Realtors read your Sales Contracts on HUD owned properties very carefully. Loan Originator's contact your Attorneys and Escrow/Settlement Officers about possible extra fees to your Buyers, because HUD Is Passing Their Closing Costs On To

Realtors read your Sales Contracts on HUD owned properties very carefully. Loan Originator's contact your Attorneys and Escrow/Settlement Officers about possible extra fees to your Buyers, because HUD Is Passing Their Closing Costs On To  Buyers!!! Just when you think government could not get sneakier, and slimier they prove you wrong.

Buyers!!! Just when you think government could not get sneakier, and slimier they prove you wrong.

I do not do a lot of HUD owned property Loans, but some time within the last year HUD has changed their closing procedure. This was done without ANY notice to Lenders, or they did an excellent job of hiding the information.

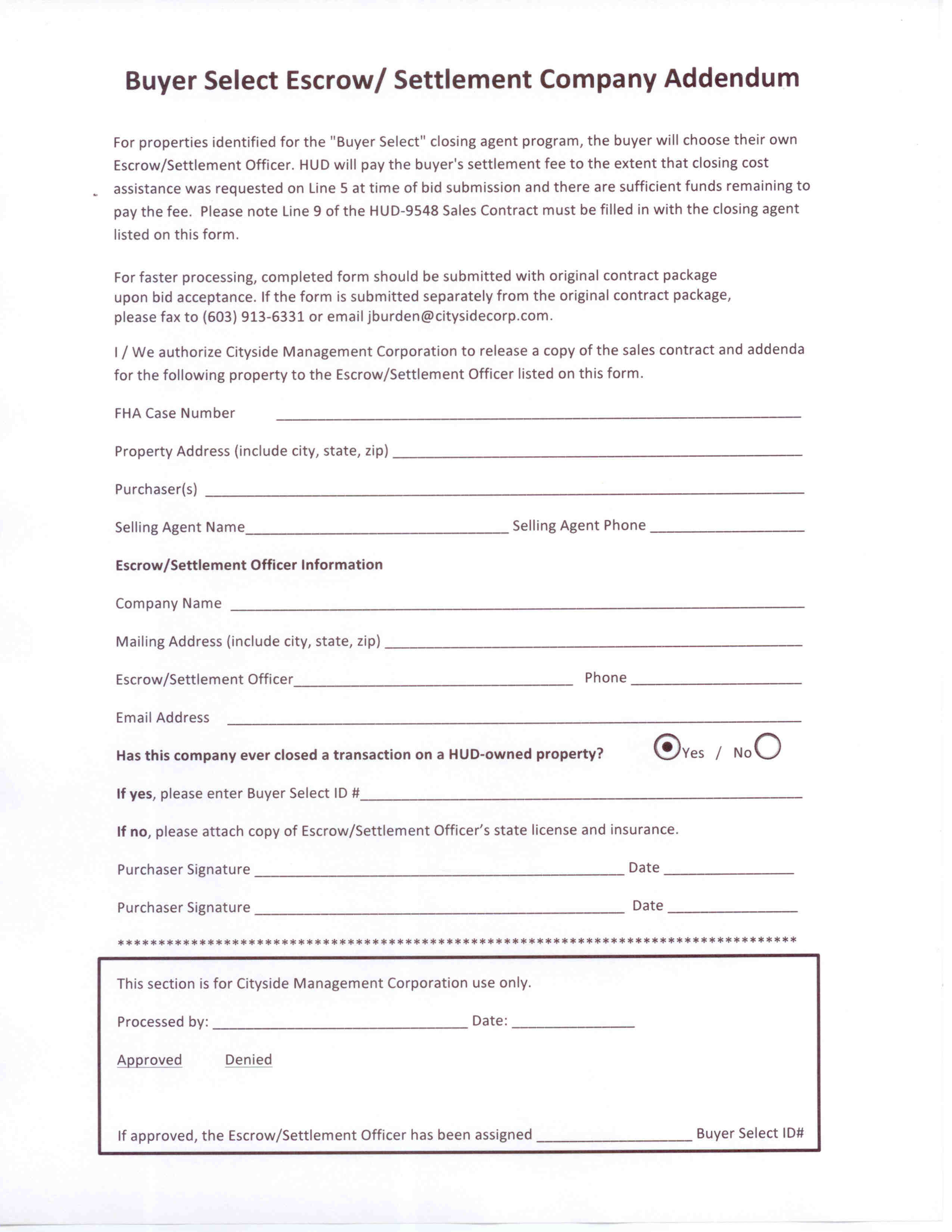

Under HUD's new procedure when a HUD Sales Contract is receive their will be a new form called "Buyer Select Escrow/Settlement Company Addendum", read it very, very carefully, especially the first paragraph which reads:

"For properties identified for the "Buyer Select" closing agent program, the buyer will choose their own Escrow/Settlement Officer. HUD will pay the buyer's settlement fee to the extent that closing cost assistance was requested on Line 5 at time of bid submission and there are sufficient funds remaining to pay the fee. Please note Line 9 of the HUD-‐9548 Sales Contract must be filled in with the closing agent listed on this form."

The "Closing Assistance" HUD is referring to is NOT for what the Buyer customarily pays for Closing Costs. What HUD is referring to are the HUD Closing Costs for Attorney or Escrow/Settlement Officer fees. In essences ALL Closing Paperwork will be done by the Buyers Attorney or Escrow/Settlement Officer, and the fees passed on to the Buyer.

Connecticut is an Attorney State, so I am not familiar how Closing Packets and Closings are handled in states which Closing are handled by a Escrow/Settlement Officer. So I will speak to how this is impacting future HUD Closings in State where Closings are done by Attorneys .

In Connecticut once a loan has been approved a Commitment Letter along with all other necessary paperwork is sent to the Attorney doing the closing paperwork. If the same Attorney is also representing the Borrower, the Attorney does the Title Search, takes out the Title Policy, contacts the Seller's Attorney for payoff and closing figures, and puts the whole closing packet together.

With this new surprise change by HUD, the Buyers Attorney will also now perform almost all of the duties normally performed by the Seller's Attorney, and the cost for the extra work will be passed on to the Buyer. So the Buyer ends up paying their Closing Costs as well as the HUD costs for Attorney representation. This is new, and if you have not been involved in a recent HUD owned property transaction, you and your Buyer will most likely be in for a BIG surprise.

Also if the property is a Condominium, the resale package which is normally paid for by the Seller here in CT, will now be paid for by the Buyer on HUD owned condominiums. So once again the government sticks it to homebuyers, and makes an already very costly process even more costly.

My advice to Realtors, Agents, Loan Originators, & Escrow/Settlement Officer, is if you are going to be involved in a HUD owned property purchase, make sure you are protecting your Buyer/Borrower by asking for enough Seller Paid Costs to cover these extra costs. HUD Is Passing Their Closing Costs On To Buyers!!! Make sure your Buyer/Borrower is not caught by surprise, and protect them by asking for reimbursement for these fees through a Seller credit.

******************************************************************************

Info about the author:

George Souto NMLS# 65149 is a Loan Originator who can assist you with all your #FHA, #CHFA, and #Conventional #mortgage needs in Connecticut. George resides in Middlesex County which includes #Middletown, #Middlefield, #Durham, #Cromwell, #Portland, #Higganum, #Haddam, #East Haddam,# Chester, #Deep River, and #Essex. George can be contacted at (860) 573-1308 or gsouto@mccuemortgage.com

Comments(89)