rate of 6%. That loan isn't worth anything right now, but over a 30-year period, it represents a profit of 6% or up to $12,000 every year for the bank that owns the loan, provided you make all of your payments.

Instead of waiting for the entire term of the loan to collect the profit, banks often bundle loans together and sell them. The bundled loans are sold to investors, much the way stock in a company would be sold. They are called mortgage-backed securities. The performance of these bonds is what lending institutions use to set their mortgage rates, along with supply and demand, financial and economic news including employment levels, political news and other factors.

Even though mortgage rates have gone up a bit in the past few months, they are still low from a historical standpoint. And with the many foreclosures on the market, there are some great deals. If you'd like more information about the current real estate market, please give us a call today at 562-961-1415.

Comments(0)